Question: I need these questions to study Chapter 5- Recognizing Expenditure in Governmental Funds Part I 1. What is the distinction between expenditures and expenses as

I need these questions to study

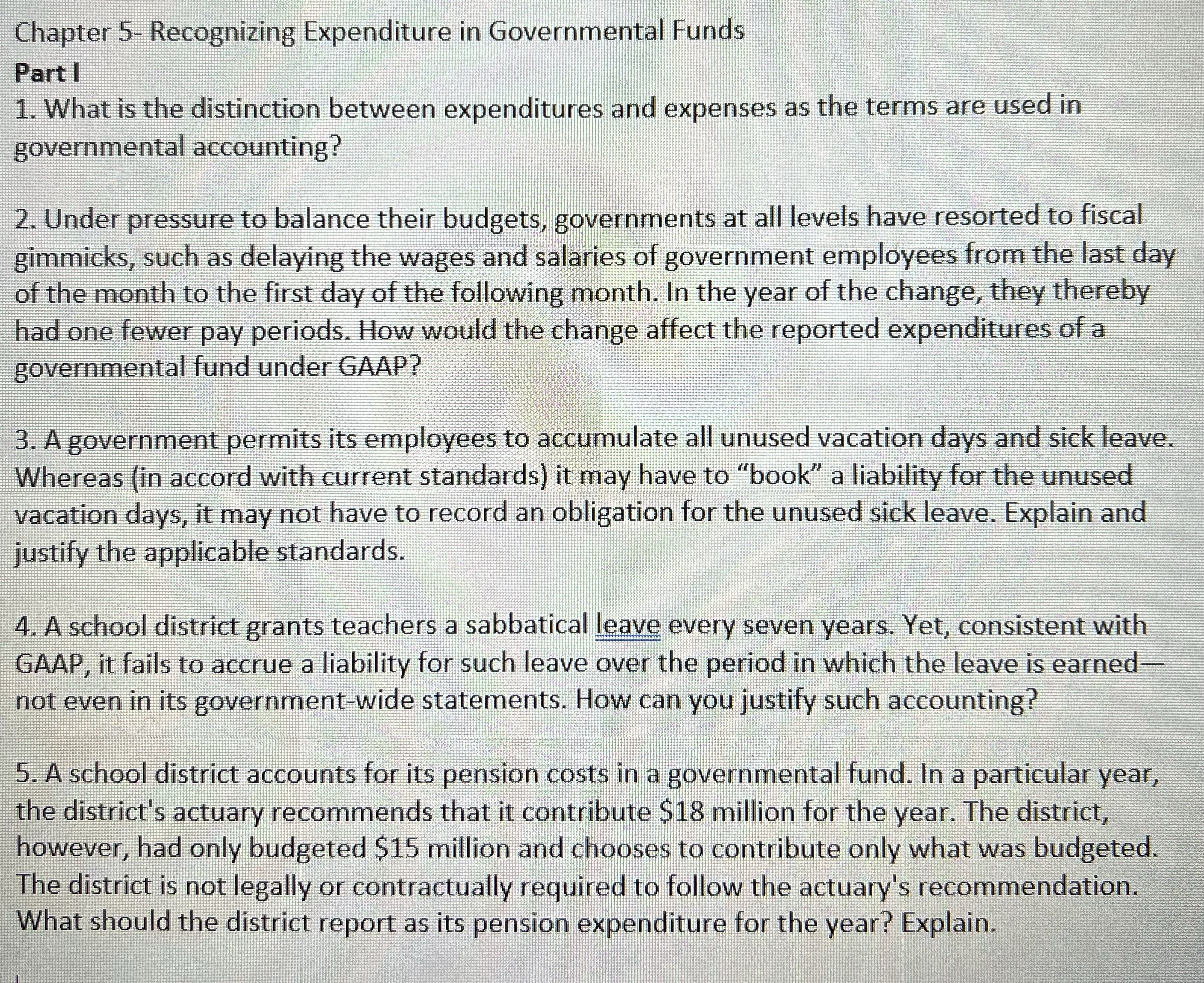

Chapter 5- Recognizing Expenditure in Governmental Funds Part I 1. What is the distinction between expenditures and expenses as the terms are used in governmental accounting? 2. Under pressure to balance their budgets, governments at all levels have resorted to fiscal gimmicks, such as delaying the wages and salaries of government employees from the last day of the month to the first day of the following month. In the year of the change, they thereby had one fewer pay periods. How would the change affect the reported expenditures of a governmental fund under GAAP? 3. A government permits its employees to accumulate all unused vacation days and sick leave. Whereas (in accord with current standards) it may have to "book" a liability for the unused vacation days, it may not have to record an obligation for the unused sick leave. Explain and justify the applicable standards. 4. A school district grants teachers a sabbatical leave every seven years. Yet, consistent with GAAP, it fails to accrue a liability for such leave over the period in which the leave is earned not even in its government-wide statements. How can you justify such accounting? 5. A school district accounts for its pension costs in a governmental fund. In a particular year, the district's actuary recommends that it contribute $18 million for the year. The district, however, had only budgeted $15 million and chooses to contribute only what was budgeted. The district is not legally or contractually required to follow the actuary's recommendation. What should the district report as its pension expenditure for the year? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts