Question: I need your help in this question pleases ASAP it is very important assets Question 4 Both Bopp Plc and l Ple operate wholesale electrical

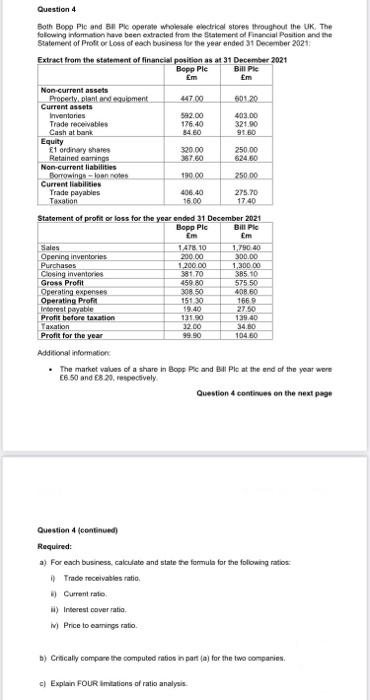

assets Question 4 Both Bopp Plc and l Ple operate wholesale electrical stores throughout the UK The following information have been extracted from the Statement of Financial Position and the Statement of Proftor Loss of each business for the year ended 31 December 2021 Extract from the statement of financial position as at 31 December 2021 Bopp Plc Bill Ple Em Em Non current assets Property, plant and equipment 44700 50120 Current Inventores 582.00 403.00 Trade receivables 176.40 321.90 Cash at bank 34.80 95.50 Equity E1 ordinary shares 320.00 250.00 Retained earrings 357.60 624.60 Non-current liabilities Boromingo - Sorter 199.00 250.00 Current liabilities Trade payables 406.40 275.70 Taxation 16.00 1740 Statement of profit or loss for the year ended 31 December 2021 Bopp Ple Bil Pic Em Em Sales 1418 10 1.290 40 Opening inventories 200.00 300.00 Purchases 1.200.00 1,300.00 Closing inventories 381.70 385.10 Gross Profit 459 80 575 50 Operating expenses 308.50 408.60 Operating profil 151 30 1669 Interest payable 19.40 27.50 Profit before taxation 131.90 13940 Taxation 32.00 34.80 Protit for the year 99.90 104.60 Additional information The market values of a share in Bops Pic and Bal Pic at the end of the year were E6 50 and 8 20. respectively Question continues on the next page Question 4 (continued) Required: a) For each business calculate and state the formula for the following ratios Trade receivables ratio - Current rate H) Interest cover ratio My Price to camins ratio b) Criticaly compare the computed ratios in porta) for the two companies, c) Explain FOUR imitations of ratio analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts