Question: I need this done asap. Please help me solve this. Thanks. Due in 1 hour. Disposal of Fixed Asset Equipment acquired on January 6 at

I need this done asap. Please help me solve this. Thanks. Due in 1 hour.

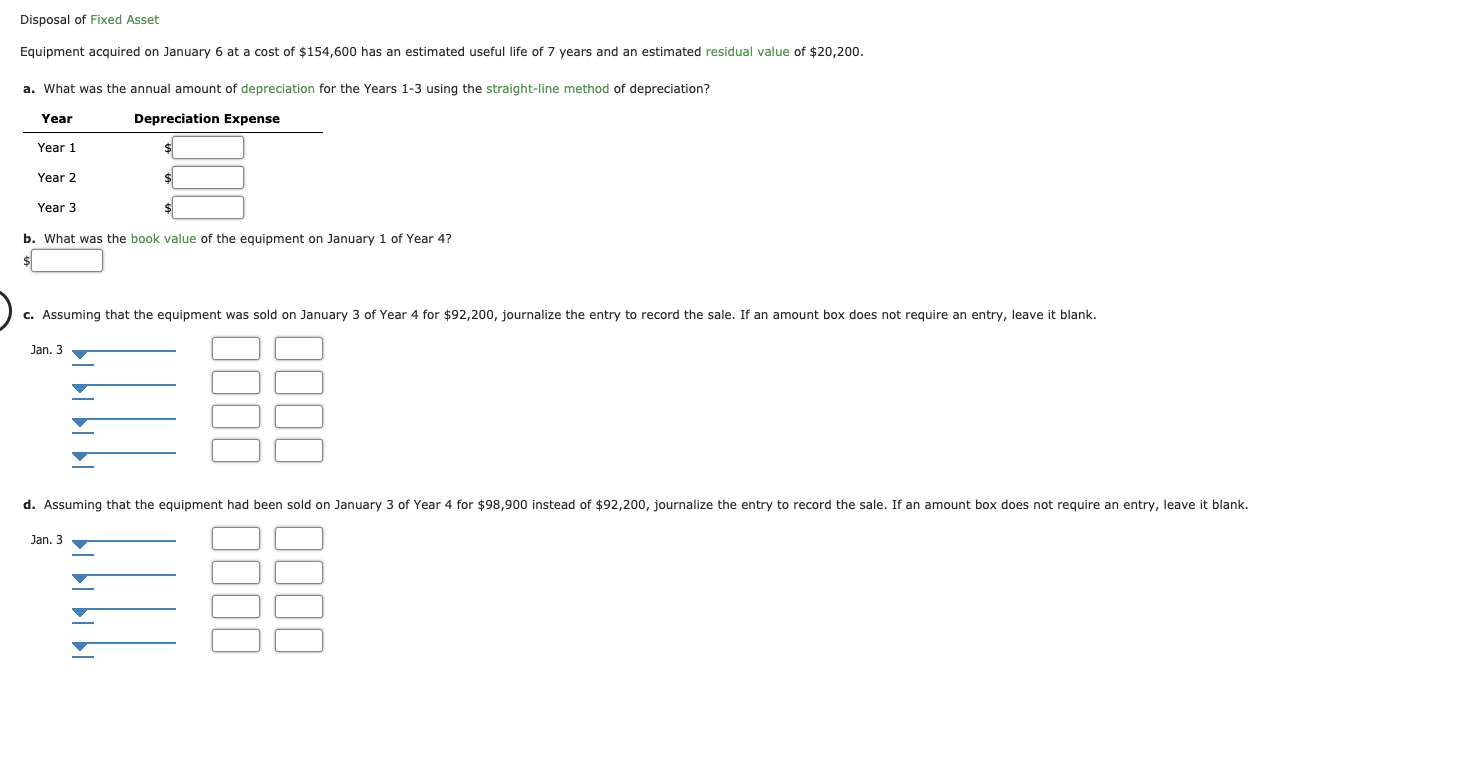

Disposal of Fixed Asset Equipment acquired on January 6 at a cost of $154,600 has an estimated useful life of 7 years and an estimated residual value of $20,200. a. What was the annual amount of depreciation for the Years 1-3 using the straight-line method of depreciation? Year Depreciation Expense Year 1 Year 2 Year 3 b. What was the book value of the equipment on January 1 of Year 4? $ c. Assuming that the equipment was sold on January 3 of Year 4 for $92,200, journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Jan. 3 d. Assuming that the equipment had been sold on January 3 of Year 4 for $98,900 instead of $92,200, journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Jan. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts