Question: I need the right answer in clear hand writing Click on TWO that are FALSE: Do not try to click on all! Negative points will

I need the right answer in clear hand writing

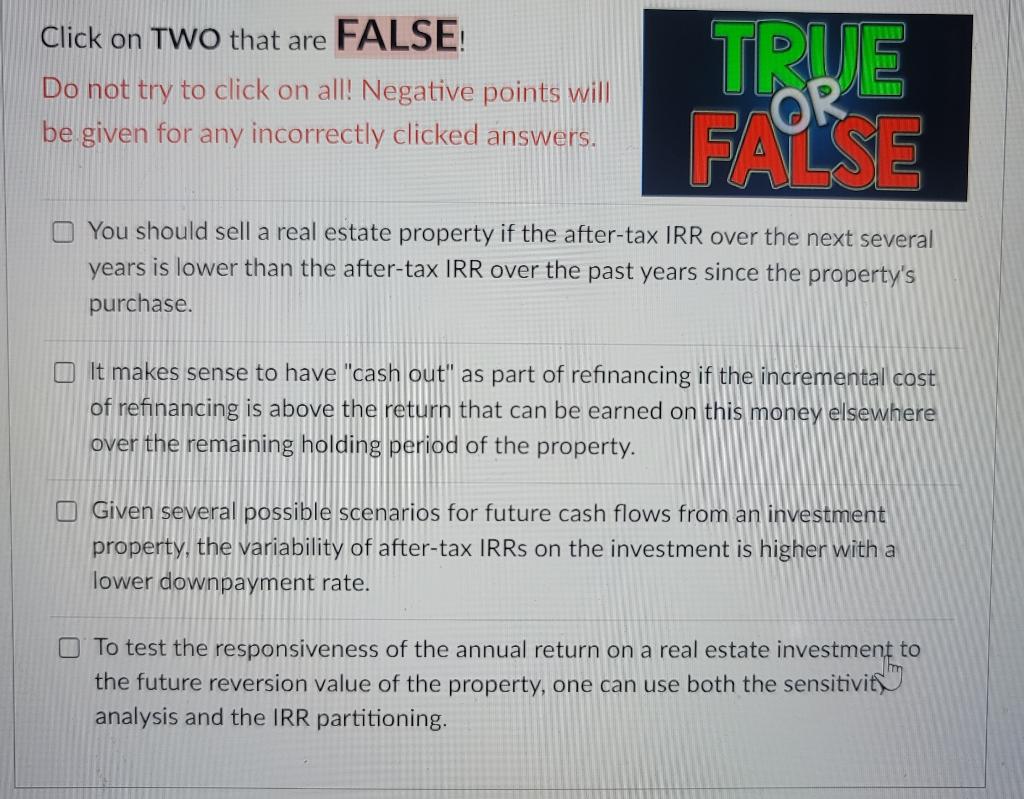

Click on TWO that are FALSE: Do not try to click on all! Negative points will be given for any incorrectly clicked answers. TRIJE FALE OR You should sell a real estate property if the after-tax IRR over the next several years is lower than the after-tax IRR over the past years since the property's purchase. It makes sense to have "cash out" as part of refinancing if the incremental cost of refinancing is above the return that can be earned on this money elsewhere over the remaining holding period of the property. Given several possible scenarios for future cash flows from an investment property, the variability of after-tax IRRs on the investment is higher with a lower downpayment rate. To test the responsiveness of the annual return on a real estate investment to the future reversion value of the property, one can use both the sensitivity analysis and the IRR partitioning. Click on TWO that are FALSE: Do not try to click on all! Negative points will be given for any incorrectly clicked answers. TRIJE FALE OR You should sell a real estate property if the after-tax IRR over the next several years is lower than the after-tax IRR over the past years since the property's purchase. It makes sense to have "cash out" as part of refinancing if the incremental cost of refinancing is above the return that can be earned on this money elsewhere over the remaining holding period of the property. Given several possible scenarios for future cash flows from an investment property, the variability of after-tax IRRs on the investment is higher with a lower downpayment rate. To test the responsiveness of the annual return on a real estate investment to the future reversion value of the property, one can use both the sensitivity analysis and the IRR partitioning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts