Question: I need to solve these using a financial calculator, please help!! I would prefer step-by-step explanations. Allied Corporation has zero coupon bonds outstanding that mature

I need to solve these using a financial calculator, please help!! I would prefer step-by-step explanations.

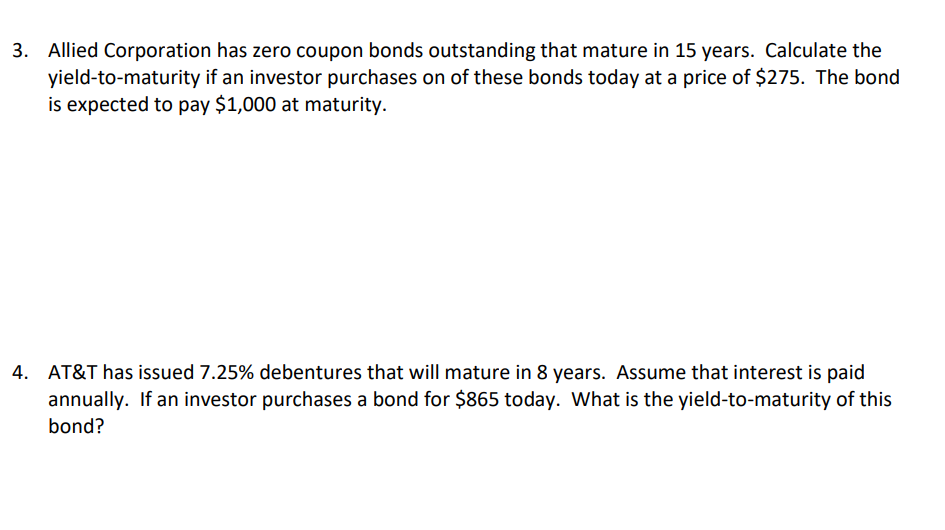

Allied Corporation has zero coupon bonds outstanding that mature in 15 years. Calculate the yield-to-maturity if an investor purchases on of these bonds today at a price of $275. The bond is expected to pay $1,000 at maturity. AT\&T has issued 7.25% debentures that will mature in 8 years. Assume that interest is paid annually. If an investor purchases a bond for $865 today. What is the yield-to-maturity of this bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts