Question: I need this problem to be solved as soon as possible please. In those following forms. Challenge #2 uctions: Prepare adjusting entries to reflect a

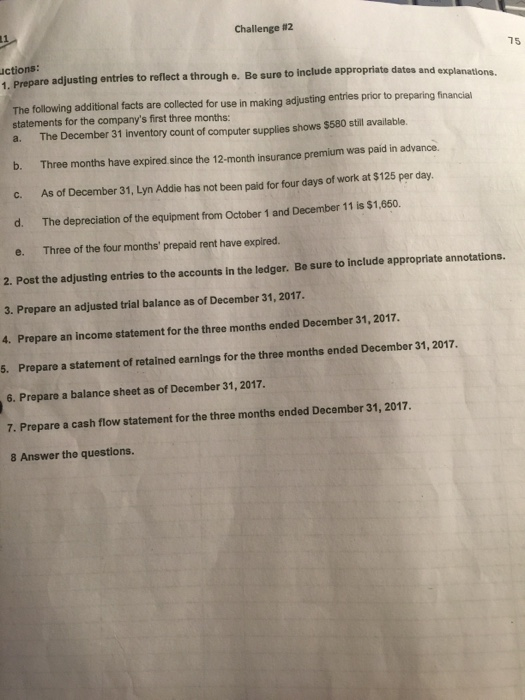

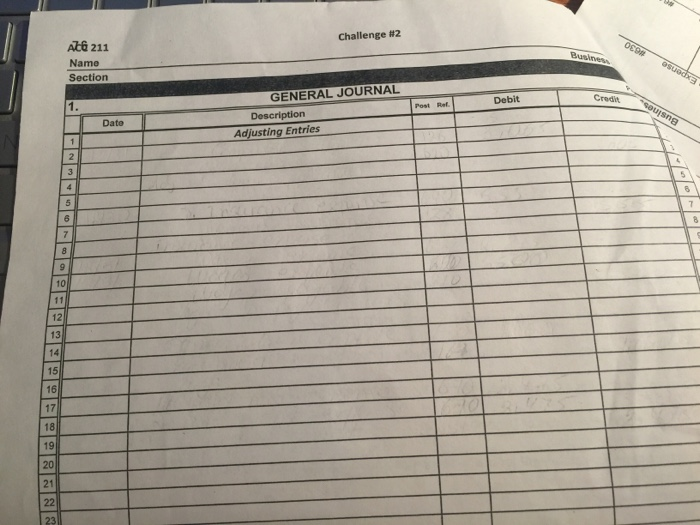

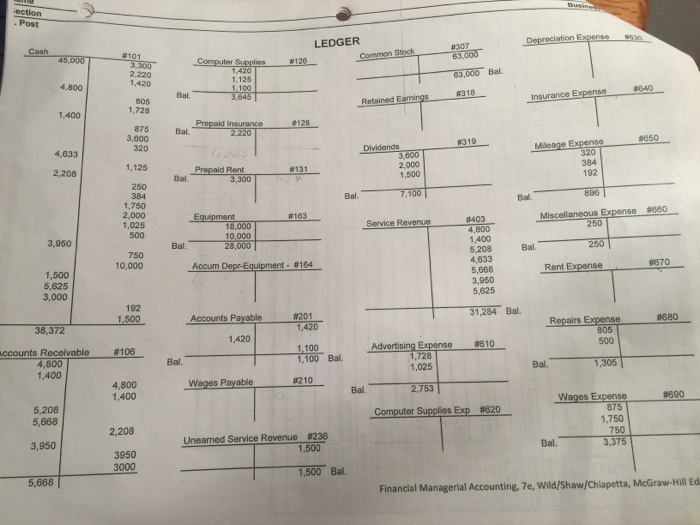

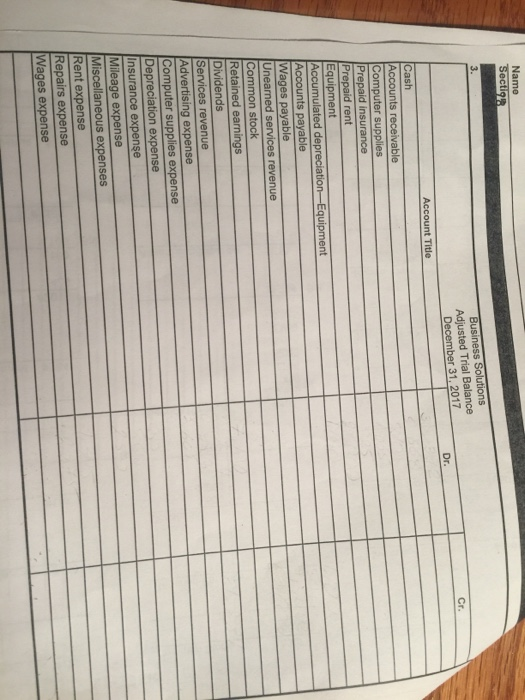

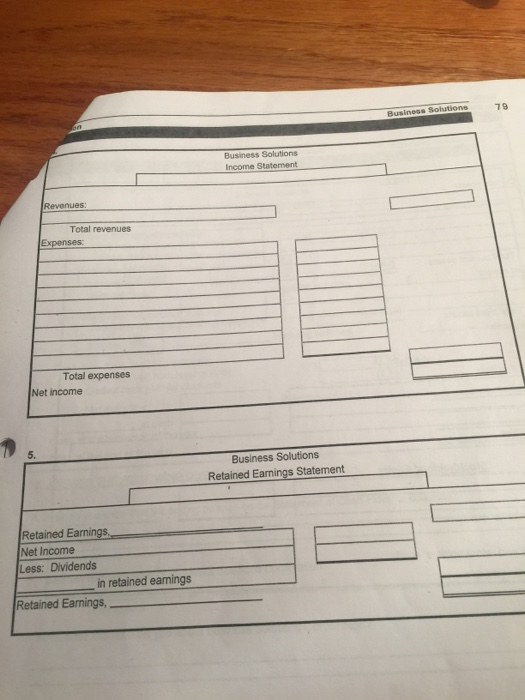

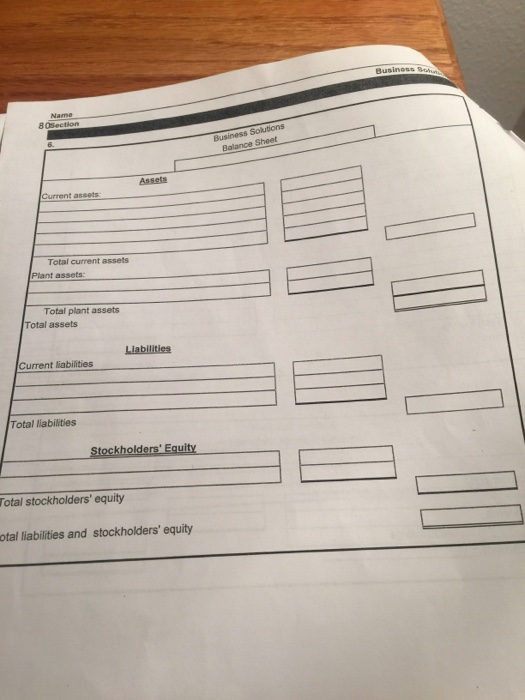

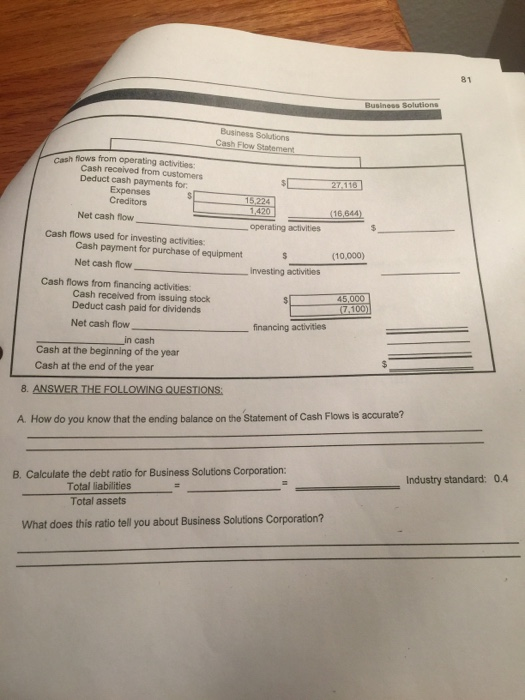

Challenge #2 uctions: Prepare adjusting entries to reflect a through e. Be sure to include appropriate dates and explanatione The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months: a. The December 31 Inventory count of computer supplies shows $580 still available, b. Three months have expired since the 12-month insurance premium was paid in advance. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day. d. The depreciation of the equipment from October 1 and December 11 is $1,650. e. Three of the four months' prepaid rent have expired. 2. Post the adjusting entries to the accounts in the ledger. Be sure to include appropriate annotations. 3. Prepare an adjusted trial balance as of December 31, 2017 4. Prepare an income statement for the three months ended December 31, 2017. 5. Prepare a statement of retained earnings for the three months ended December 31, 2017. 6. Prepare a balance sheet as of December 31, 2017. 7. Prepare a cash flow statement for the three months ended December 31, 2017. 8 Answer the questions. Challenge #2 AT6 211 Namo Section GENERAL JOURNAL Description Adjusting Entries rost not Debit oung ection . Post Depreciation Expense 3 LEDGER Common Stock 301 Cash 63.000 45,000 Computer Supplies 126 2101 3.300 2,220 1,420 63,000 Bal 4,800 040 Bal 3.645 318 805 1.728 Retained Emings Insurance Expense 1,400 875 Bal. Prepaid insurance 2.220 3,600 320 Dividends Mileage Expense 320 4,633 2,208 384 1,125 3,800 2.000 1.500 Prepaid Rent 3.300 192 Bal 7.100 896 250 384 1,750 2.000 1,025 500 380 Service Revenue Equipment 18,000 10,000 28,000 Miscellaneous Expense 250 3,950 Bal Bal. 250 750 10,000 #403 4.800 1,400 5208 4.633 5.668 3,950 5.625 Accum Depr-Equipment - $164 Rent Expense #670 1,500 5,625 3,000 192 1,500 31,284 Bal. Accounts Payable #201 1,420 Repairs Expense #680 38,372 805 1,420 #610 500 #106 1,100 1,100 Bal accounts Receivable 4,800 1,400 Advertising Expense 1,728 1,025 Bal Bal 1,305 Wages Payable #210 4.800 1,400 Bal." 2,753 #690 5,208 5,668 Computer Supplies Exp#820 Wages Expense 875 1,750 750 Bal 3,375 2,208 3,950 Unearned Service Revenue #236 1,500 3950 3000 1,500 Bal. 5,668 Financial Managerial Accounting, 7e, Wild/Shaw/Chiapetta, McGraw-Hill Ed. Name Section Business Solutions Adjusted Trial Balance December 31, 2017 Account Title Cash Accounts receivable Computer supplies Prepaid insurance Prepaid rent Equipment Accumulated depreciation Equipment Accounts payable Wages payable Unearned services revenue Common stock Retained earnings Dividends Services revenue Advertising expense Computer supplies expense Depreciation expense Insurance expense Mileage expense Miscellaneous expenses Rent expense Repairs expense Wages expense 79 Business Solutions Business Solutions Income Statement Revenues: Total revenues Expenses Total expenses Net income Business Solutions Retained Earnings Statement Retained Earnings Net Income Less: Dividends in retained earnings Retained Earnings, Business Solutions Balance Sheet Total current assets Plant assets Total plant assets Total assets Liabilities Current liabilities Total liabilities Stockholders' Equity stal stockholders' equity "al liabilities and stockholders' equity Challenge #2 uctions: Prepare adjusting entries to reflect a through e. Be sure to include appropriate dates and explanatione The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months: a. The December 31 Inventory count of computer supplies shows $580 still available, b. Three months have expired since the 12-month insurance premium was paid in advance. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day. d. The depreciation of the equipment from October 1 and December 11 is $1,650. e. Three of the four months' prepaid rent have expired. 2. Post the adjusting entries to the accounts in the ledger. Be sure to include appropriate annotations. 3. Prepare an adjusted trial balance as of December 31, 2017 4. Prepare an income statement for the three months ended December 31, 2017. 5. Prepare a statement of retained earnings for the three months ended December 31, 2017. 6. Prepare a balance sheet as of December 31, 2017. 7. Prepare a cash flow statement for the three months ended December 31, 2017. 8 Answer the questions. Challenge #2 AT6 211 Namo Section GENERAL JOURNAL Description Adjusting Entries rost not Debit oung ection . Post Depreciation Expense 3 LEDGER Common Stock 301 Cash 63.000 45,000 Computer Supplies 126 2101 3.300 2,220 1,420 63,000 Bal 4,800 040 Bal 3.645 318 805 1.728 Retained Emings Insurance Expense 1,400 875 Bal. Prepaid insurance 2.220 3,600 320 Dividends Mileage Expense 320 4,633 2,208 384 1,125 3,800 2.000 1.500 Prepaid Rent 3.300 192 Bal 7.100 896 250 384 1,750 2.000 1,025 500 380 Service Revenue Equipment 18,000 10,000 28,000 Miscellaneous Expense 250 3,950 Bal Bal. 250 750 10,000 #403 4.800 1,400 5208 4.633 5.668 3,950 5.625 Accum Depr-Equipment - $164 Rent Expense #670 1,500 5,625 3,000 192 1,500 31,284 Bal. Accounts Payable #201 1,420 Repairs Expense #680 38,372 805 1,420 #610 500 #106 1,100 1,100 Bal accounts Receivable 4,800 1,400 Advertising Expense 1,728 1,025 Bal Bal 1,305 Wages Payable #210 4.800 1,400 Bal." 2,753 #690 5,208 5,668 Computer Supplies Exp#820 Wages Expense 875 1,750 750 Bal 3,375 2,208 3,950 Unearned Service Revenue #236 1,500 3950 3000 1,500 Bal. 5,668 Financial Managerial Accounting, 7e, Wild/Shaw/Chiapetta, McGraw-Hill Ed. Name Section Business Solutions Adjusted Trial Balance December 31, 2017 Account Title Cash Accounts receivable Computer supplies Prepaid insurance Prepaid rent Equipment Accumulated depreciation Equipment Accounts payable Wages payable Unearned services revenue Common stock Retained earnings Dividends Services revenue Advertising expense Computer supplies expense Depreciation expense Insurance expense Mileage expense Miscellaneous expenses Rent expense Repairs expense Wages expense 79 Business Solutions Business Solutions Income Statement Revenues: Total revenues Expenses Total expenses Net income Business Solutions Retained Earnings Statement Retained Earnings Net Income Less: Dividends in retained earnings Retained Earnings, Business Solutions Balance Sheet Total current assets Plant assets Total plant assets Total assets Liabilities Current liabilities Total liabilities Stockholders' Equity stal stockholders' equity "al liabilities and stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts