Question: I need help solving these problems. Pls help me by answering and showing explanations. CHAPTER 11 Note: Depreciation schedule refers to the depreciation ?! each

I need help solving these problems. Pls help me by answering and showing explanations.

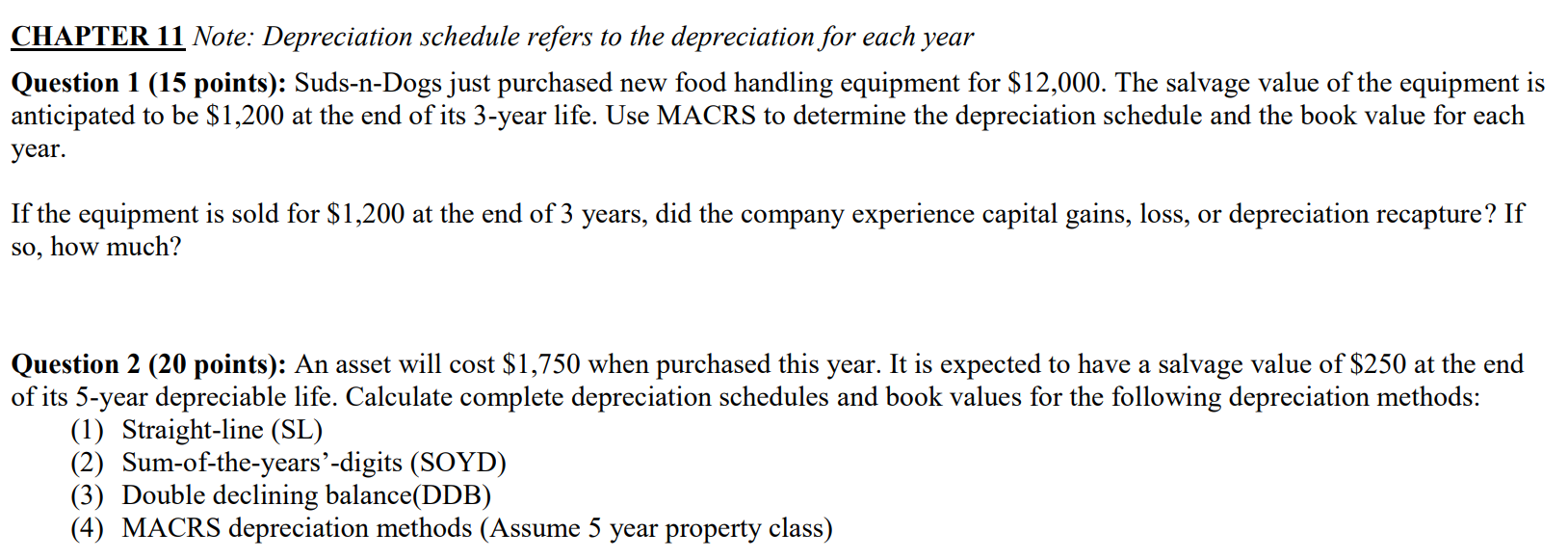

CHAPTER 11 Note: Depreciation schedule refers to the depreciation ?!\" each year Question 1 (15 points): Suds-nDogs just purchased new food handling equipment for $12,000. The salvage value of the equipment is anticipated to be $1,200 at the end of its 3-year life. Use MACRS to determine the depreciation schedule and the book value for each year. If the equipment is sold for $1,200 at the end of 3 years, did the company experience capital gains, loss, or depreciation recapture? If so, how much? Question 2 (20 points): An asset will cost $1 ,750 when purchased this year. It is expected to have a salvage value of $250 at the end of its 5-year depreciable life. Calculate complete depreciation schedules and book values for the following depreciation methods: {1) Straight-line (SL) {2) Sum-ofthe-years'-digits (SOYD) (3) Double declining balance(DDB) (4) MACRS depreciation methods (Assume 5 year property class)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts