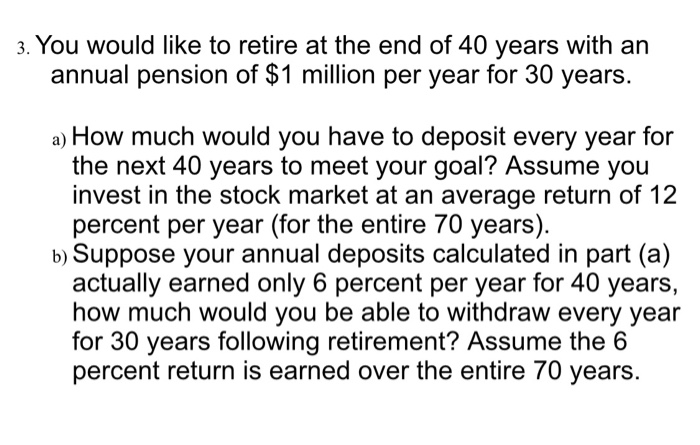

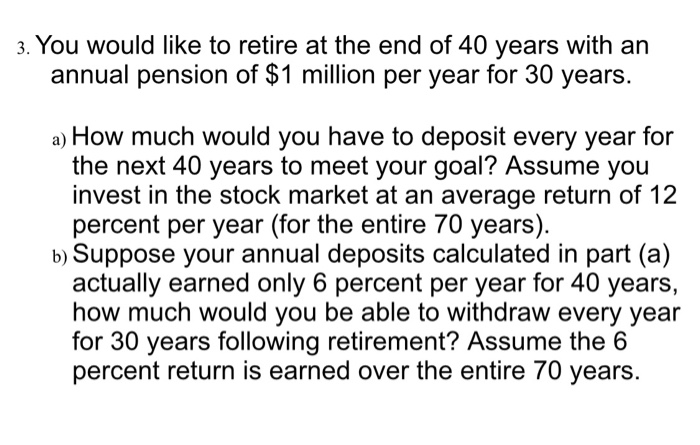

Question: I need this computer typed as soon as possible 3. You would like to retire at the end of 40 years with an annual pension

I need this computer typed as soon as possible

3. You would like to retire at the end of 40 years with an annual pension of $1 million per year for 30 years. a) How much would you have to deposit every year for the next 40 years to meet your goal? Assume you invest in the stock market at an average return of 12 percent per year (for the entire 70 years). b) Suppose your annual deposits calculated in part (a) actually earned only 6 percent per year for 40 years, how much would you be able to withdraw every year for 30 years following retirement? Assume the 6 percent return is earned over the entire 70 years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock