Question: I need your help solving these problems. Pls help me by answering and showing explanation. Question 3 (20 points): A tool costing $300 has no

I need your help solving these problems. Pls help me by answering and showing explanation.

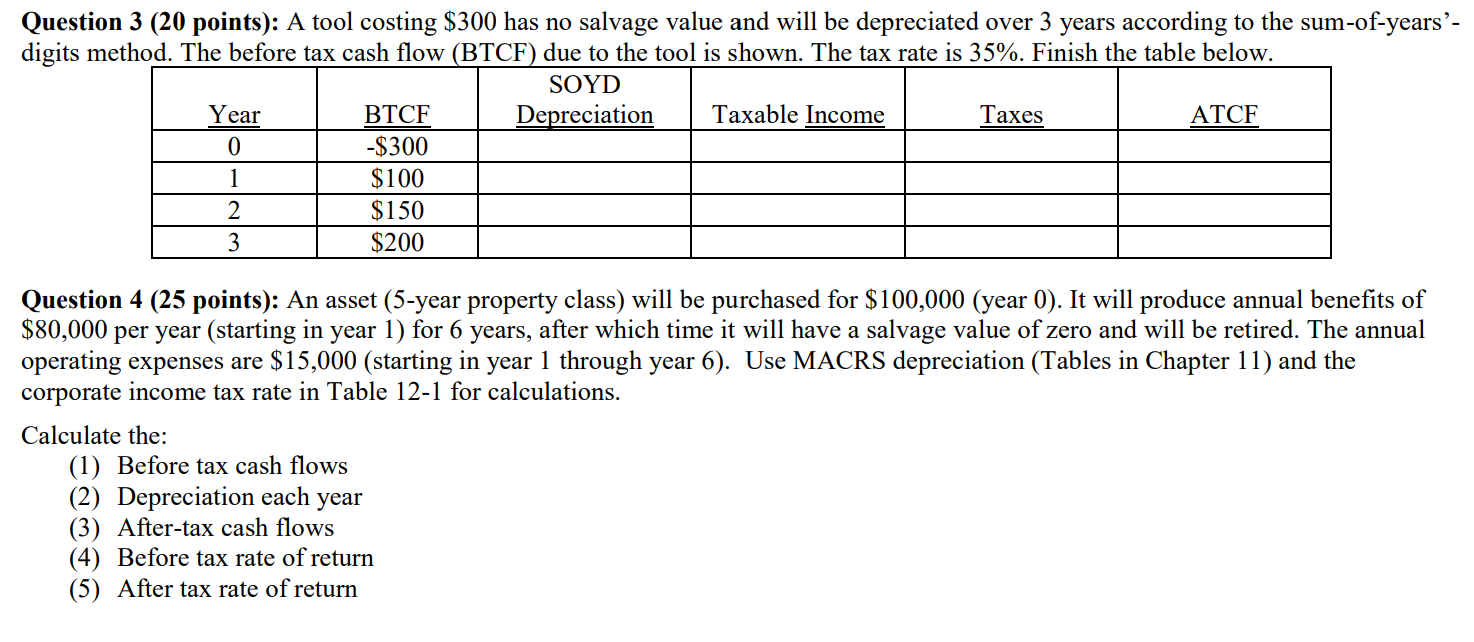

Question 3 (20 points): A tool costing $300 has no salvage value and will be depreciated over 3 years according to the sum-ofyears'- digits method. The before tax cash flow BTCF due to the tool is shown. The tax rate is 35%. Finish the table below. SOYD Year BTCF Dc - reciation Taxable Income Taxes -3300 '- .- ATCF Question 4 (25 points): An asset (5-year property class) will be purchased for $100,000 (year 0). It will produce annual benefits of $80,000 per year (starting in year 1) for 6 years, after which time it will have a salvage value of zero and will be retired. The annual operating expenses are $15,000 (starting in year 1 through year 6). Use MACRS depreciation (Tables in Chapter 11) and the corporate income tax rate in Table 12-1 for calculations. Calculate the: (1) Before tax cash ows (2) Depreciation each year (3) After-tax cash flows (4) Before tax rate ofretum (5) After tax rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts