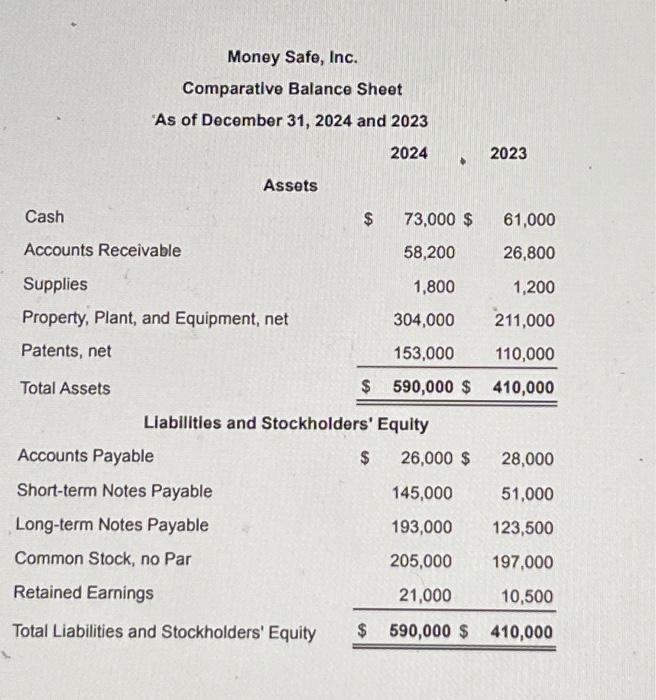

Question: I need this answerd as soon as possible please Money Safe, Inc. Comparative Balance Sheet As of December 31, 2024 and 2023 Data table Requirements

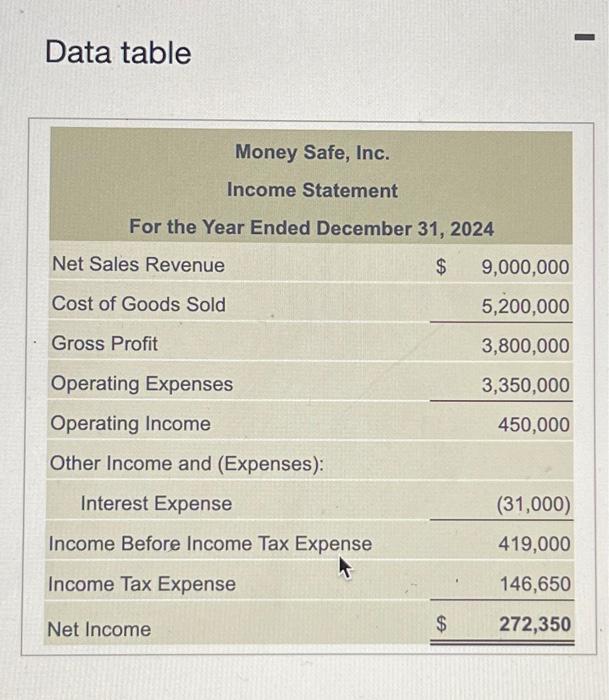

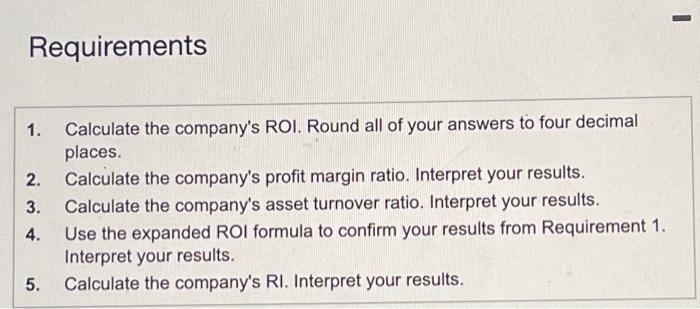

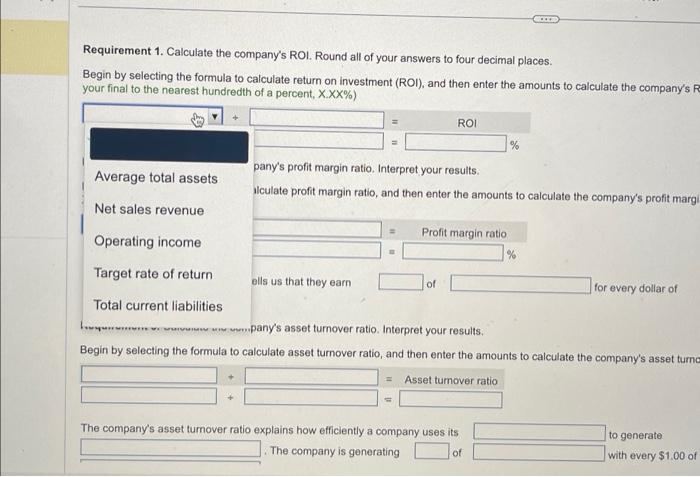

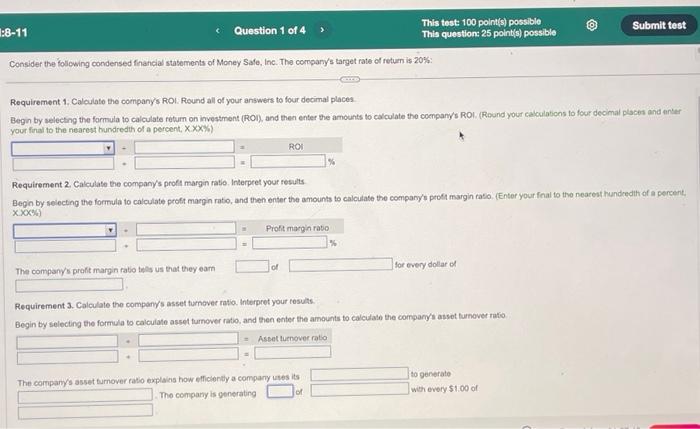

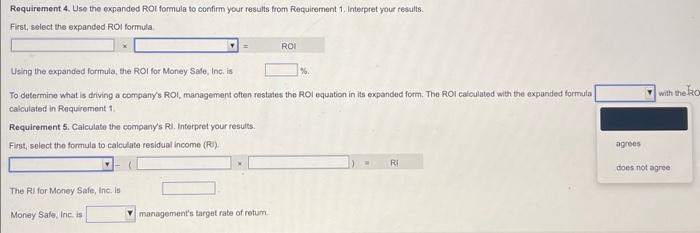

Money Safe, Inc. Comparative Balance Sheet As of December 31, 2024 and 2023 Data table Requirements 1. Calculate the company's ROI. Round all of your answers to four decimal places. 2. Calculate the company's profit margin ratio. Interpret your results. 3. Calculate the company's asset turnover ratio. Interpret your results. 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. 5. Calculate the company's RI. Interpret your results. Requirement 1. Calculate the company's ROI. Round all of your answers to four decimal places. Begin by selecting the formula to calculate return on investment (ROI), and then enter the amounts to calculate the company's your final to the nearest hundredth of a percent, XX% ) Begin by selecting the formula to calculate asset turnover ratio, and then enter the amounts to calculate the company's asset turn The company's asset tumover ratio explains how efficiently a company uses its to generate . The company is generating of with every $1.00 of Requirement 1, Calculate the company's Rol: Round all of your answers to four decimal places Begin by selecting the farmula to calculate retum on investment (ROI), and then enter the amounts to calculate the company's ROl: (Round your calculations to four decimal places and anter your final to the nearest bundredth of a percent, xx4 ) Requirement 2. Calculate the company's proft margin ratio. Interpeet your results Begn by selecting the forrmula to calculate proft maggn rato, and then enter the amounts to calculate the company's profi margin ratio. (Enter your fnal to the neatest hundredith of a persent. The company's profit margin ratio tels us that they earn for every dollar of Requirement 3. Calculate the company's asset tumover ratia. Interpret your results. Begin by selecting the formula to calculate asset furnover ratio, and then enter the amounts to calculalo the compary'i asset turnover rato =Assetlumoverrato= The company's asset tumover ratio explakis how efficiontly a compary utes its to generate The compary is generating of whth every $1.00 of Requirement 4. Use the expanded ROt formula to confirm your results from Requirement 1. Interpret your results. First, select the expanded ROI formula Using the expanded formula, the ROI for Money Sade, inc, is To determine what is driving a company's ROI, management often restates the ROl equation in its expanded form. The ROI caiculated with the expanded formula calculated in Requirement 1. Requirement 5. Calculate the company's Ra. Interpret your results. First, select the formula to calculate residual income (Ri) The Ri for Money Safe, Inc. is Money Sate, Inc, is management's targat rate of rotum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts