Question: I need the excel formulas as well, please. Problem 2 You purchase a new tool system for detecting metal fatigue in your airplane engines. The

I need the excel formulas as well, please.

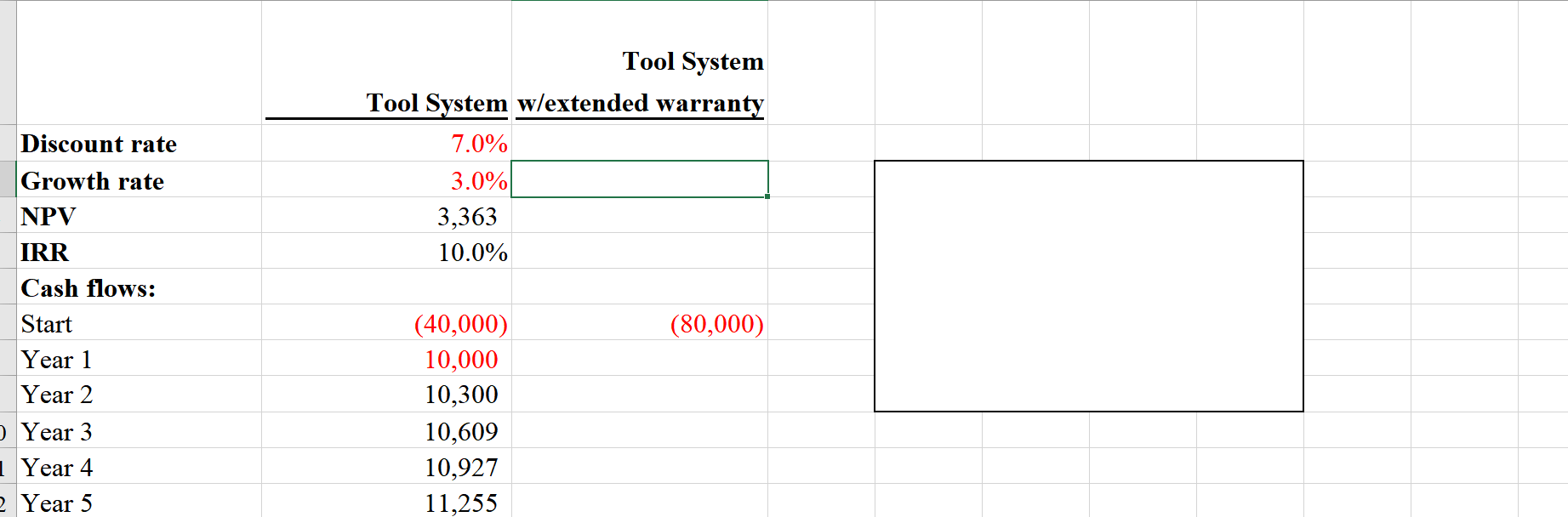

Problem 2 You purchase a new tool system for detecting metal fatigue in your airplane engines. The cost of the system is $40,000 and will expand your business cash flow by $10,000/year in year 1 and these will grow by 3% per year. The system will work for 5 years before you have to replace it with a new one. What is its NPV (use a 7% discount rate) and IRR? The vendor offers you an extended warranty costing $40,000 on top of the purchase price of $40,000. This warranty extends the system's life by 5 years. What is the NPV and the IRR of the machine with the extended warranty? Should you get the warranty? Discount rate Tool System Tool System w/extended warranty 7.0% 3.0% 3,363 10.0% (80,000) Growth rate NPV IRR Cash flows: Start Year 1 Year 2 Year 3 1 Year 4 2 Year 5 (40,000) 10,000 10,300 10,609 10,927 11,255

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts