Question: please help with work on how to do this. course investments at business school. thank you so much in advance There was a problem checking

please help with work on how to do this. course investments at business school. thank you so much in advance

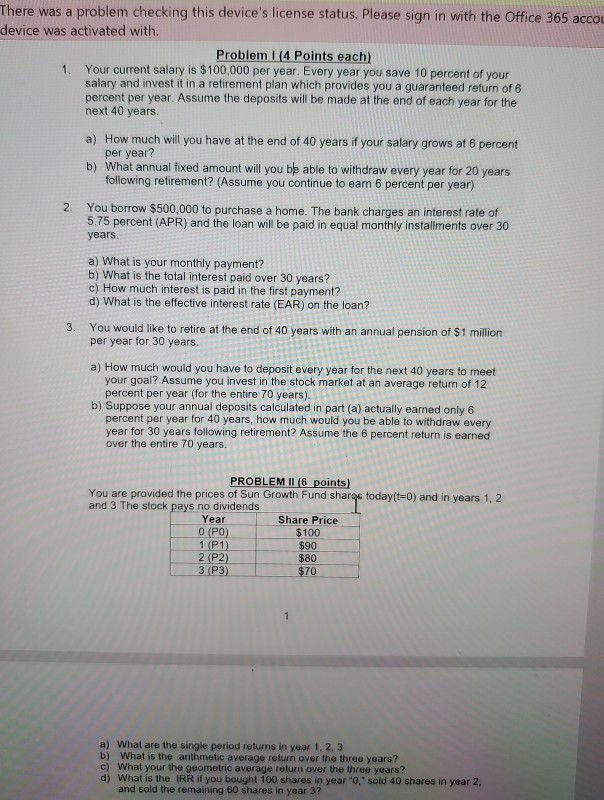

There was a problem checking this device's license status. Please sign in with the Office 365 acco device was activated with Problem I (4 Points each) 1. Your current salary is $100,000 per year. Every year you save 10 percent of your salary and invest it in a retirement plan which provides you a guaranteed return of 6 percent per year. Assume the deposits will be made at the end of each year for the next 40 years. a) How much will you have at the end of 40 years if your salary grows at 6 percent per year? b) What annual fixed amount will you be able to withdraw every year for 20 years following retirement? (Assume you continue to eam 6 percent per year) 2. You borrow $500,000 to purchase a home. The bank charges an interest rate of 5.75 percent (APR) and the loan will be paid in equal monthly installments over 30 years a) What is your monthly payment? b) What is the total interest paid over 30 years? c) How much interest is paid in the first payment? d) What is the effective interest rate (EAR) on the loan? 3. You would like to retire at the end of 40 years with an annual pension of $1 million per year for 30 years a) How much would you have to deposit every year for the next 40 years to meet your goal? Assume you invest in the stock market at an average return of 12 percent per year (for the entire 70 years). b) Suppose your annual deposits calculated in part (a) actually eamed only 6 percent per year for 40 years, how much would you be able to withdraw every year for 30 years following retirement? Assume the 6 percent return is earned over the entire 70 years. PROBLEM II/6 points) You are provided the prices of Sun Growth Fund sharqs today(t=0) and in years 1, 2 and 3 The stock pays no dividends Year Share Price O (PO) $100 1 (P1) $90 2 (P2) $80 3 (P3) $70 a) What are the single period returns in year 1, 2, 3 b) What is the arithmetic average return over the three years? c) What your the geometric average return over the three years? d) What is the IRR if you bought 100 shares in year "O, sold 40 shares in year 2 and sold the remaining 60 shares in year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts