Question: I need typed answer with explanation. Don't use AI BOT. Zoe and Andrew form the ZA General Partnership as equal partners. They make the following

I need typed answer with explanation. Don't use AI BOT.

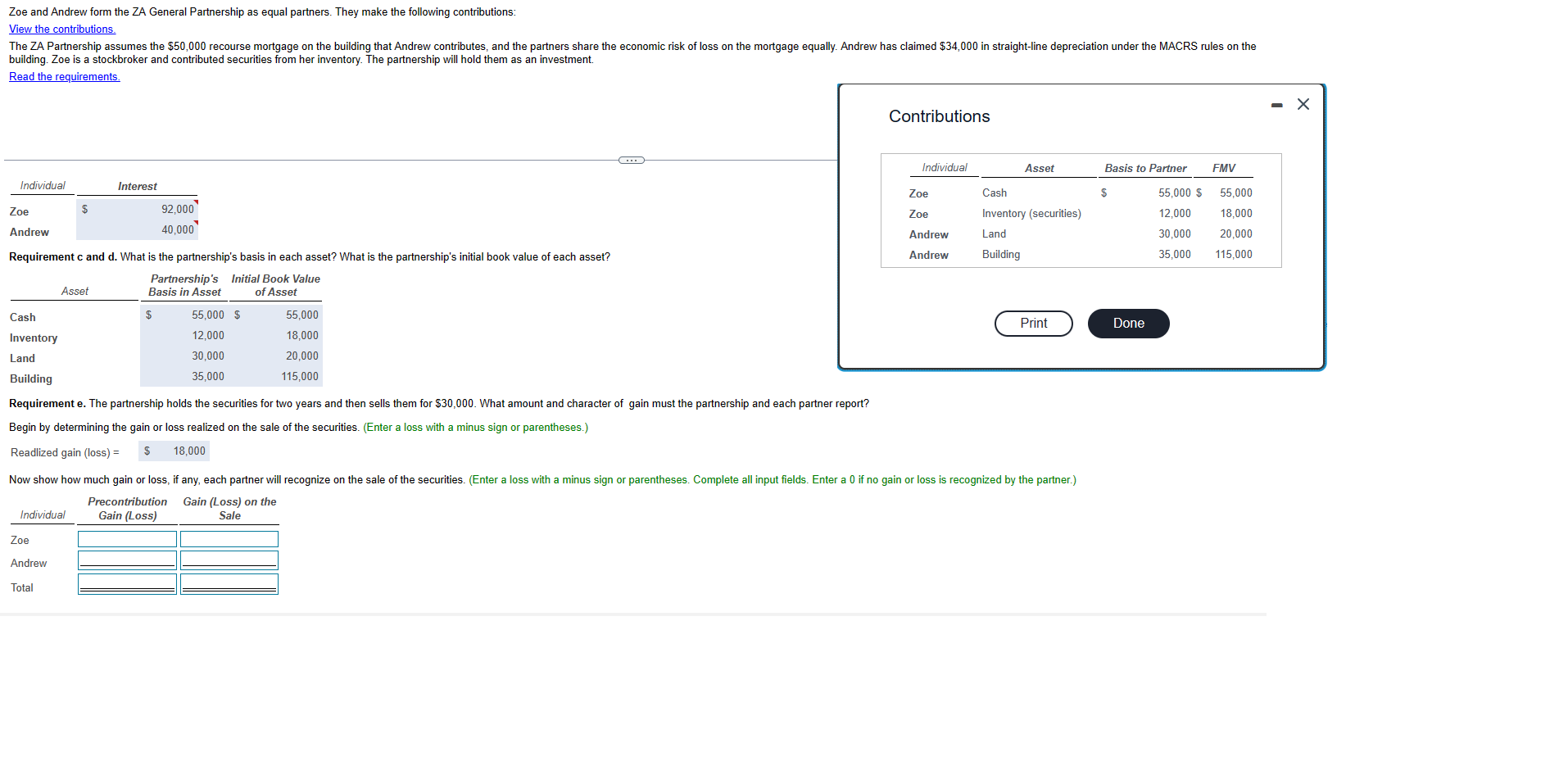

Zoe and Andrew form the ZA General Partnership as equal partners. They make the following contributions: View the contributions. The ZA Partnership assumes the $50,000 recourse mortgage on the building that Andrew contributes, and the partners share the economic risk of loss on the mortgage equally. Andrew has claimed $34,000 in straight-line depreciation under the MACRS rules on the building. Zoe is a stockbroker and contributed securities from her inventory. The partnership will hold them as an investment. Read the requirements. - X Contributions Individual Asset Basis to Partner FMV Individual Interest Zoe Cash $ 65,000 $ 55,000 Zoe $ 92,000 Zoe Inventory (securities) 12,000 18,000 Andrew 40,000 Andrew _and 30,000 20,000 Requirement c and d. What is the partnership's basis in each asset? What is the partnership's initial book value of each asset? Andrew Building 35,000 115,000 Partnership's Initial Book Value Asset Basis in Asset of Asset Cash 55,000 $ 55,000 Print Done Inventory 12,000 18,000 Land 30,000 20,000 Building 35,000 115,000 Requirement e. The partnership holds the securities for two years and then sells them for $30,000. What amount and character of gain must the partnership and each partner report? Begin by determining the gain or loss realized on the sale of the securities. (Enter a loss with a minus sign or parentheses.) Readlized gain (loss) = $ 18,000 Now show how much gain or loss, if any, each partner will recognize on the sale of the securities. (Enter a loss with a minus sign or parentheses. Complete all input fields. Enter a 0 if no gain or loss is recognized by the partner.) Precontribution Gain (Loss) on the Individual Gain (Loss) Sale Zoe Andrew Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts