Question: I nees help with question 2-8 Question 2 1 pts Which of the following statements is incorrect? The forward rate is what you agree to

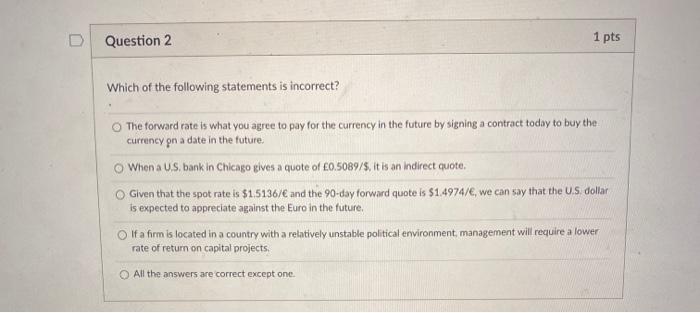

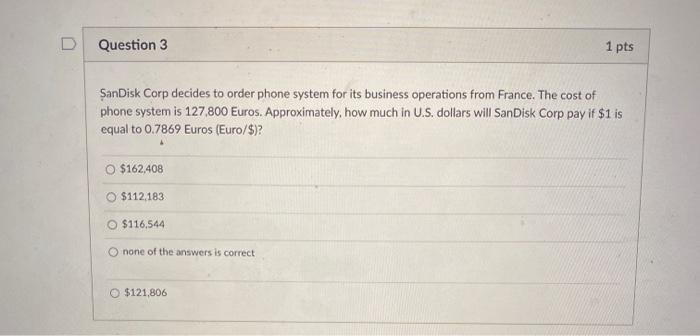

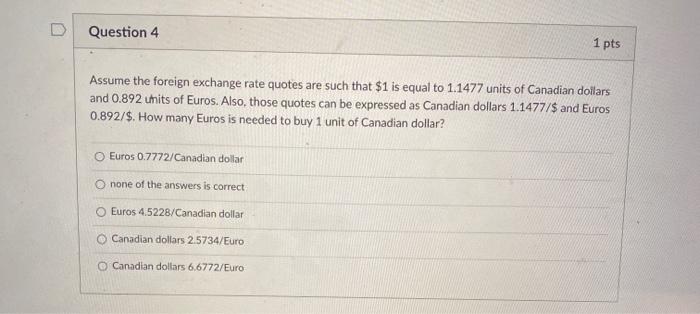

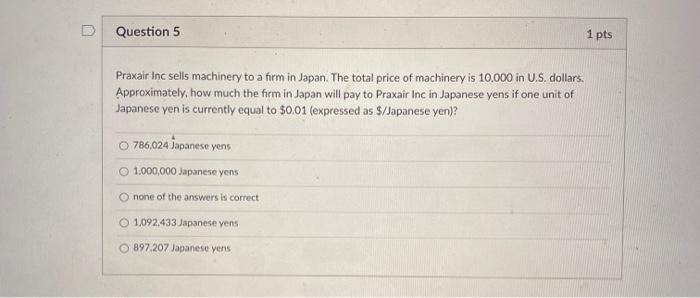

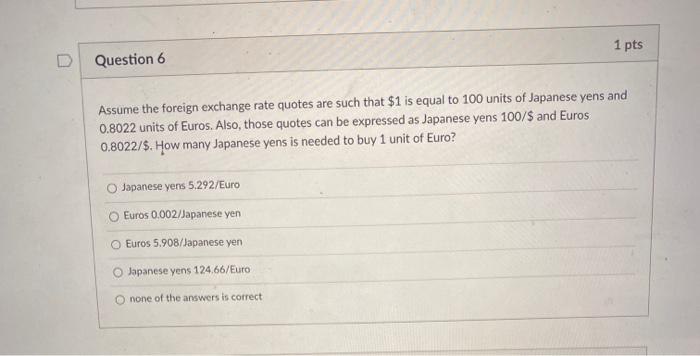

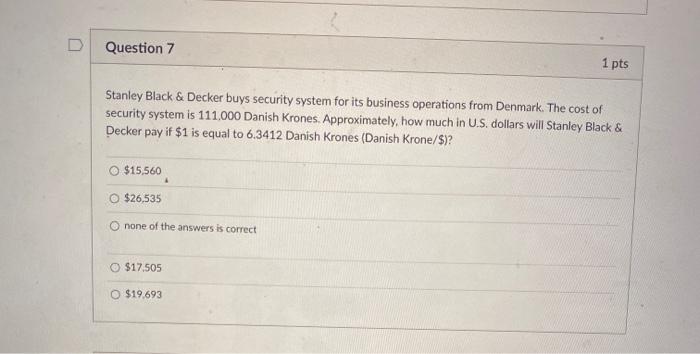

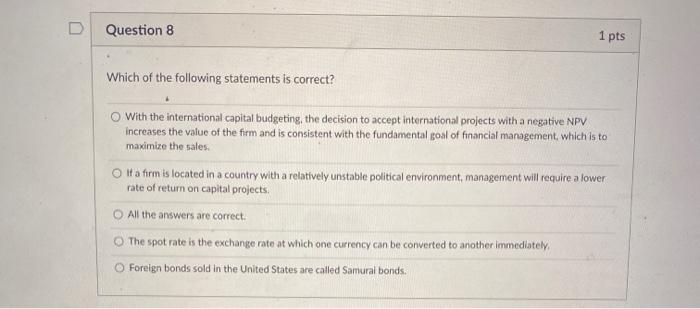

Question 2 1 pts Which of the following statements is incorrect? The forward rate is what you agree to pay for the currency in the future by signing a contract today to buy the currency on a date in the future When a US bank in Chicago gives a quote of 0.5089/5, it is an Indirect quote. Given that the spot rate is $1.5136/ and the 90-day forward quote is $1.4974/, we can say that the US dollar is expected to appreciate against the Euro in the future, If a firm is located in a country with a relatively unstable political environment management will require a lower rate of return on capital projects. All the answers are correct except one. Question 3 1 pts SanDisk Corp decides to order phone system for its business operations from France. The cost of phone system is 127,800 Euros. Approximately, how much in U.S. dollars will SanDisk Corp pay if $1 is equal to 0.7869 Euros (Euro/$)? O $162.408 $112.183 $116,544 none of the answers is correct $121,806 Question 4 1 pts Assume the foreign exchange rate quotes are such that $1 is equal to 1.1477 units of Canadian dollars and 0.892 units of Euros. Also, those quotes can be expressed as Canadian dollars 1.1477/$ and Euros 0.892/$. How many Euros is needed to buy 1 unit of Canadian dollar? Euros 0.7772/Canadian dollar none of the answers is correct Euros 4.5228/Canadian dollar Canadian dollars 2.5734/Euro Canadian dollars 6.6772/Euro Question 5 1 pts Praxair Inc sells machinery to a firm in Japan. The total price of machinery is 10.000 in U.S. dollars. Approximately, how much the firm in Japan will pay to Praxair Inc in Japanese yens if one unit of Japanese yen is currently equal to $0.01 (expressed as $/Japanese yen)? O 786,024 Japanese yens O 1,000,000 Japanese yens Onone of the answers is correct O 1,092,433 Japanese yens 897,207 Japanese yens 1 pts Question 6 Assume the foreign exchange rate quotes are such that $1 is equal to 100 units of Japanese yens and 0.8022 units of Euros. Also, those quotes can be expressed as Japanese yens 100/$ and Euros 0.8022/6. How many Japanese yens is needed to buy 1 unit of Euro? Japanese yens 5.292/Euro Euros 0.002/Japanese yen Euros 5.908/Japanese yen Japanese yens 124.66/Euro O none of the answers is correct Question 7 1 pts Stanley Black & Decker buys security system for its business operations from Denmark. The cost of security system is 111,000 Danish Krones. Approximately, how much in U.S. dollars will Stanley Black & Decker pay if $1 is equal to 6.3412 Danish Krones (Danish Krone/$)? $15.560 O $26,535 none of the answers is correct $17.505 O $19.693 Question 8 1 pts Which of the following statements is correct? O With the international capital budgeting, the decision to accept international projects with a negative NPV increases the value of the firm and is consistent with the fundamental goal of financial management, which is to maximize the sales. o la firm is located in a country with a relatively unstable political environment, management will require a lower rate of return on capital projects. O All the answers are correct The spot rate is the exchange rate at which one currency can be converted to another immediately O Foreign bonds sold in the United States are called Samural bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts