Question: I need the solution for question 9 only. Consider that IBM is trading at $144 and Exxon Mobil is trading at $ 88. In your

I need the solution for question 9 only.

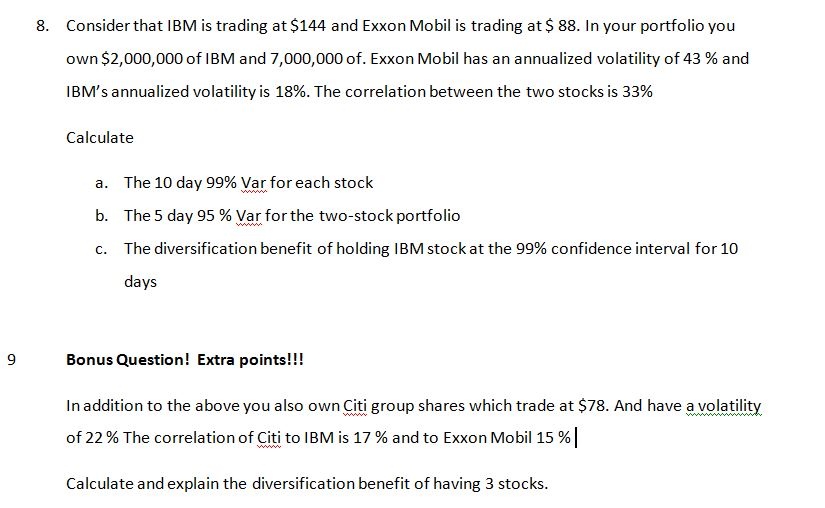

Consider that IBM is trading at $144 and Exxon Mobil is trading at $ 88. In your portfolio you own $2,000,000 of IBM and 7,000,000 of, Exxon Mobil has an annualized volatility of 43 % and IBM's annualized volatility is 18%. The correlation between the two stocks is 33% 8. Calculate The 10 day 99% Var for each stock The 5 day 95 % Var for the two-stock portfolio The diversification benefit of holding IBM stock at the 99% confidence interval for 10 days a. b. c. 9 Bonus Question! Extra points!!! In addition to the above you also own Citi group shares which trade at $78. And have a volatility of 22 % The correlation of Citi to IBM is 17 % and to Exxon Mobil 15 % ! Calculate and explain the diversification benefit of having 3 stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts