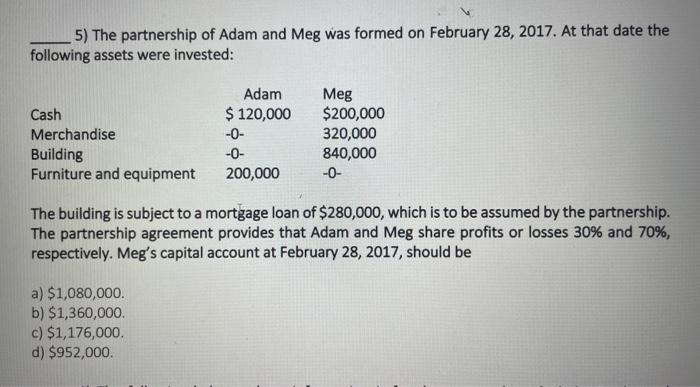

Question: I need the process please, step by step. TY 5) The partnership of Adam and Meg was formed on February 28,2017 . At that date

5) The partnership of Adam and Meg was formed on February 28,2017 . At that date the following assets were invested: The building is subject to a mortgage loan of $280,000, which is to be assumed by the partnership. The partnership agreement provides that Adam and Meg share profits or losses 30% and 70%, respectively. Meg's capital account at February 28, 2017, should be a) $1,080,000. b) $1,360,000. c) $1,176,000. d) $952,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts