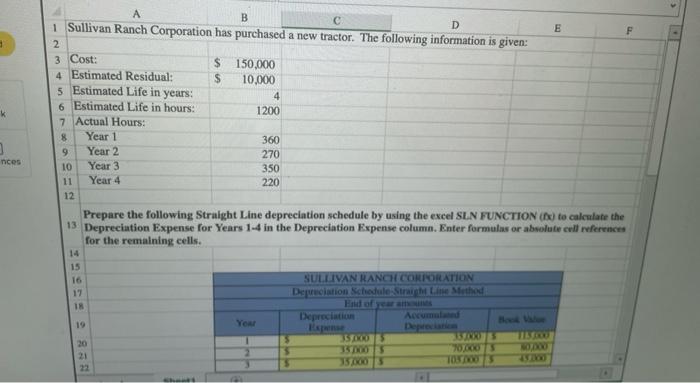

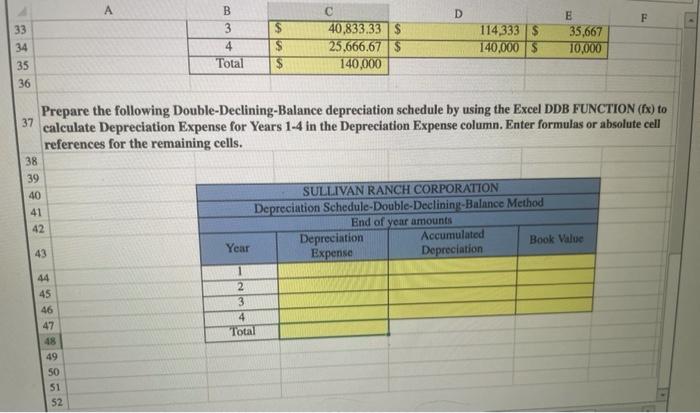

Question: I need the Excel Formula for Double Declining method. Excel Formula please! 5 B F A D 1 Sullivan Ranch Corporation has purchased a new

5 B F A D 1 Sullivan Ranch Corporation has purchased a new tractor. The following information is given: E 2 3 Cost: $ 150,000 4 Estimated Residual: S 10,000 5 Estimated Life in years: 4 6 Estimated Life in hours: 1200 7 Actual Hours: 8 Year 1 360 9 Year 2 270 10 Year 3 350 11 Year 4 220 12 Prepare the following Straight Line depreciation schedule by using the excel SIN FUNCTION (1x) to calculate the 13 Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. nces 14 15 16 SULLIVAN RANCH CORPORATION Depreciation Schedule Straight Line Method Depreciation Accm 19 Your TE 20 21 355 351005 3503 SEROS 2005 TOS A D B 3 F 33 114333$ 140.000$ 34 35 36 E 35,667 10,000 40,833.33 $ 25.666.67$ 140,000 4 Total Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (Ex) to 37 calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 38 39 40 SULLIVAN RANCH CORPORATION 41 Depreciation Schedule-Double-Declining-Balance Method 42 End of year amounts Depreciation Accumulated 43 Year Book Value Expense Depreciation 44 1 45 2 46 3 47 4 48 Total 49 50 51 52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts