Question: I need the solution and the answer of this question. I am in a hurry, so quick response will be appreciated. Thank you! January 1,

I need the solution and the answer of this question. I am in a hurry, so quick response will be appreciated. Thank you!

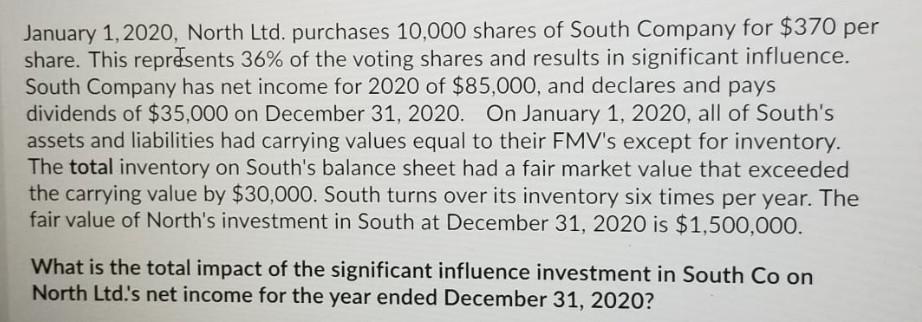

January 1, 2020, North Ltd. purchases 10,000 shares of South Company for $370 per share. This represents 36% of the voting shares and results in significant influence. South Company has net income for 2020 of $85,000, and declares and pays dividends of $35,000 on December 31, 2020. On January 1, 2020, all of South's assets and liabilities had carrying values equal to their FMV's except for inventory. The total inventory on South's balance sheet had a fair market value that exceeded the carrying value by $30,000. South turns over its inventory six times per year. The fair value of North's investment in South at December 31, 2020 is $1,500,000. What is the total impact of the significant influence investment in South Co on North Ltd.'s net income for the year ended December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts