Question: I need the solution and the answer of this question. I am in a hurry, so quick response will be appreciated. Thank you! Python owns

I need the solution and the answer of this question. I am in a hurry, so quick response will be appreciated. Thank you!

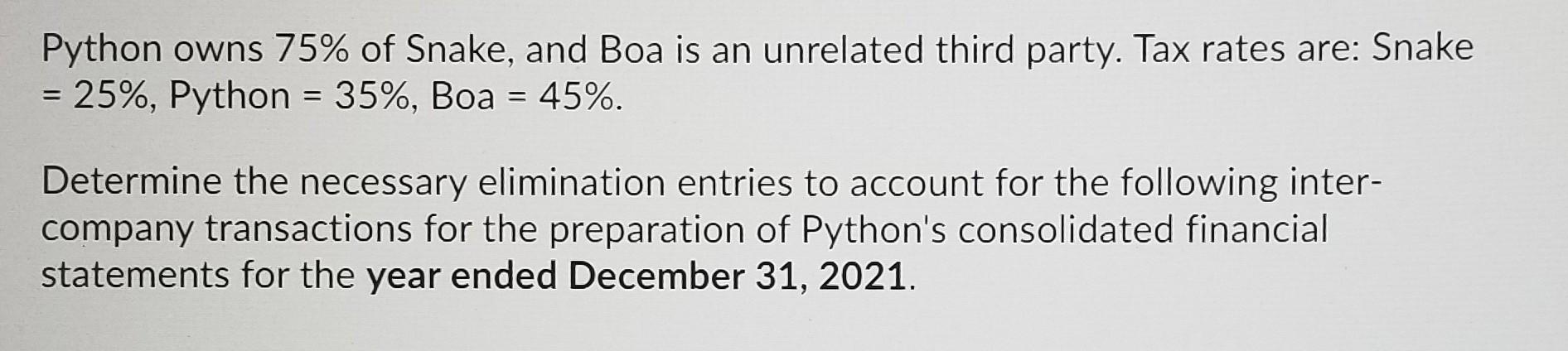

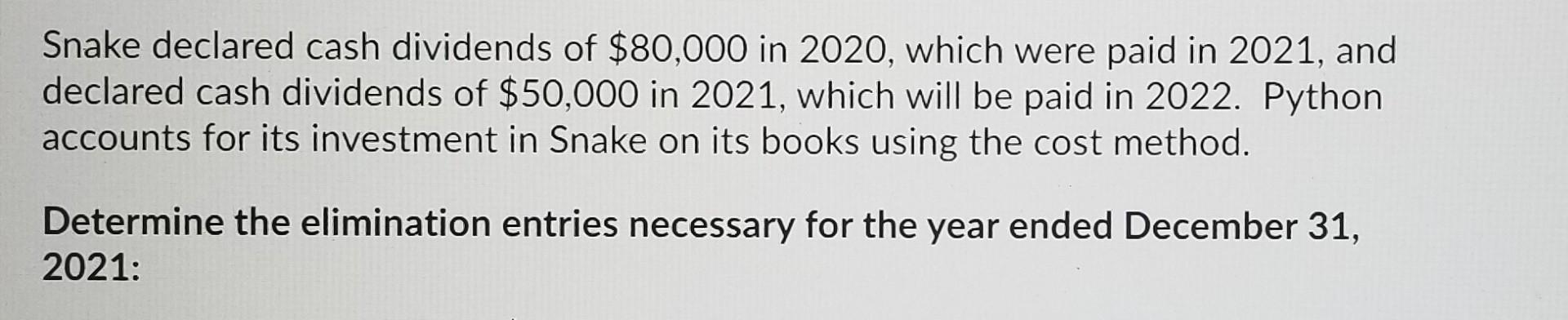

Python owns 75% of Snake, and Boa is an unrelated third party. Tax rates are: Snake = 25%, Python = 35%, Boa = 45%. Determine the necessary elimination entries to account for the following inter- company transactions for the preparation of Python's consolidated financial statements for the year ended December 31, 2021. Snake declared cash dividends of $80,000 in 2020, which were paid in 2021, and declared cash dividends of $50,000 in 2021, which will be paid in 2022. Python accounts for its investment in Snake on its books using the cost method. Determine the elimination entries necessary for the year ended December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts