Question: i need to solve each problem on these pages with explanation please and the instruction is on the said of each pages LEARNING OBJECTIVES 1.

i need to solve each problem on these pages with explanation please

and the instruction is on the said of each pages

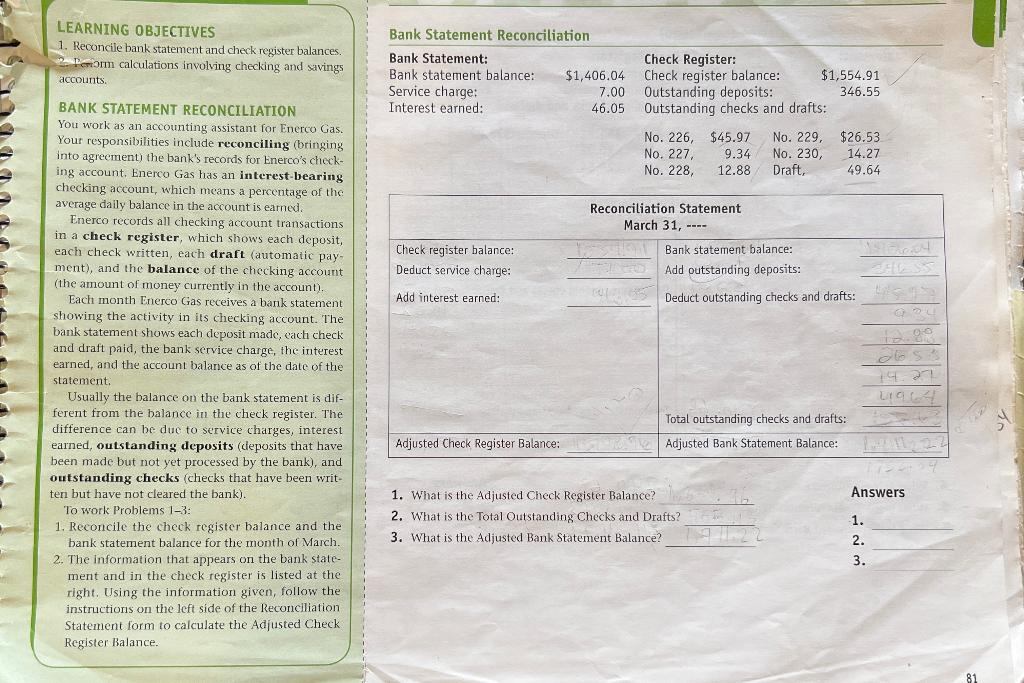

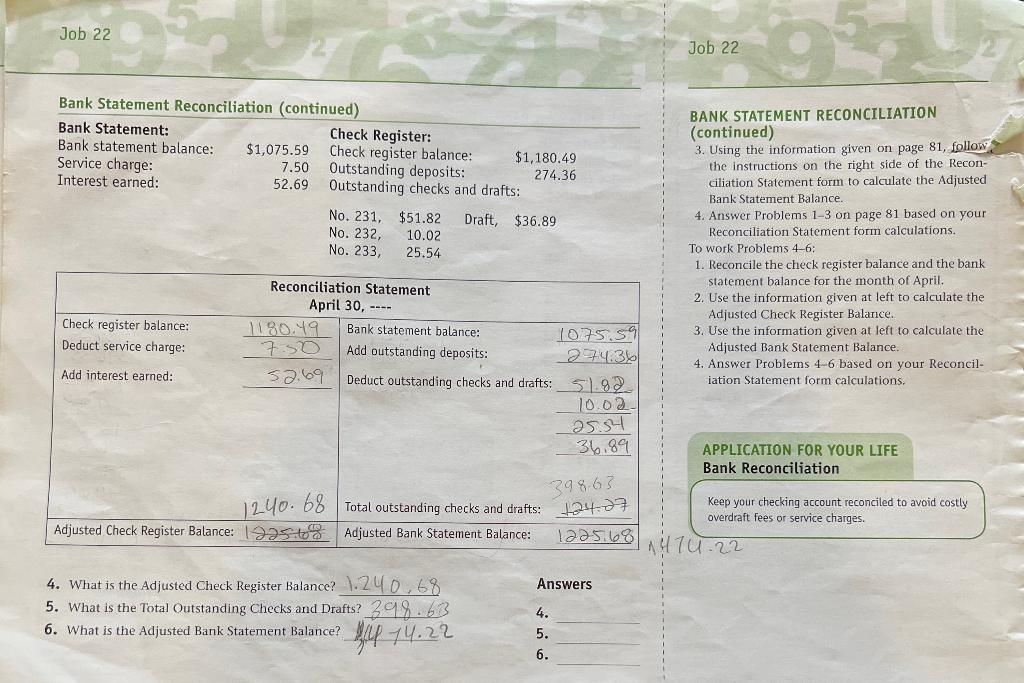

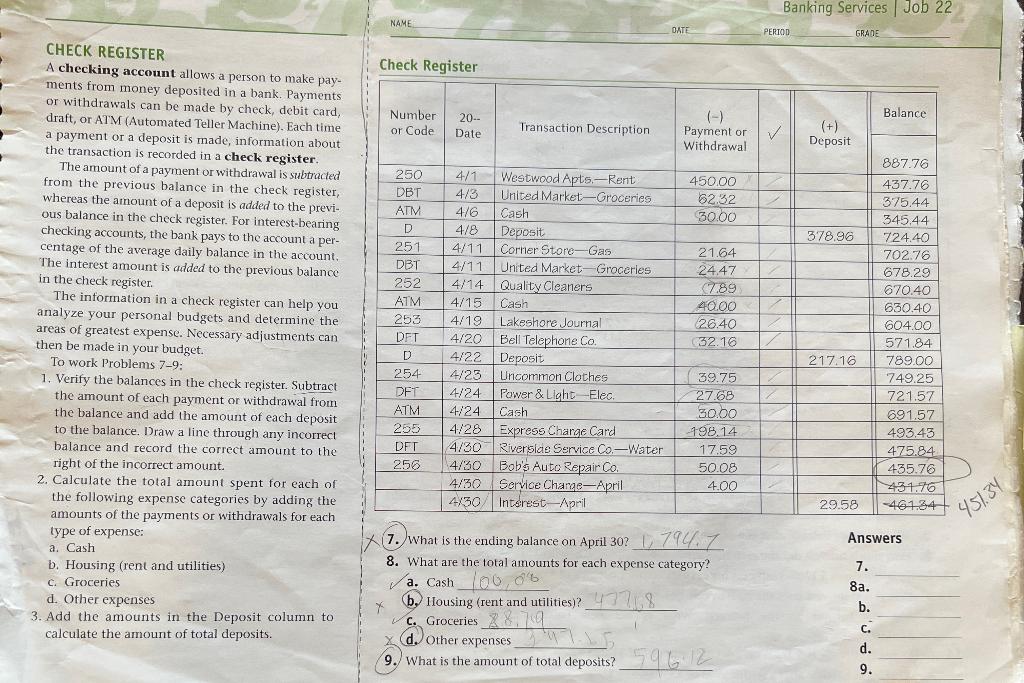

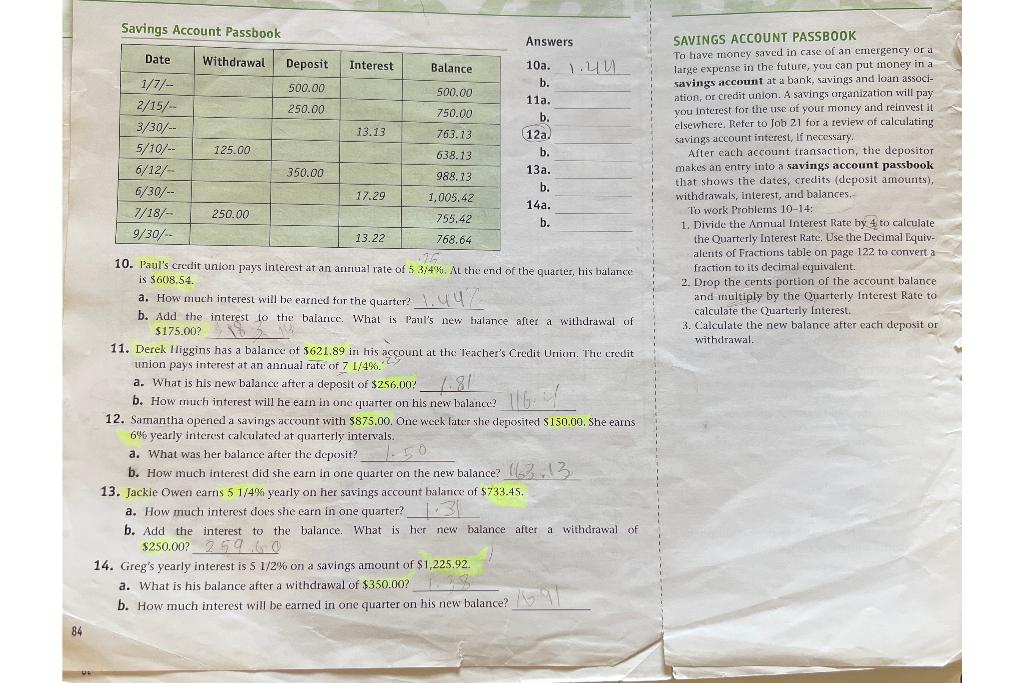

LEARNING OBJECTIVES 1. Reconcile bank statement and check register balances. 2. Perrorm calculations involving checking and savings accounts: BANK STATEMENT RECONCILIATION You work as an accounting assistant for Enerco Gas. Your responsibilities include reconciling (bringing into agreement) the bank's records for Enerco's checking account, Enerco Gas has an interest-bearing checking account, which means a percentage of the average dally balance in the account is earned. Enerco records all checking account transactions in a check register, which shows each deposit, each check written, each draft (automatic payment), and the balance of the checking account (the amount of money currently in the account). Each month Enerco Gas receives a bank statement showing the activity in its checking account. The bank statement shows each deposit made, each check and draft paid, the bank service charge, the interest earned, and the account balance as of the date of the statement, Usually the balance on the bank statement is different from the balance in the check register. The difference can be due to service charges, interest earned, outstanding deposits (deposits that have been made but not yet processed by the bank), and outstanding checks (checks that have been written but have not cleared the bank). 1. What is the Adjusted Check Register Balance? Answers To work Problems 1-3: 2. What is the Total Outstanding Checks and Drafts? 1. Reconcile the check register balance and the 1. bank statement balance for the month of March. 3. What is the Adjusted Bank Statement Balance? 2. 2. The information that appears on the bank statement and in the check register is listed at the right. Using the information given, follow the instructions on the left side of the Reconciliation Statement form to calculate the Adjusted Check Register Balance. Bank Statement Rarnneilistion Canndt.... N BANK STATEMENT RECONCILIATION (continued) 3. Using the information given on page 81 , follow. the instructions on the right side of the Reconciliation Statement form to calculate the Adjusted Bank Statement Balance. 4. Answer Problems 1-3 on page 81 based on your Reconciliation Statement form calculations. To work Problems 4-6: 1. Reconcile the check register balance and the bank statement balance for the month of April. 2. Use the information given at left to calculate the Adjusted Check Register Balance. 3. Use the information given at left to calculate the Adjusted Bank Statement Balance. 4. Answer Problems 4-6 based on your Reconciliation Statement form calculations. APPLICATION FOR YOUR LIFE Bank Reconciliation Keep your checking account reconciled to avoid costly overdraft fees or service charges. 4. What is the Adjusted Check Register Balance? 1.240,68 Answers 5. What is the Total Outstanding Checks and Drafts? 498.633 4. 6. What is the Adjusted Bank Statement Balance? 5/4,14.22. CHECK REGISTER A checking account allows a person to make pay- Check Register ments from money deposited in a bank. Payments or withdrawals can be made by check, debit card, draft, or ATM (Automated Teller Machine). Each time a payment or a deposit is made, information about the transaction is recorded in a check register. The amount of a payment or withdrawal is subtracted from the previous balance in the check register, whereas the amount of a deposit is added to the previous balance in the check register. For interest-bearing checking accounts, the bank pays to the account a percentage of the average daily balance in the account. The interest amount is added to the previous balance in the check register. The information in a check register can help you analyze your personal budgets and determine the areas of greatest expense. Necessary adjustments can then be made in your budget. To work Problems 7-9: 1. Verify the balances in the check register. Subtract the amount of each payment or withdrawal from the balance and add the amount of each deposit to the balance. Draw a line through any incorrect balance and record the correct amount to the right of the incorrect amount. 2. Calculate the total amount spent for each of the following expense categories by adding the amounts of the payments or withdrawals for each type of expense: Answers a. Cash 7. What is the ending balance on April 30 ? b. Housing (rent and utilities) 8. What are the total amounts for each expense category? 7. c. Groceries 8a. d. Other expenses (b. Housing (rent and utilities)? 3. Add the amounts in the Deposit column to b. c. Groceries calculate the amount of total deposits. c. d. 9. What is the amount of total deposits? 9. Savings Account Passbook Answers SAVINGS ACCOUNT PASSBOOK To have money saved in case of an emergency or a 10a. 1.4 large expense in the future, you can put money in a b. savings account at a bank, savings and loan associ- 11a. ation, or credit unlon. A savings organization will pay b. you interest for the use of your moncy and reinvest it elsewhere. Refer to Job 21 for a review of calculating (12a. savings account interest, If necessary. b. After each account transaction, the depositor 13a. makes an entry into a savings account passbook that shows the dates, credits (deposit amounts), b. withdrawals, interest, and balances.- 14a. To work Problems 10-14: b. 1. Divide the Annual Interest Rate by 4 , to calculate the Quarterly Interest Rate. Use the Decimal Equivalents of Fractions table on page 122 to convert a 10. Paul's credit union pays interest at an anmual rate of 53;4%, the end of the quarter, his balance fraction to its decimal equivalent. is $608.54. 2. Drop the cents portion of the account balance a. Hou much interest will be earned far the quarter? and multiply by the Quarterly Interest Rate to b. Add the interest to the balance. What is Paul's new balance after a withdrawal of calculate the Quarterly interest. $175.00 ? 3. Calculate the new balance atter each deposit or 11. Derek Higgins has a balance of $621.89 in his account at the Teacher's Credit Union. The creuit withdrawal. union pays interest at an annual rate of 71/4%. a. What is his new balance after a deposit of $256.00 ? b. How much interest will he earn in one quarter on his new balance? 12. Samantha opened a savings account with $875.00. One week later she deposited $150.00. She earns 6% yearly interest calculated at quarterly intervals. a. What was her balance after the deposit? b. How much interest did she earn in one quarter on the new balance? 13. Jackie Owen earns 51/4% yearly on her saxings account balance of $733.45. a. How much interest does she earn in one quarter? b. Add the interest to the balance. What is her new balance after a withdrawal of $250.00?259.0 14. Greg's yearly interest is 51/2% on a savings amount of $1,225.92. a. What is his balance after a withdrawal of $350.00 ? b. How much interest will be earned in one quarter on his new balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts