Question: Solve the problem with supporting computations 10. The directors of Canada Corporation, whose F50 par value share capital is currently selling at P60 per share,

Solve the problem with supporting computations

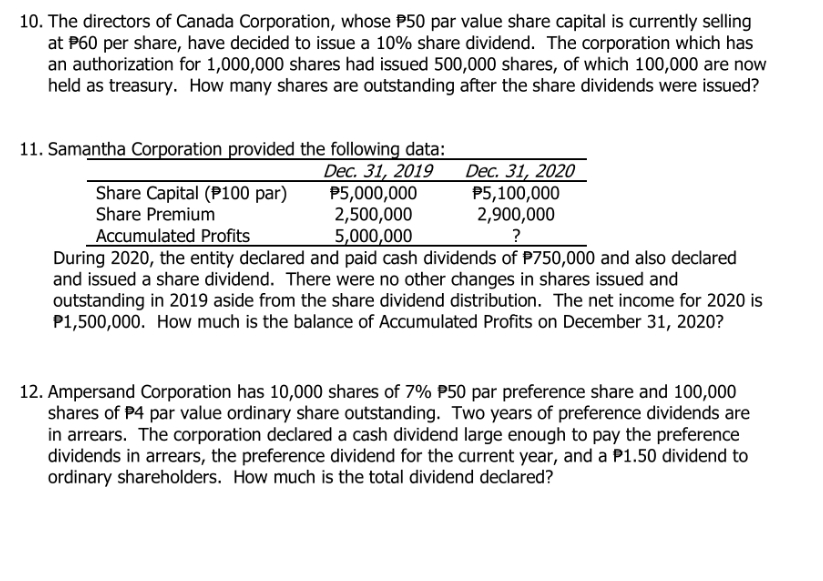

10. The directors of Canada Corporation, whose F50 par value share capital is currently selling at P60 per share, have decided to issue a 10% share dividend. The corporation which has an authorization for 1,000,000 shares had issued 500,000 shares, of whidw 100,000 are now held as treasury. How many shares are outstanding after the share dividends were issued? 11. Samantha Corporation provided the following data: Dec. 31 2019 Dec; 31 2020 Share Capital (P100 par} P5,000,000 P5,100,000 Share Premium 2,500,000 2,900,000 Accumulated Prol: 5 000 000 ? During 2020, the entity declared and paid cash dividends of P250000 and also declared and issued a share dividend. There were no other changes in shares issued and outstanding in 2019 aside from the share dividend distribution. The net income for 2020 is P1,500,000. How much is the balance of Accumulated Prots on December 31, 2020? 12. Ampersand Corporation has 10,000 shares of 2% F50 par preference share and 100,000 shares of F4 par value ordinary share outstanding. Two years of preference dividends are in arrears. The corporation declared a cash dividend large enough to pay the preference dividends in arrears, the preference dividend for the current year, and a P1.50 dividend to ordinary shareholders. How much is the total dividend declared

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts