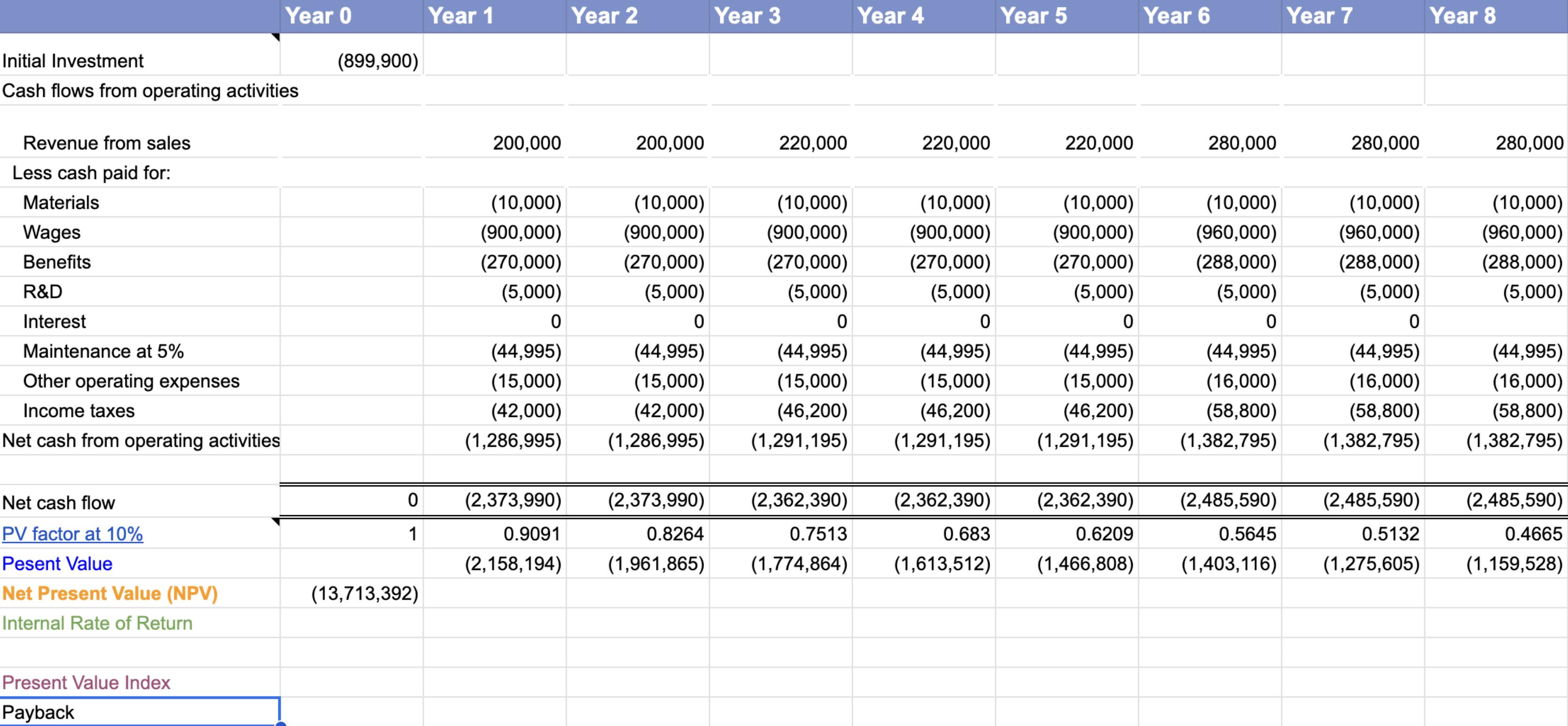

Question: I need the payback row for all years and the explanation on how to do it. Initial Investment Cash flows from operating activities Revenue from

I need the payback row for all years and the explanation on how to do it.

Initial Investment Cash flows from operating activities Revenue from sales Less cash paid for: Materials Wages Benefits R&D Interest Maintenance at 5% Other operating expenses Income taxes Net cash from operating activities Net cash flow PV factor at 10% Pesent Value Net Present Value (NPV) Internal Rate of Return Year 0 Present Value Index Payback (899,900) 0 1 (13,713,392) Year 1 200,000 (10,000) (900,000) (270,000) (5,000) 0 (44,995) (15,000) (42,000) (1,286,995) Year 2 200,000 (10,000) (900,000) (270,000) (5,000) 0 Year 3 (2,373,990) (2,373,990) 0.9091 (2,158,194) 0.8264 (1,961,865) 220,000 (10,000) (900,000) (270,000) (5,000) 0 Year 4 (10,000) (900,000) (270,000) (5,000) 0 (44,995) (44,995) (44,995) (15,000) (15,000) (15,000) (42,000) (46,200) (46,200) (1,286,995) (1,291,195) (1,291,195) (2,362,390) 0.7513 (1,774,864) 220,000 (2,362,390) 0.683 (1,613,512) Year 5 220,000 (10,000) (900,000) (270,000) (5,000) 0 Year 6 280,000 (10,000) (960,000) (288,000) (5,000) 0 (44,995) (44,995) (15,000) (16,000) (46,200) (58,800) (1,291,195) (1,382,795) (2,362,390) (2,485,590) 0.5645 0.6209 (1,466,808) (1,403,116) Year 7 280,000 (10,000) (960,000) (288,000) (5,000) 0 (44,995) (16,000) (58,800) (1,382,795) (2,485,590) 0.5132 (1,275,605) Year 8 280,000 (10,000) (960,000) (288,000) (5,000) (44,995) (16,000) (58,800) (1,382,795) (2,485,590) 0.4665 (1,159,528)

Step by Step Solution

There are 3 Steps involved in it

To calculate the payback period for each year you need to follow these steps Calculate the cumulative cash flows for each year by summing up the cash ... View full answer

Get step-by-step solutions from verified subject matter experts