Question: I need to know how to do it on excel, but you can show it on paper on how to solve it Given the financial

I need to know how to do it on excel, but you can show it on paper on how to solve it

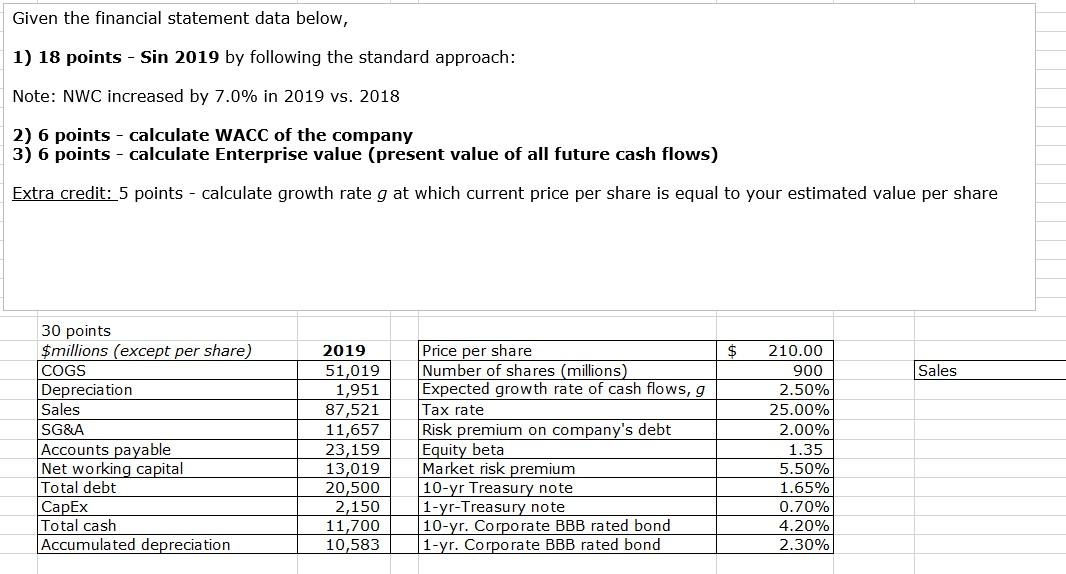

Given the financial statement data below, 1) 18 points - Sin 2019 by following the standard approach: Note: NWC increased by 7.0% in 2019 vs. 2018 2) 6 points - calculate WACC of the company 3) 6 points - calculate Enterprise value (present value of all future cash flows) Extra credit: 5 points - calculate growth rate g at which current price per share is equal to your estimated value per share $ Sales 30 points $millions (except per share) COGS Depreciation Sales SG&A Accounts payable Net working capital Total debt CapEx Total cash Accumulated depreciation 2019 51,019 1,951 87,521 11,657 23,159 13,019 20,500 2,150 11,700 10,583 Price per share Number of shares (millions) Expected growth rate of cash flows, 9 Tax rate Risk premium on company's debt Equity beta Market risk premium 10-yr Treasury note 1-yr-Treasury note 10-yr. Corporate BBB rated bond 1-yr. Corporate BBB rated bond 210.00 900 2.50% 25.00% 2.00% 1.35 5.50% 1.65% 0.70% 4.20% 2.30% Given the financial statement data below, 1) 18 points - Sin 2019 by following the standard approach: Note: NWC increased by 7.0% in 2019 vs. 2018 2) 6 points - calculate WACC of the company 3) 6 points - calculate Enterprise value (present value of all future cash flows) Extra credit: 5 points - calculate growth rate g at which current price per share is equal to your estimated value per share $ Sales 30 points $millions (except per share) COGS Depreciation Sales SG&A Accounts payable Net working capital Total debt CapEx Total cash Accumulated depreciation 2019 51,019 1,951 87,521 11,657 23,159 13,019 20,500 2,150 11,700 10,583 Price per share Number of shares (millions) Expected growth rate of cash flows, 9 Tax rate Risk premium on company's debt Equity beta Market risk premium 10-yr Treasury note 1-yr-Treasury note 10-yr. Corporate BBB rated bond 1-yr. Corporate BBB rated bond 210.00 900 2.50% 25.00% 2.00% 1.35 5.50% 1.65% 0.70% 4.20% 2.30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts