Question: i need to solve each problem on these pages with explanation please and the instruction is on the said of each pages from 1 to

i need to solve each problem on these pages with explanation please

and the instruction is on the said of each pages from 1 to 10

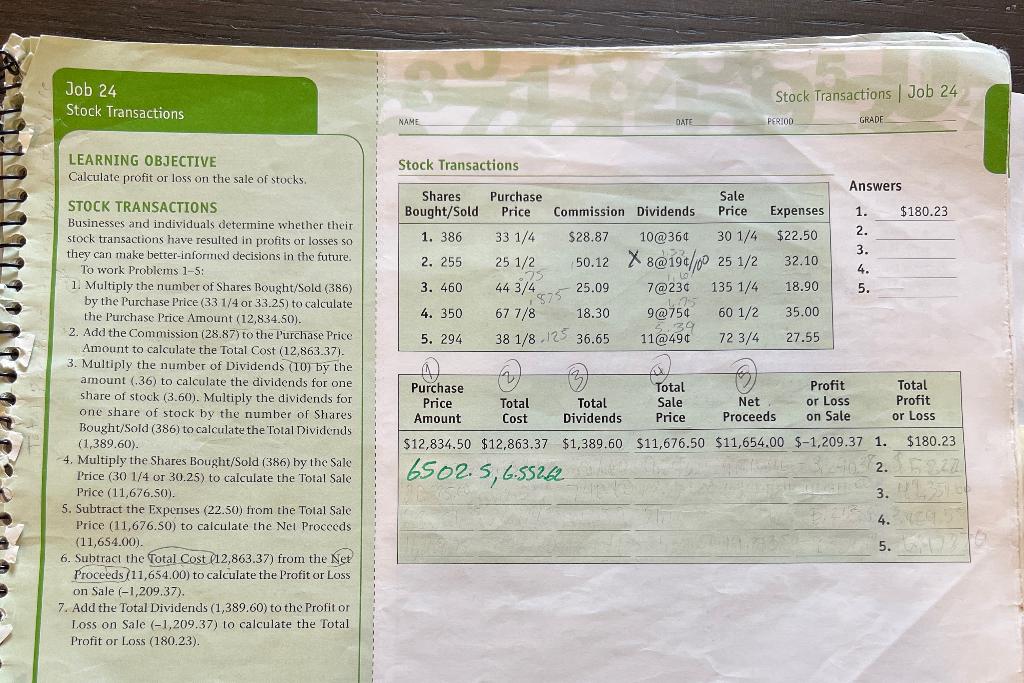

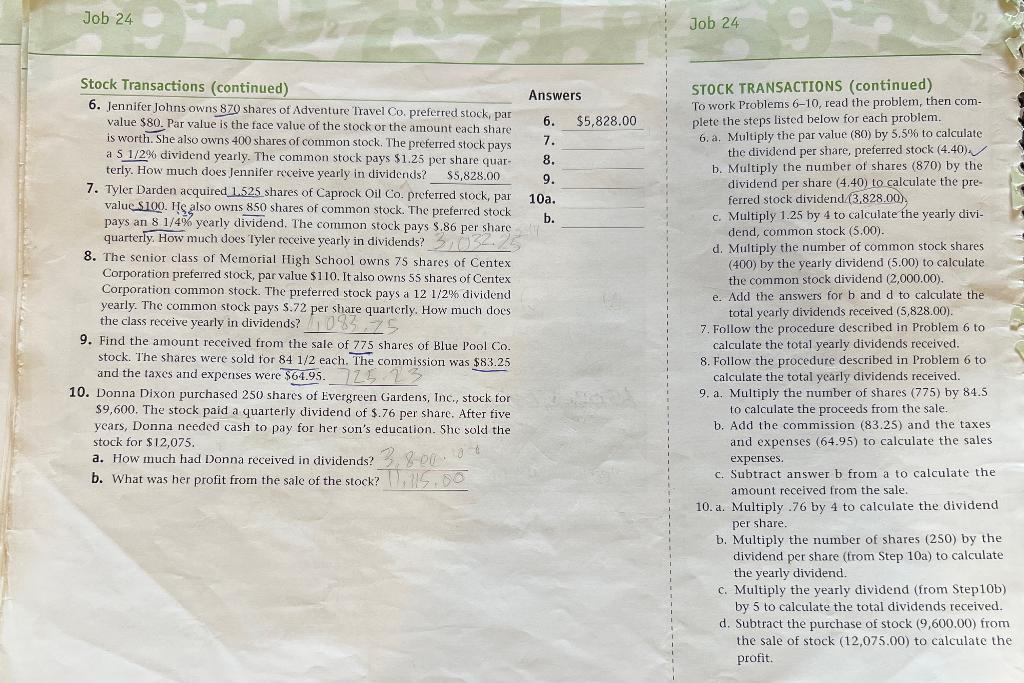

Stock Iransactions NAME LEARNING OBJECTIVE Stock Transactions Calculate profit or loss on the sale of stocks. STOCK TRANSACTIONS Businesses and individuals determine whether their stock transactions have resulted in profits or losses so they can make better-informed decisions in the future. To work Problems 1-5: 1. Multiply the number of Shares Bought/Sold (386) by the Purchase Price ( 331/4 or 33.25 ) to calculate the Purchase Price Amount (12,834.50). 2. Add the Commission (28.87) to the Purchase Price Amount to calculate the Total Cost (12,863.37). 3. Multiply the number of Dividends (10) by the amount (.36) to calculate the dividends for one share of stock (3.60). Multiply the dividends for one share of stock by the number of Shares Bought/Sold (386) to calculate the Total Dividends (1,389.60) ) 4. Multiply the Shares Bought/Sold (386) by the Sale Price (301/4 or 30.25) to calculate the Total Sale Price (11,676.50). 5. Subtract the Expenses (22.50) from the Tolal Sale Price (11,676.50) to calculate the Net Procceds (11,654.00). 6. Subtracl the Total Cost (12,863.37) from the Net Proceeds (11,654.00) to calculate the Profit or Loss on Sale (1,209,37). 7. Add the Total Dividends ( 1,389.60) to the Profit or Loss on Sale (1,209.37) to calculate the Total Profit or Loss (180.23). Stock Transactions (continued) 6. Jennifer Johns owns 870 shares of Adventure Iravel Co. preferred stock, par Answers STOCK TRANSACTIONS (continued) To work Problems 6-10, read the problem, then comvalue $80. Par value is the face value of the stock or the amount each share 6.$5,828.00 plete the steps listed below for each problem. is worth. She also owns 400 shares of common stock. The preferred stock pays 7. 6. a. Multiply the par value ( 80 ) by 5.5% to calculate a 51/2% dividend yearly. The common stock pays $1.25 per share quar- 8 . the dividend per share, preferred stock (4.40)4 terly. How much does Jennifer receive yearly in dividends? $5,828.009. b. Multiply the number of shares (870) by the 7. Tyler Darden acquired 1.525 shares of Caprock Oil Co. preferred stock, par 10a. dividend per share (4,40) to calculate the prevalue $100. He also owns 850 shares of common stock. The preferred stock ferred stock dividend (3.828.00) pays an 81/4% yearly dividend. The common stock pays $.86 per share b. c. Multiply 1.25 by 4 to calculate the yearly diviquarterly. How much does Iyler receive yearly in dividends? dend, common stock (5.00). 8. The senior class of Memorial High School owns 75 shares of Centex d. Multiply the number of common stock shares (400) by the yearly dividend (5.00) to calculate Corporation preferred stock, par value $110. It also owns 55 shares of Centex the common stock dividend (2,000.00). Corporation common stock. The preferred stock pays a 121/2% dividend e. Add the answers for b and d to calculate the yearly. The common stock pays $.72 per share quarterly. How much does the class receive yearly in dividends? total yearly dividends received (5,828.00). 7. Follow the procedure described in Problem 6 to 9. Find the amount received from the sale of 775 shares of Blue Pool Co. calculate the total yearly dividends received. stock. The shares were sold tor 841/2 each. The commission was $83.25 8. Follow the procedure described in Problem 6 to and the taxes and experises were $64.95. calculate the total yearly dividends received. 10. Donna Dixon purchased 250 shares of Evergreen Gardens, Inc, stock for 9. a, Multiply the number of shares (775) by 84.5 $9,600. The stock paid a quarterly dividend of $.76 per share. After tive to calculate the proceeds from the sale. years, Donna needed cash to pay for her son's education. She sold the b. Add the commission (83.25) and the taxes stock for $12,075. and expenses (64.95) to calculate the sales a. How much had Donna received in dividends? expenses. b. What was her profit from the sale of the stock? c. Subtract answer b from a to calculate the amount received from the sale. 10. a. Multiply .76 by 4 to calculate the dividend per share. b. Multiply the number of shares (250) by the dividend per share (from Step 10a) to calculate the yearly dividend. c. Multiply the yearly dividend (from Step 10b ) by 5 to calculate the total dividends received. d. Subtract the purchase of stock (9,600.00) from the sale of stock (12,075.00) to calculate the profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts