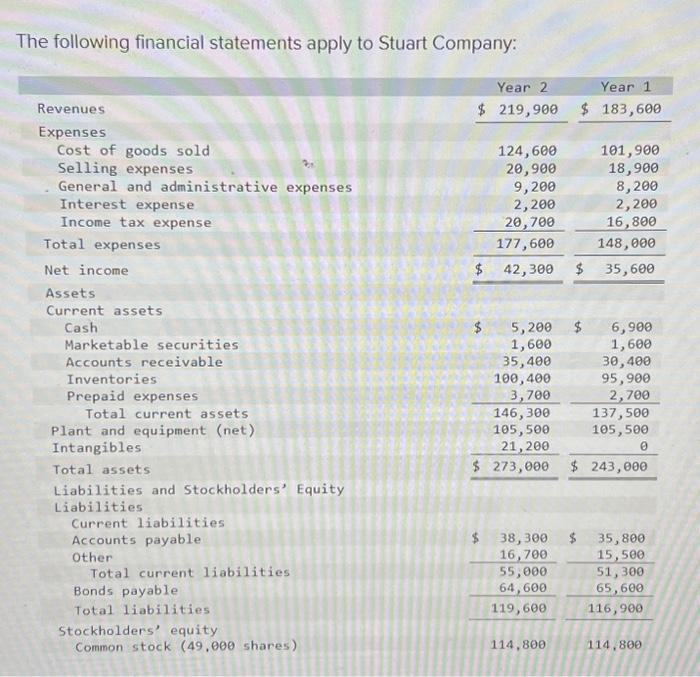

Question: I need this correct this time please help! The following financial statements apply to Stuart Company: Required Calculate the following ratios for Year 1 and

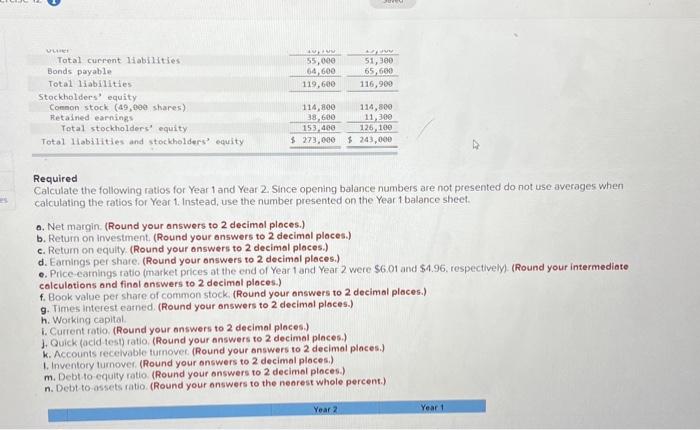

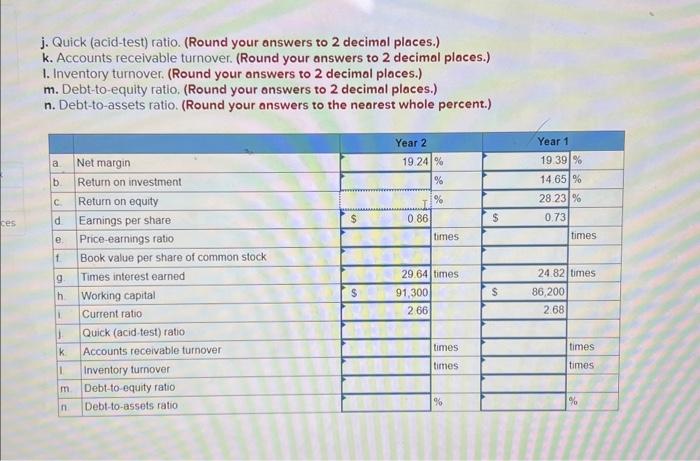

The following financial statements apply to Stuart Company: Required Calculate the following ratios for Year 1 and Year 2. Since opening balance numbers are not presented do not use averages when calculating the ratios for Year 1. Instead, use the number presented on the Year 1 balance sheet. a. Net margin. (Round your answers to 2 decimal places.) b. Return on investment. (Round your answers to 2 decimal ploces.) c. Retum on equity. (Round your answers to 2 decimal places.) d. Eamings per shate. (Round your onswers to 2 decimal places.) e. Price-carnings ratio (market prices at the end of Year 1 and Year 2 were \$6.01 and \$4.96, respectively) (Round your intermediate colculotions and final answers to 2 decimal places.) f. Book value per share of common stock. (Round your answers to 2 decimal ploces.) g. Times interest earned. (Round your onswers to 2 decimal places.) h. Working capital i. Current ratio. (Round your answers to 2 decimal places.) 1. Quick (ocid test) ratio, (Round your answers to 2 decimal piaces.) k. Accounts recelvable turnover (Round your answers to 2 decimal places.) 1. Inventory tumover. (Round your onswers to 2 decimal ploces.) m. Debt to equity ratio. (Round your onswers to 2 decimal ploces.) n. Debt to-assets ratio. (Round your answers to the nearest whole percent.) j. Quick (acid-test) ratio. (Round your answers to 2 decimal places.) k. Accounts receivable turnover. (Round your answers to 2 decimal places.) 1. Inventory turnover. (Round your answers to 2 decimal places.) m. Debt-to-equity ratio. (Round your answers to 2 decimal places.) n. Debt-to-assets ratio. (Round your answers to the nearest whole percent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts