Question: i. . Notes: Inventory at 31 March 2020 is valued at 72,320. ii. On 1 March 2020, the directors made a 1:5 bonus issue of

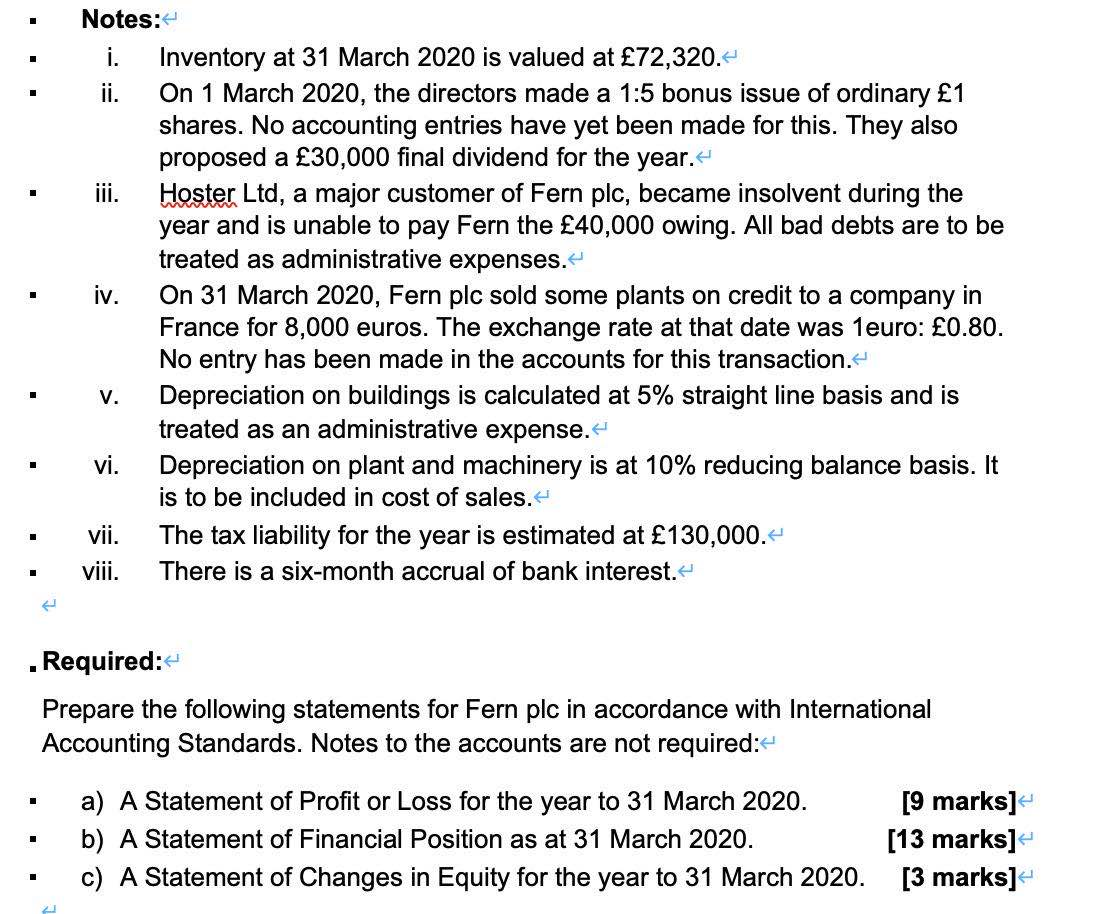

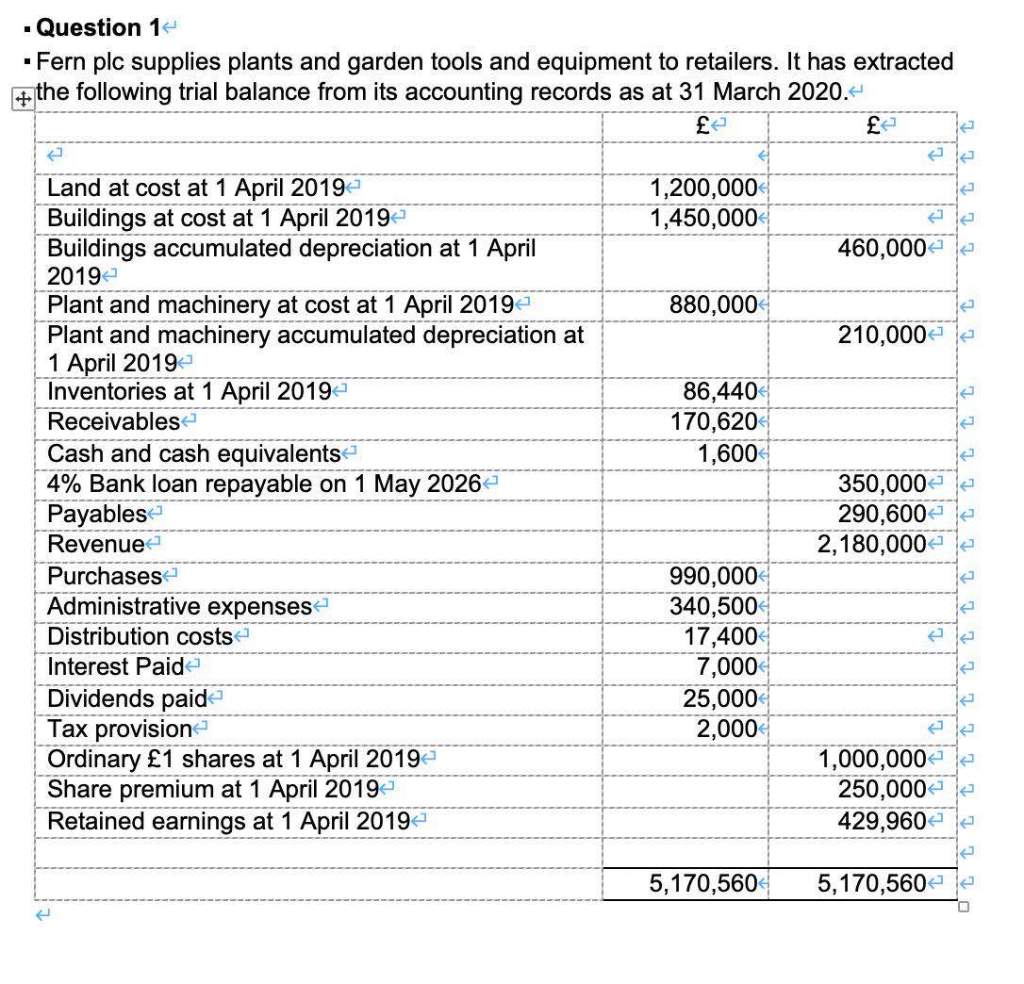

i. . Notes: Inventory at 31 March 2020 is valued at 72,320. ii. On 1 March 2020, the directors made a 1:5 bonus issue of ordinary 1 shares. No accounting entries have yet been made for this. They also proposed a 30,000 final dividend for the year.' iii. Hoster Ltd, a major customer of Fern plc, became insolvent during the year and is unable to pay Fern the 40,000 owing. All bad debts are to be treated as administrative expenses. iv. On 31 March 2020, Fern plc sold some plants on credit to a company in France for 8,000 euros. The exchange rate at that date was 1euro: 0.80. No entry has been made in the accounts for this transaction. Depreciation on buildings is calculated at 5% straight line basis and is treated as an administrative expense. vi. Depreciation on plant and machinery is at 10% reducing balance basis. It is to be included in cost of sales. vii. The tax liability for the year is estimated at 130,000.- viii. There is a six-month accrual of bank interest." V. . . Required: Prepare the following statements for Fern plc in accordance with International Accounting Standards. Notes to the accounts are not required: 4 . a) A Statement of Profit or Loss for the year to 31 March 2020. b) A Statement of Financial Position as at 31 March 2020. c) A Statement of Changes in Equity for the year to 31 March 2020. [9 marks] [13 marks] [3 marks] 2 Question 1 - Fern plc supplies plants and garden tools and equipment to retailers. It has extracted #the following trial balance from its accounting records as at 31 March 2020.- ke 1,200,000 1,450,000 460,000 880,000 210,000 ku 86,440 170,620 1,600 14 / Land at cost at 1 April 2019 Buildings at cost at 1 April 2019 Buildings accumulated depreciation at 1 April 2019 Plant and machinery at cost at 1 April 2019- Plant and machinery accumulated depreciation at 1 April 2019 Inventories at 1 April 2019 Receivables Cash and cash equivalents 4% Bank loan repayable on 1 May 2026 Payables Revenue Purchases Administrative expenses Distribution costs Interest Paid Dividends paid Tax provision Ordinary 1 shares at 1 April 2019 Share premium at 1 April 2019- Retained earnings at 1 April 2019 350,000 290,600 2,180,000 i ka 990,000 340,500 17,400 7,000 25,000 2,000 1 1,000,000 250,000 429,960 le 5,170,560 5,170,560 le

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts