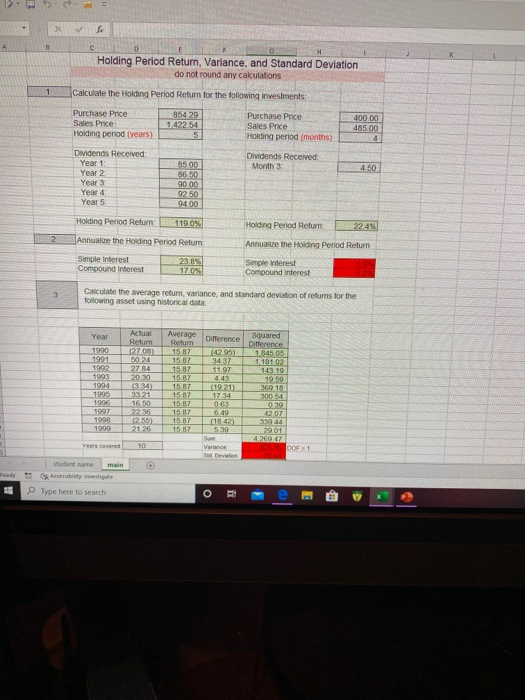

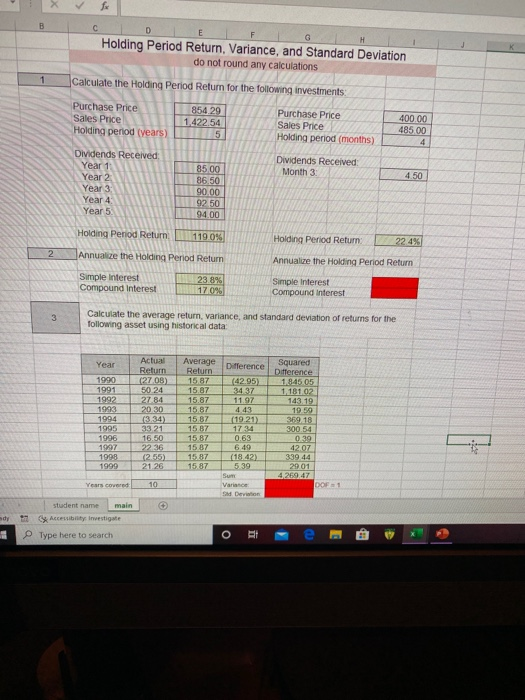

Question: i need the formulas for the areas in red > 5. X OE Holding Period Return, Variance, and Standard Deviation do not found any cakulations

> 5. X OE Holding Period Return, Variance, and Standard Deviation do not found any cakulations Calculate the Holding Period Return for the following investments Purchase Price Sales Price Holding period (years) 854 29 1422.54 Purchase Price Sales Price Holding period (months) 485.00 Dividends Received: Year 1 Year 2 Dividends Received Month 3 8500 86.50 90.00 Year 4 9400 Holding Period Return 1190 Holding Period Return Annuaire the Holding Period Retur Annualize the Holding Period Return Simple interest Compound interest Simple interest Compound interest Calculate the average return, variance and standard deviation of returns for the following asset using historical data Actual Average Difference Squared ference 42.95) 34 37 15.87 214 20.30 1.845.05 1,181,02 143.19 19.50 369 18 3006 0.39 (1921) 13.34) 33 21 12.55) 21 26 15.07 (1842) 426047 Years cover 10 Varios y Student name main estate Type here to search EL Holding Period Return, Variance, and Standard Deviation do not round any calculations Calculate the Holding Period Return for the following investments: Purchase Price Sales Price Holding period (years) 854 29 1422.54 5 Purchase Price Sales Price Holding period (months) L 400 00 485.00 Dividends Received: Month 3 4.50 Dividends Received: Year 1 Year 2 Year 3 Year 4 Year 5 85.00 86.50 90.00 92 50 94.00 Holding Period Return 119.04 Holding Period Return: 224% Annualize the Holding Period Return Annualize the Holding Period Return Simple interest Compound interest 23.8% 17 0961 Simple interest Compound Interest Calculate the average return, variance, and standard deviation of returns for the following asset using historical data Year Average on Actual Return (27.08) 1990 1991 15.87 15.87 15.87 (42.95) 34.37 11.97 Squared Difference 1,945 05 1,18102 143.19 1959 1992 1994 27.84 20 30 (334) 33 21 15 B7 (19.21) 300.54 1996 22.36 (2.55) 21.26 6.49 (18 42) 1998 1999 15.87 339 44 29 01 4.269.47 10 Variance 17 dy - student name main Accutibility Investigate Type here to search O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts