Question: i need the solution to solve these problems. The current total market value of RRT Co. is $10 million. The firm plans to raise and

i need the solution to solve these problems.

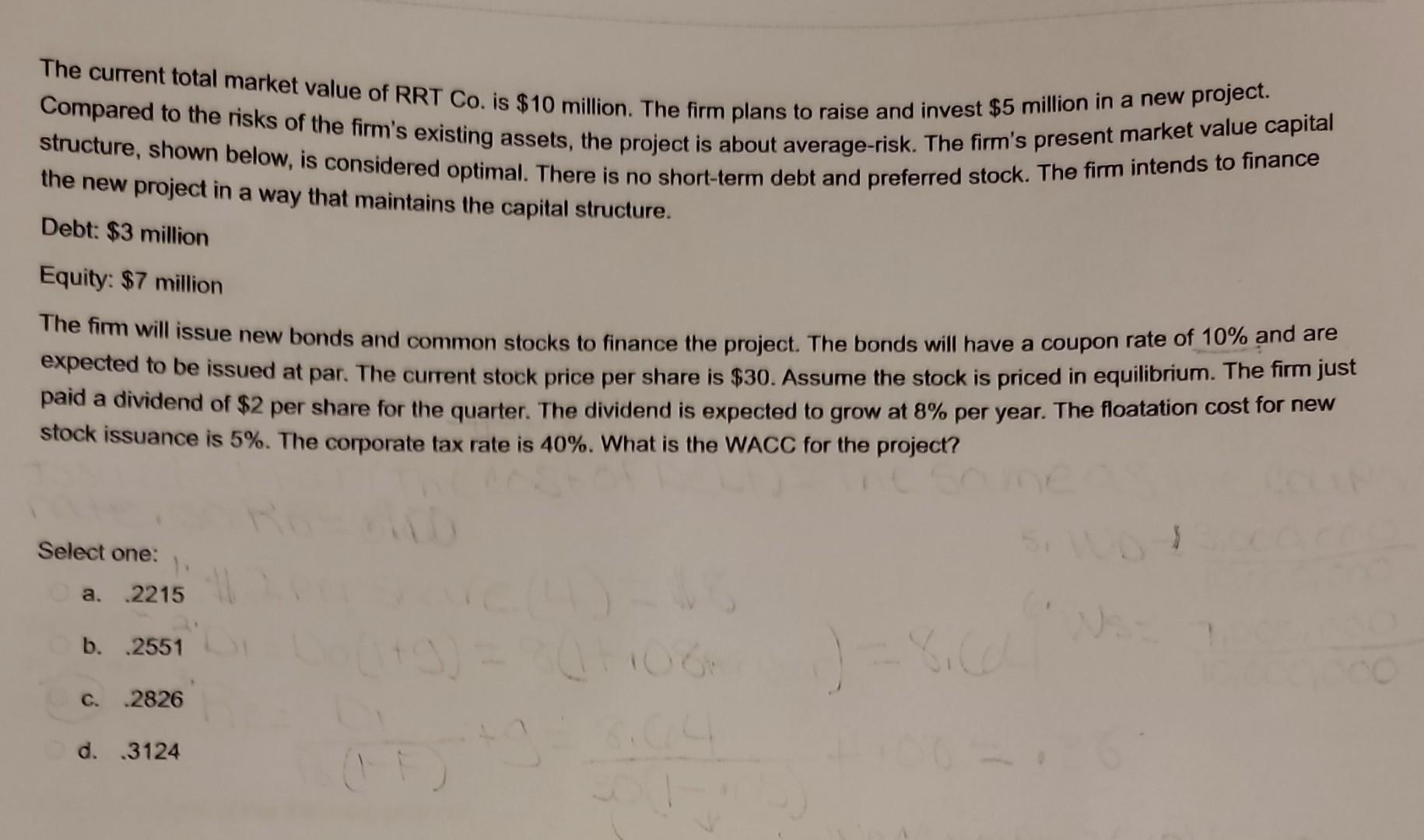

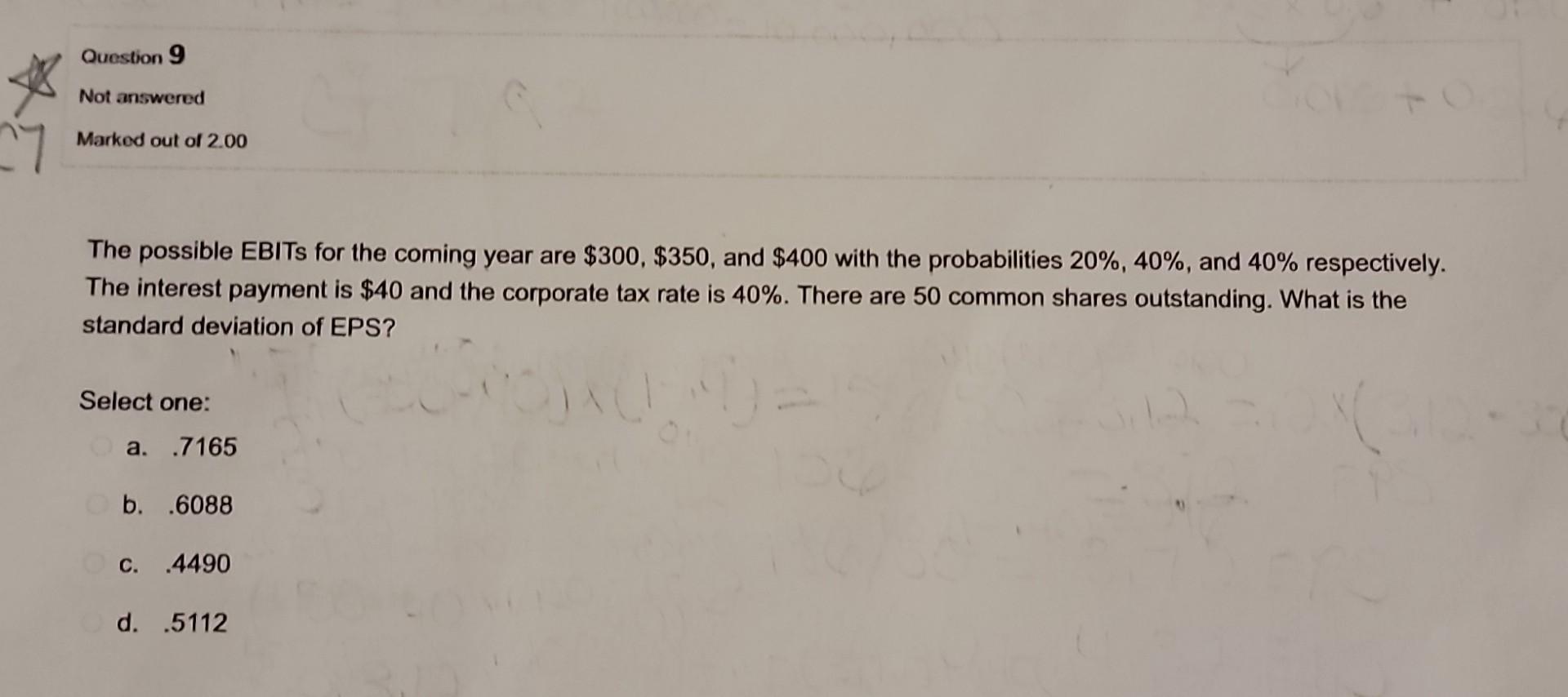

The current total market value of RRT Co. is $10 million. The firm plans to raise and invest $5 million in a new project. Compared to the risks of the firm's existing assets, the project is about average-risk. The firm's present market value capital structure, shown below, is considered optimal. There is no short-term debt and preferred stock. The firm intends to finance the new project in a way that maintains the capital structure. Debt: $3 million Equity: $7 million The firm will issue new bonds and common stocks to finance the project. The bonds will have a coupon rate of 10% and are expected to be issued at par. The current stock price per share is $30. Assume the stock is priced in equilibrium. The firm just paid a dividend of $2 per share for the quarter. The dividend is expected to grow at 8% per year. The floatation cost for new stock issuance is 5%. The corporate tax rate is 40%. What is the WACC for the project? Select one: a. .2215 b. 2551 108 C. .2826 d. 3124 505 Question 9 Not answered Marked out of 2.00 27 The possible EBITS for the coming year are $300, $350, and $400 with the probabilities 20%, 40%, and 40% respectively. The interest payment is $40 and the corporate tax rate is 40%. There are 50 common shares outstanding. What is the standard deviation of EPS? Select one: a. .7165 b. .6088 C. .4490 d. .5112

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts