Question: I need this answered with work shown please PORTFOLIO PERFORMANCE MEASUREMENT You are evaluating the performance of two portfolios for the Gilmores. The S&P stock

I need this answered with work shown please

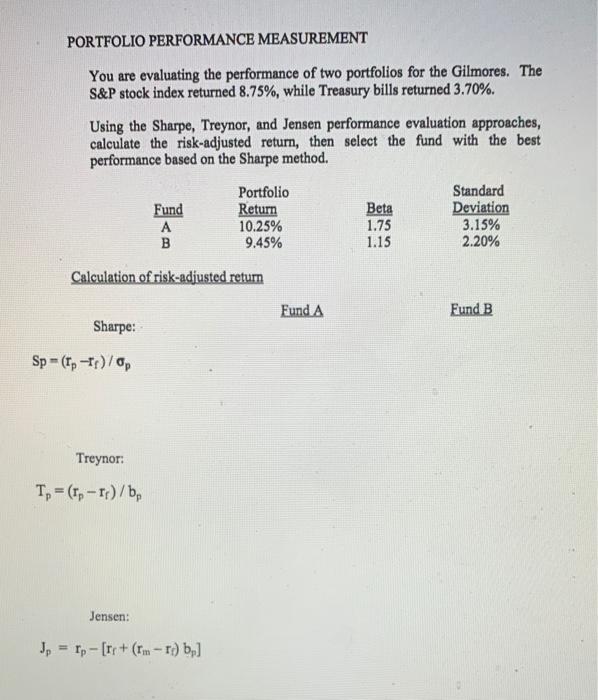

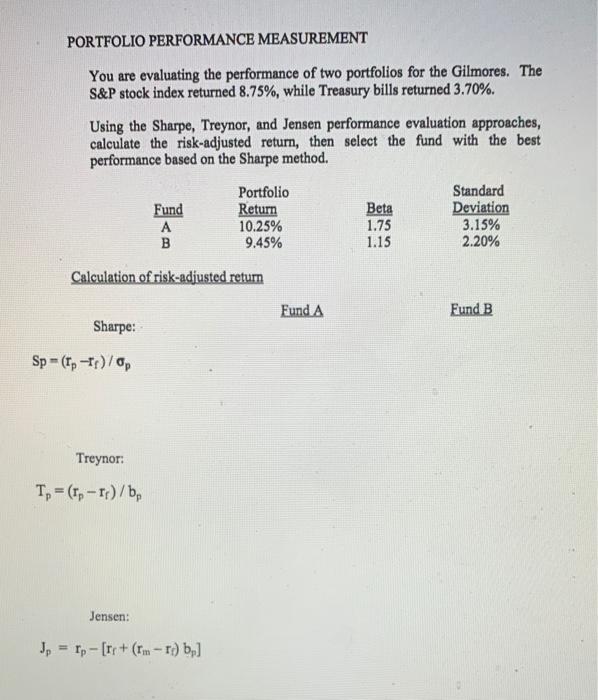

PORTFOLIO PERFORMANCE MEASUREMENT You are evaluating the performance of two portfolios for the Gilmores. The S&P stock index returned 8.75%, while Treasury bills returned 3.70%. Using the Sharpe, Treynor, and Jensen performance evaluation approaches, calculate the risk-adjusted return, then select the fund with the best performance based on the Sharpe method. Fund A B Portfolio Return 10.25% 9.45% Beta 1.75 1.15 Standard Deviation 3.15% 2.20% Calculation of risk-adjusted return Fund A Fund B Sharpe: Sp - (Tp-Tr)/0, Treynor: : To = (tp-Tr)/b Jensen: Jp = rp - [rr+ (Im - To) by]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock