Question: I need three boxes. thanks for your help. Amy and Mitchell share equally in the profits, losses, and capital of the accrual basis AM Products

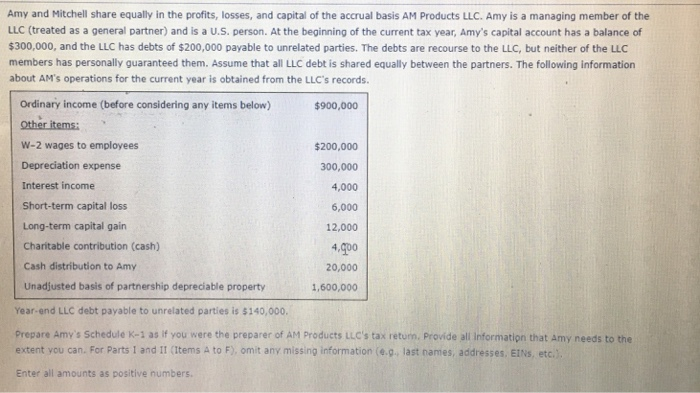

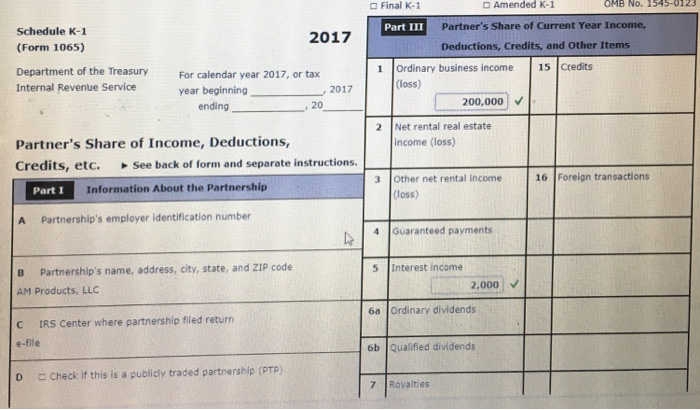

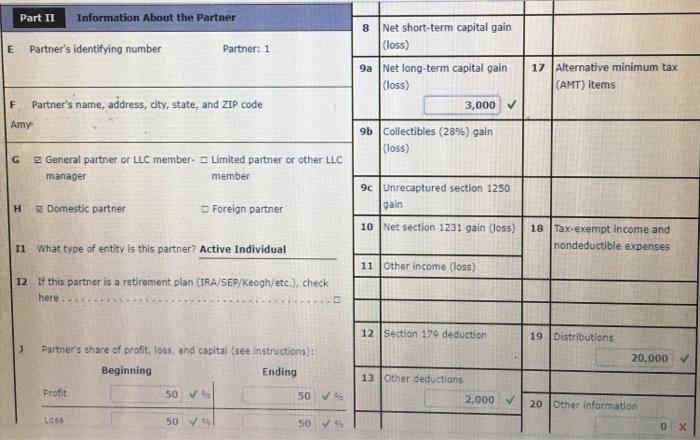

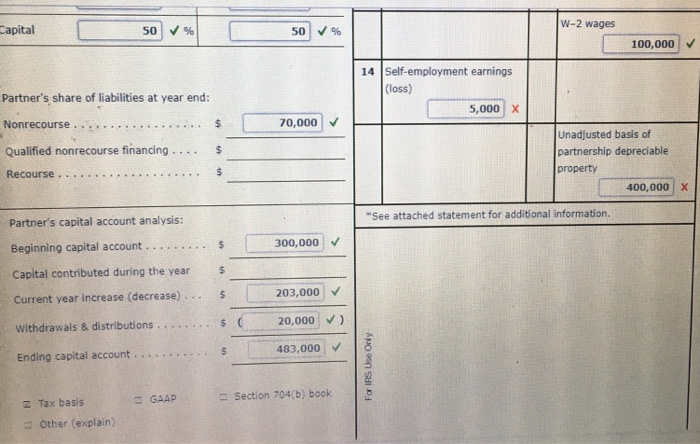

Amy and Mitchell share equally in the profits, losses, and capital of the accrual basis AM Products LLC. Amy is a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Amy's capital account has a balance of $300,000, and the LLC has debts of $200,000 payable to unrelated parties. The debts are recourse to the LLC, but neither of the LLGC members has personally guaranteed them. Assume that all LLC debt is shared equally between the partners. The following information about AM's operations for the current year is obtained from the LLC's records Ordinary income (before considering any items below) 900,000 W-2 wages to employees Depreciation expense Interest income Short-term capital loss Long-term capital gain Charitable contribution (cash) Cash distribution to Amy Unadjusted basis of partnership depreciable property $200,000 300,000 4,000 6,000 12,000 4,g00 20,000 1,600,000 Year-end LLC debt payable to unrelated parties is $140,000. Prepare Amy's Schedule K-1 as if you were the preparer of AM Products Lc's tax retum, Provide all Information that Amy needs to the extent you can. For Parts I and II (Items A to F), omit any missing information (e.g, last names, addresses, EINs, etc.) Enter all amounts as positive numbers. O Final K-1 D Amended K-1 OMB No. 5-0123 Part III Partner's Share of Current Year Income, Schedule K-1 (Form 1065) Department of the Treasury 2017 Deductions, Credits, and Other Items 1 Ordinary business income 15 Credits For calendar year 2017, or tax year beginning Internal Revenue Service (loss) , 2017 20 200,000 ending 2 Net rental real estate Partner's Share of Income,D Credits, etc. see back of form and separate instructions. income (loss) 3 Other net rental income 16 Foreign transactions Part I Information About the Partnership (loss) A Partnership's employer identification number 4 Guaranteed payments B Partnership's name, address, city, state, and ZIP code AM Products, LLC 5 Interest income 2.000 V 6a Ordinary dividends C IRS Center where partnership filed return e-file 6b Qualifled dividends D Check if this is a publicly traded partnership (PTP) 7 Rovalties Part II Information About the Partner 8 Net short-term capital gain E Partner's identifying number Partner: 1 (loss) 9a Net long-term capital gain 17 Alternative minimum tax loss) (AMT) items F Partner's name, address, city, state, and ZIP code 3,000 Amy 9b | Collectibles (2896) gain (loss) G 2 General partner or LLC member- Limited partner or other LLC manager member 9c Unrecaptured section 1250 H Domestic partner Foreign partner gain 10 Net section 1231 gain (loss) 18 Tax-exempt income and I1 What type of entity is this partner? Active Individual nondeductible expenses 11 Other income (loss) 12 If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here ..*... 12 Section 179 deduction 19 Distributions 3 Partners share of profit, loss, and capital (see instructions): 20,000 Beginning Ending Other deductions Profit 50 % 2,000 20 Other information Loss W-2 wages apital 50 v 96 100,000v 14 Self-employment earnings (loss) Partner's share of liabilities at year end: Nonrecourse . Qualified nonrecourse financing....$ 5,000 X 70,000 Unadjusted basis of property 400,000 x "See attached statement for additional information Partner's capital account analysis: Beginning capital account.... $ Capital contributed during the year Current year increase (decrease). .. $ Withdrawals & distributions . . Ending capital account . 300,000 203,000 s 20,000 ) 483,000 z Tax basis GAAPSection 704(b) book Other (explain) Amy and Mitchell share equally in the profits, losses, and capital of the accrual basis AM Products LLC. Amy is a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Amy's capital account has a balance of $300,000, and the LLC has debts of $200,000 payable to unrelated parties. The debts are recourse to the LLC, but neither of the LLGC members has personally guaranteed them. Assume that all LLC debt is shared equally between the partners. The following information about AM's operations for the current year is obtained from the LLC's records Ordinary income (before considering any items below) 900,000 W-2 wages to employees Depreciation expense Interest income Short-term capital loss Long-term capital gain Charitable contribution (cash) Cash distribution to Amy Unadjusted basis of partnership depreciable property $200,000 300,000 4,000 6,000 12,000 4,g00 20,000 1,600,000 Year-end LLC debt payable to unrelated parties is $140,000. Prepare Amy's Schedule K-1 as if you were the preparer of AM Products Lc's tax retum, Provide all Information that Amy needs to the extent you can. For Parts I and II (Items A to F), omit any missing information (e.g, last names, addresses, EINs, etc.) Enter all amounts as positive numbers. O Final K-1 D Amended K-1 OMB No. 5-0123 Part III Partner's Share of Current Year Income, Schedule K-1 (Form 1065) Department of the Treasury 2017 Deductions, Credits, and Other Items 1 Ordinary business income 15 Credits For calendar year 2017, or tax year beginning Internal Revenue Service (loss) , 2017 20 200,000 ending 2 Net rental real estate Partner's Share of Income,D Credits, etc. see back of form and separate instructions. income (loss) 3 Other net rental income 16 Foreign transactions Part I Information About the Partnership (loss) A Partnership's employer identification number 4 Guaranteed payments B Partnership's name, address, city, state, and ZIP code AM Products, LLC 5 Interest income 2.000 V 6a Ordinary dividends C IRS Center where partnership filed return e-file 6b Qualifled dividends D Check if this is a publicly traded partnership (PTP) 7 Rovalties Part II Information About the Partner 8 Net short-term capital gain E Partner's identifying number Partner: 1 (loss) 9a Net long-term capital gain 17 Alternative minimum tax loss) (AMT) items F Partner's name, address, city, state, and ZIP code 3,000 Amy 9b | Collectibles (2896) gain (loss) G 2 General partner or LLC member- Limited partner or other LLC manager member 9c Unrecaptured section 1250 H Domestic partner Foreign partner gain 10 Net section 1231 gain (loss) 18 Tax-exempt income and I1 What type of entity is this partner? Active Individual nondeductible expenses 11 Other income (loss) 12 If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here ..*... 12 Section 179 deduction 19 Distributions 3 Partners share of profit, loss, and capital (see instructions): 20,000 Beginning Ending Other deductions Profit 50 % 2,000 20 Other information Loss W-2 wages apital 50 v 96 100,000v 14 Self-employment earnings (loss) Partner's share of liabilities at year end: Nonrecourse . Qualified nonrecourse financing....$ 5,000 X 70,000 Unadjusted basis of property 400,000 x "See attached statement for additional information Partner's capital account analysis: Beginning capital account.... $ Capital contributed during the year Current year increase (decrease). .. $ Withdrawals & distributions . . Ending capital account . 300,000 203,000 s 20,000 ) 483,000 z Tax basis GAAPSection 704(b) book Other (explain)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts