Question: I need to solve systematic risk is I need to solve when the seller I need to solve when investor I need to solve toward

I need to solve systematic risk is

I need to solve when the seller

I need to solve when investor

I need to solve toward risk beta for risk

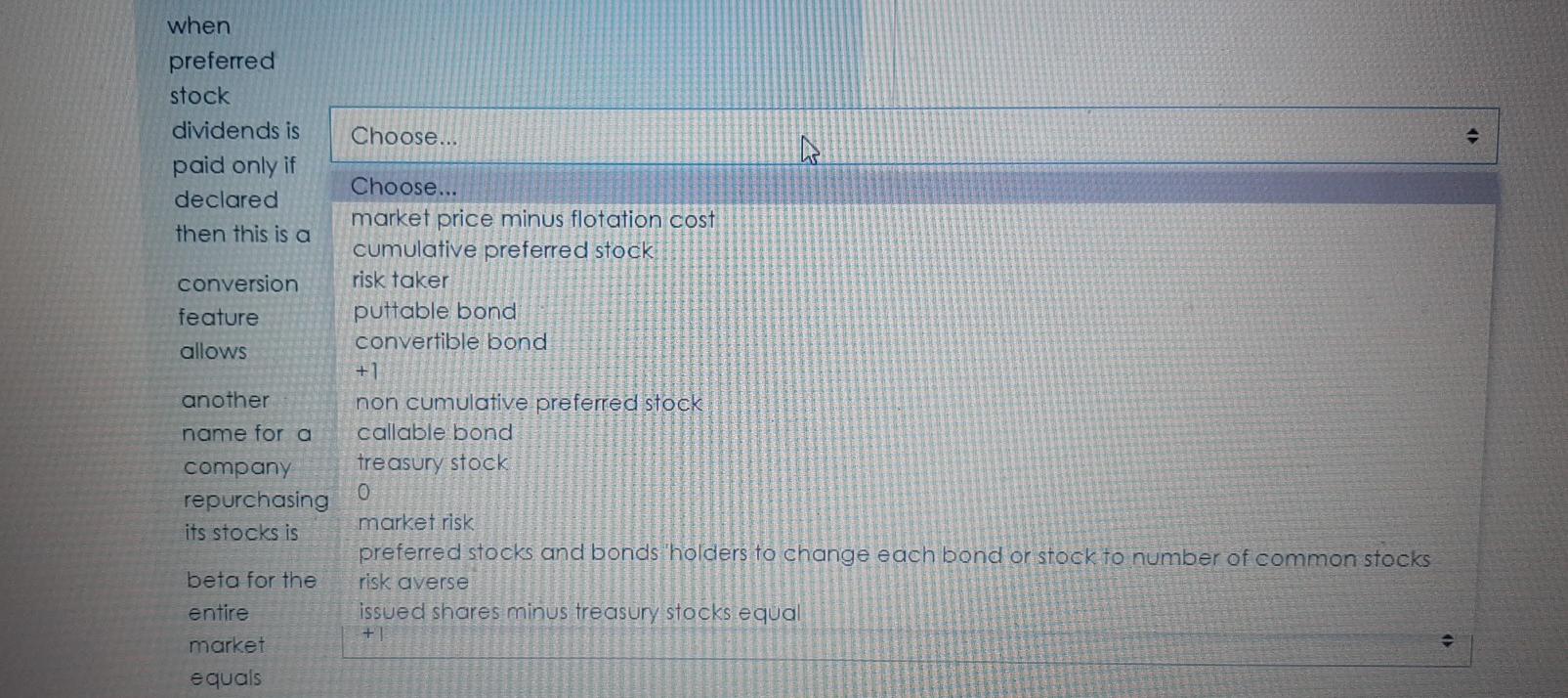

I need to solve when preferred stock

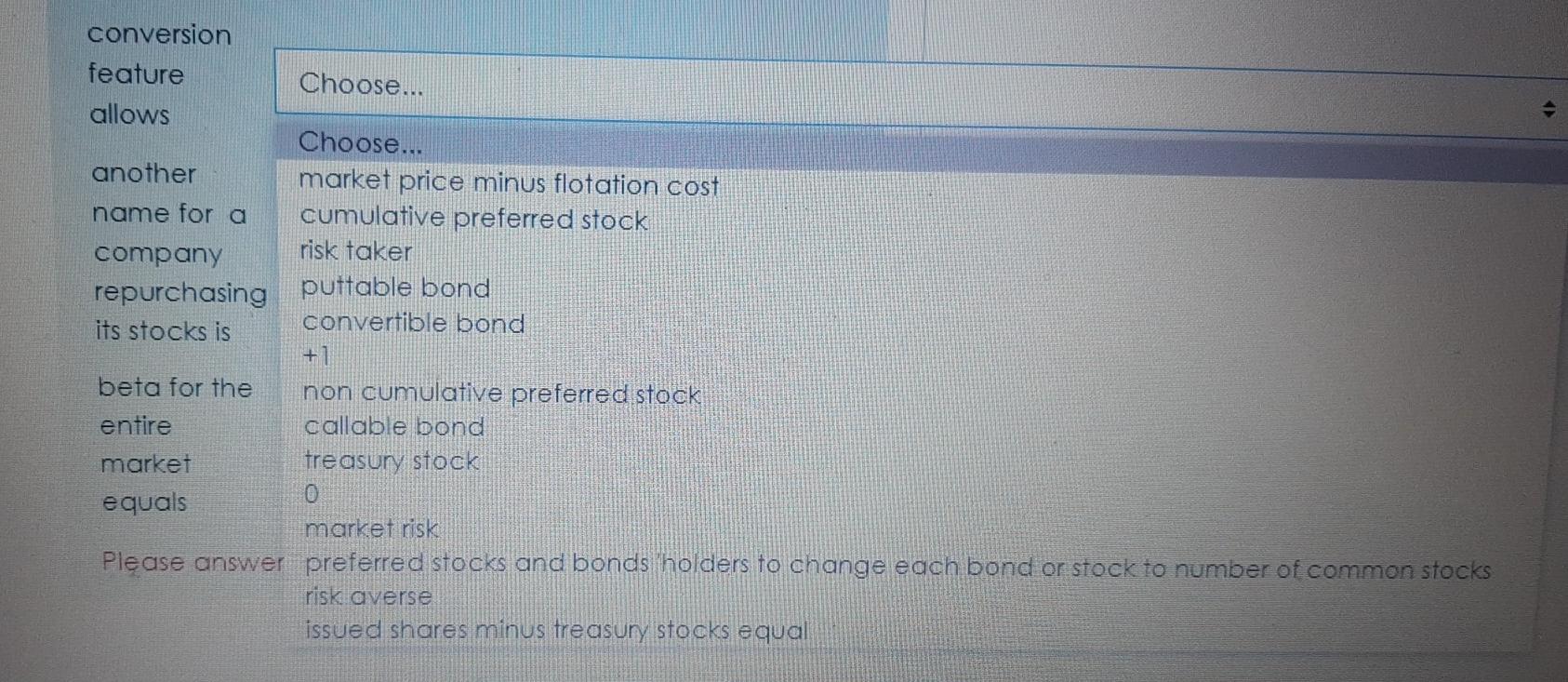

I need to solve conversion feature

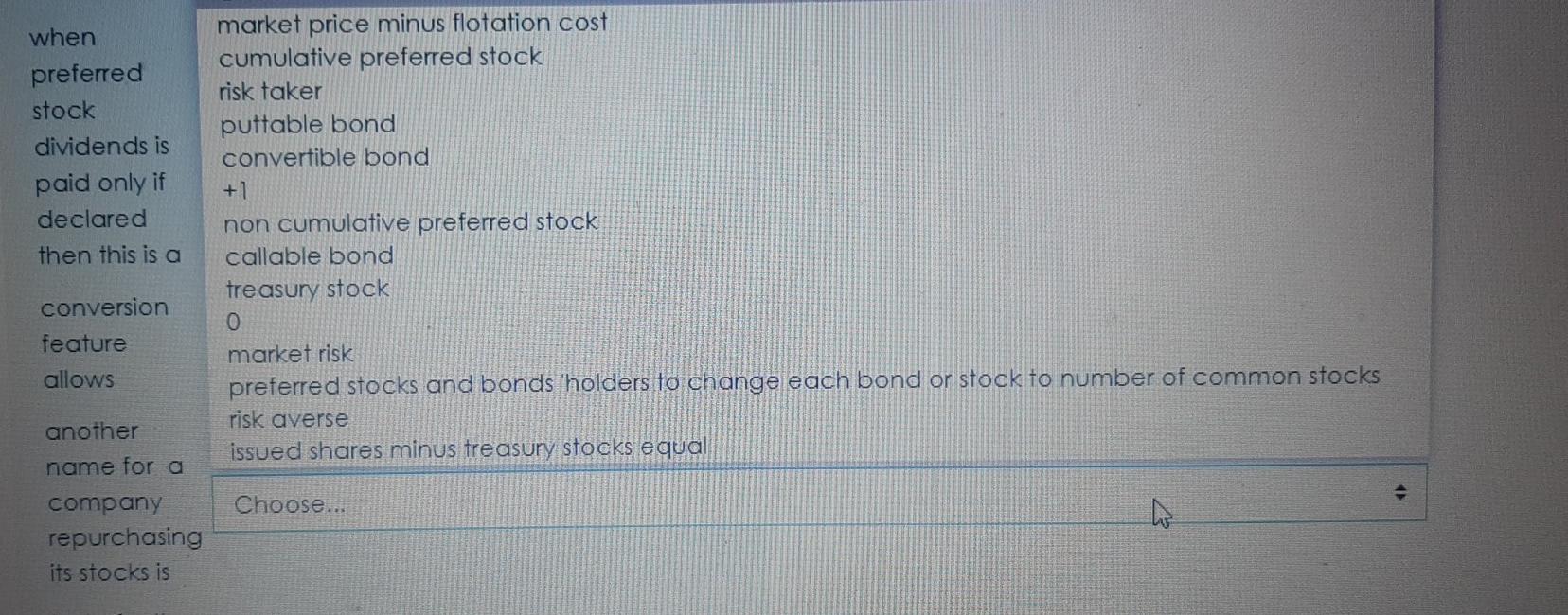

I need to solve another name for a company

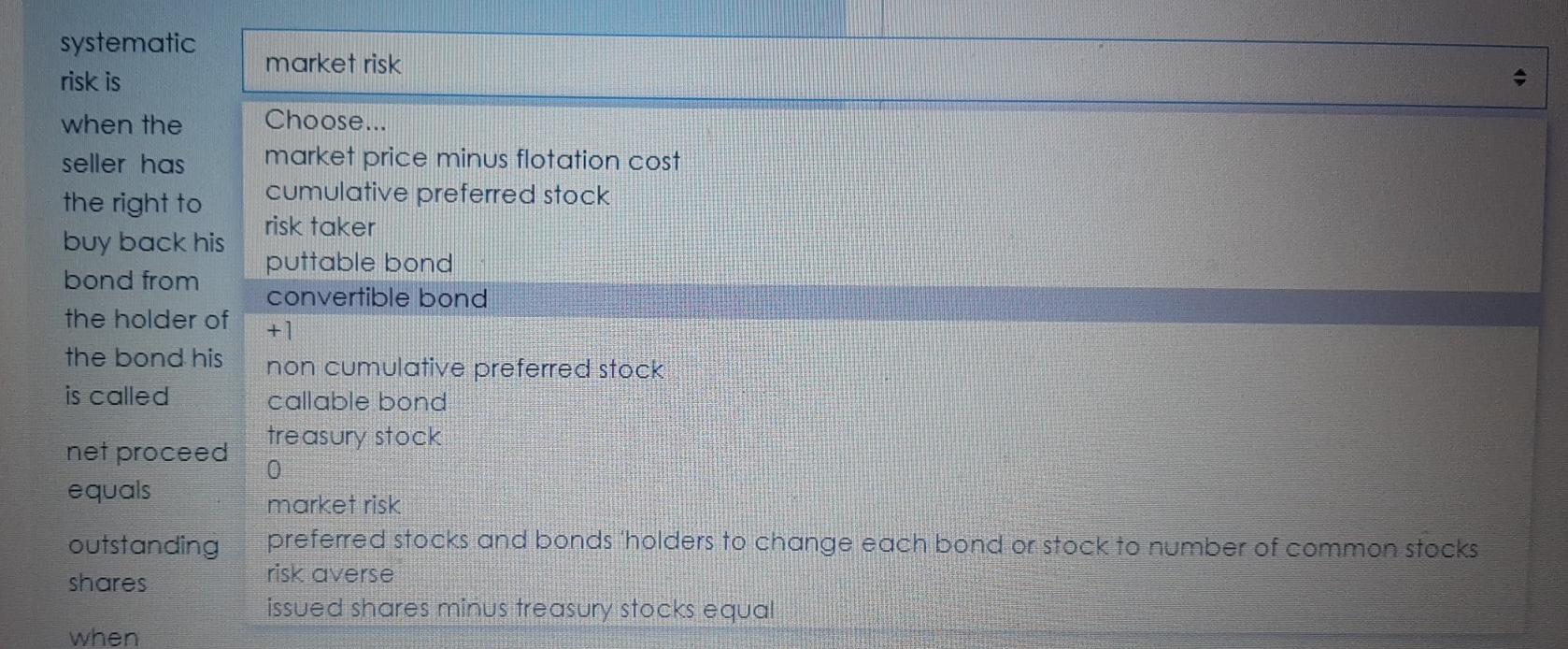

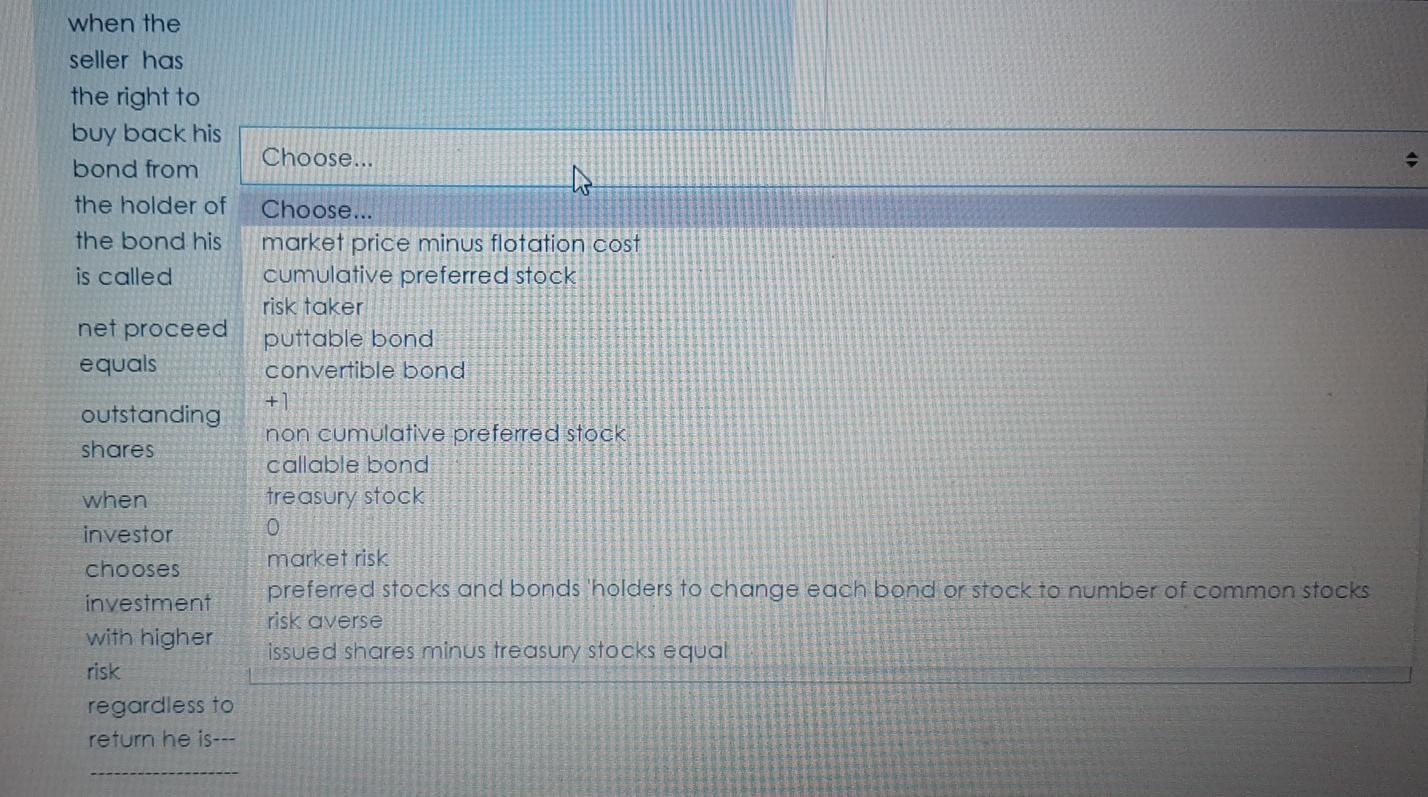

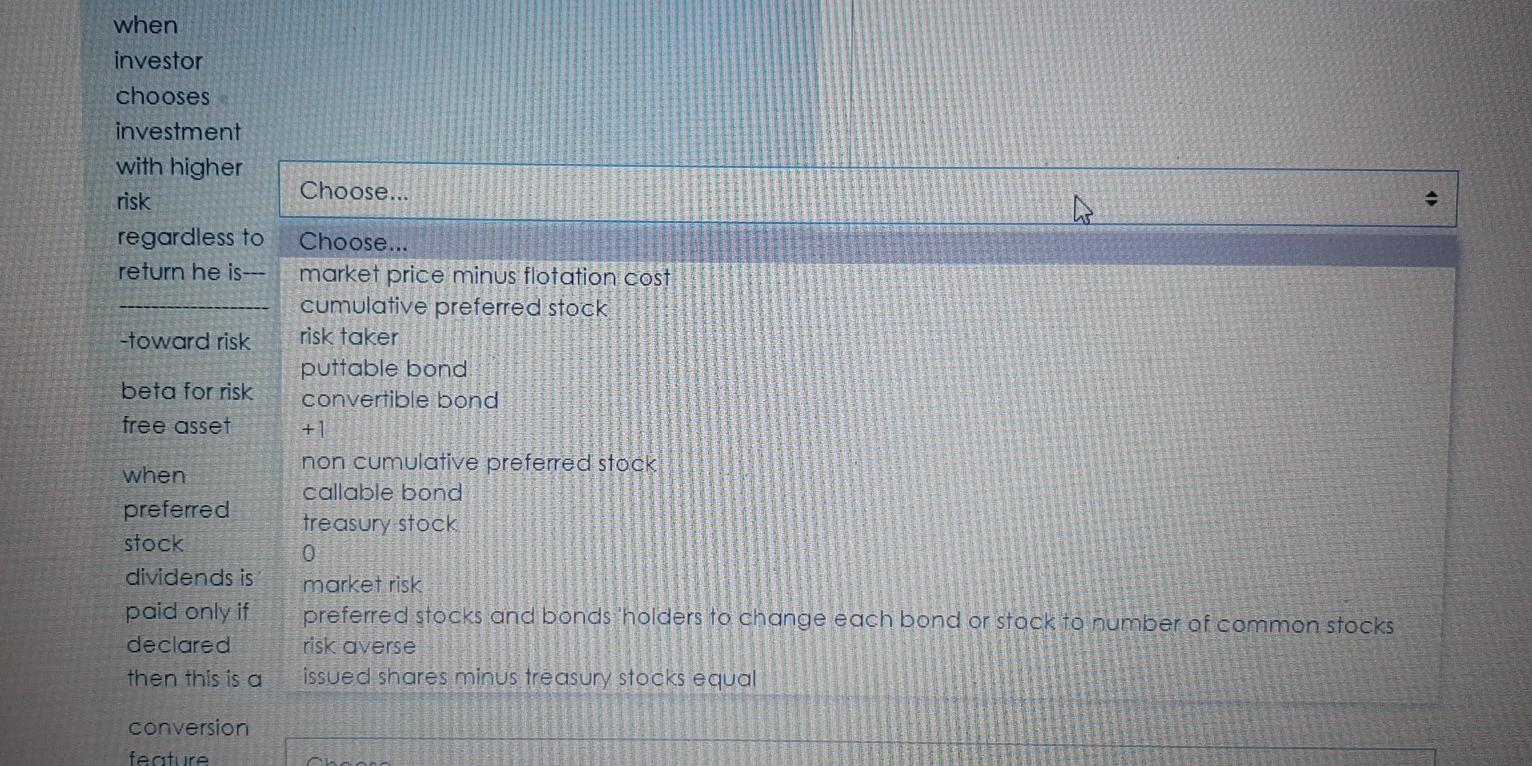

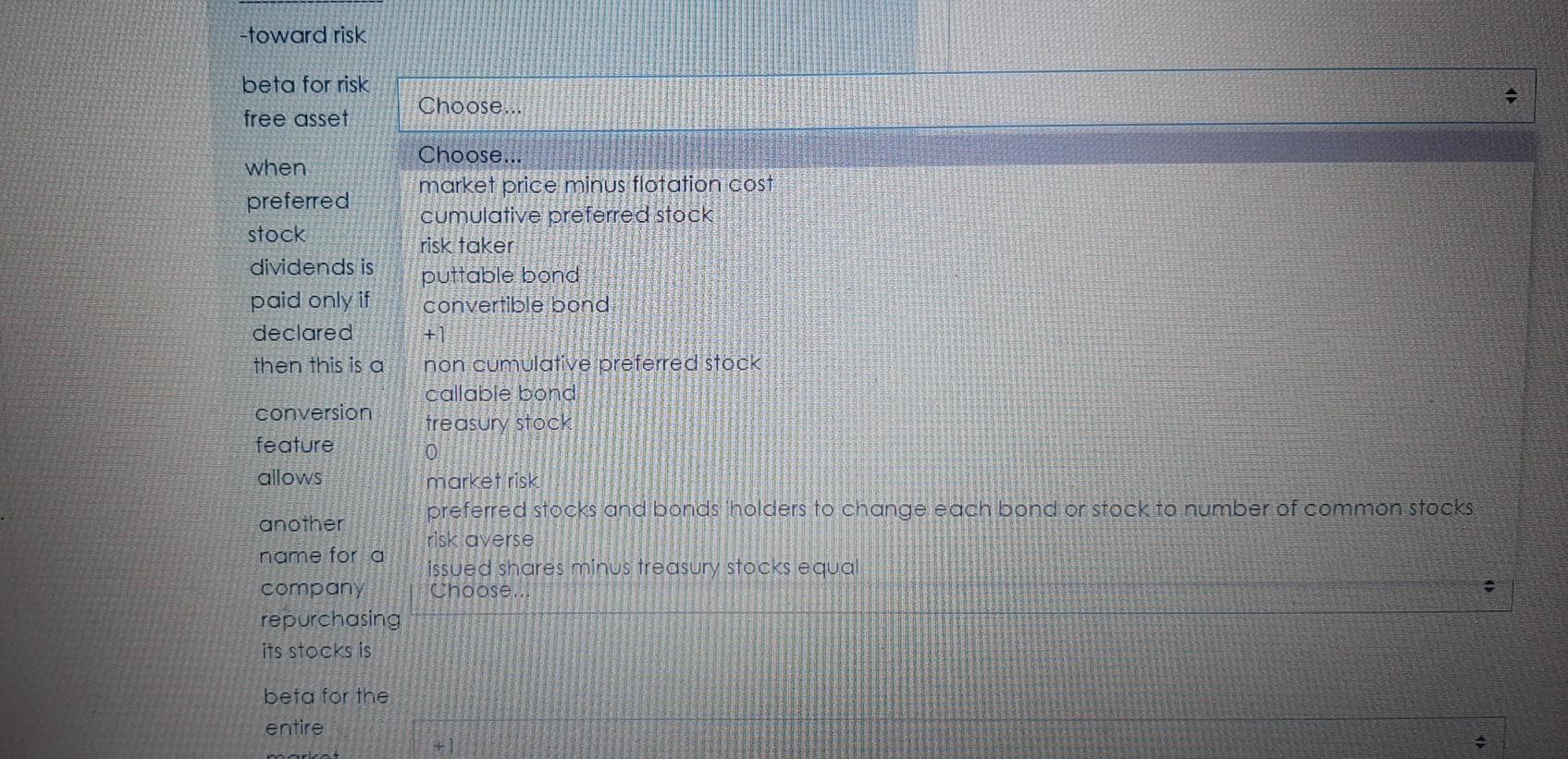

market risk . systematic risk is when the seller has the right to buy back his bond from the holder of the bond his is called Choose... market price minus flotation cost cumulative preferred stock risk taker puttable bond convertible bond +1 non cumulative preferred stock callable bond treasury stock net proceed equals outstanding shares market risk preferred stocks and bonds 'holders to change each bond or stock to number of common stocks risk averse issued shares minus treasury stocks equal when when the seller has the right to buy back his bond from the holder of the bond his is called Choose... . net proceed equals outstanding shares Choose... market price minus flotation cost cumulative preferred stock risk taker puttable bond convertible bond +] non cumulative preferred stock callable bond treasury stock 0 market risk preferred stocks and bonds 'holders to change each bond or stock to number of common stocks risk averse issued shares minus treasury stocks equal when investor chooses investment with higher risk regardless to return he is--- when investor chooses investment with higher risk regardless to return he is--- Choose... -toward risk beta for risk free asset Choose... market price minus flotation cost cumulative preferred stock risk taker puttable bond convertible bond +1 non cumulative preferred stock callable bond treasury stock when preferred stock dividends is paid only if declared then this is a market risk preferred stocks and bonds 'holders to change each bond or stock to number of common stocks risk averse issued shares minus treasury stocks equal conversion feature toward risk beta for risk free asset Choose... when preferred stock dividends is paid only if declared then this is a Choose... market price minus flotation cost cumulative preferred stock risk taker puttable bond convertible bond +1 non cumulative preferred stock callable bond treasury stock conversion feature allows another name for a market risk preferred stocks and bonds 'holders to change each bond or stock to number of common stocks risk averse issued shares minus treasury stocks equal Choose... company repurchasing its stocks is beta for the entire when preferred stock dividends is paid only if declared then this is a Choose... conversion feature allows another name for a Choose... market price minus flotation cost cumulative preferred stock risk taker puttable bond convertible bond +1 non cumulative preferred stock callable bond treasury stock 0 market risk preferred stocks and bonds 'holders to change each bond or stockto number of common stocks risk averse issued shares minus treasury stocks e qual + company repurchasing its stocks is beta for the entire market e quals conversion feature Choose... allows Choose... another market price minus flotation cost name for a cumulative preferred stock company risk taker repurchasing puttable bond its stocks is convertible bond +1 beta for the non cumulative preferred stock entire callable bond market treasury stock 0 equals market risk Please answer preferred stocks and bonds holders to change each bond or stock to number of common stocks risk averse issued shares minus treasury stocks equal when preferred stock dividends is paid only if declared then this is a market price minus flotation cost cumulative preferred stock risk taker puttable bond convertible bond +1 non cumulative preferred stock callable bond treasury stock 0 market risk preferred stocks and bonds 'holders to change each bond or stock to number of common stocks risk averse issued shares minus treasury stocks equal conversion feature allows another name for a Choose... h company repurchasing its stocks is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts