Question: I only need (a) done please keep it in that format. Phoenix Company is considering investments in projects C1 and C2. Both require an initial

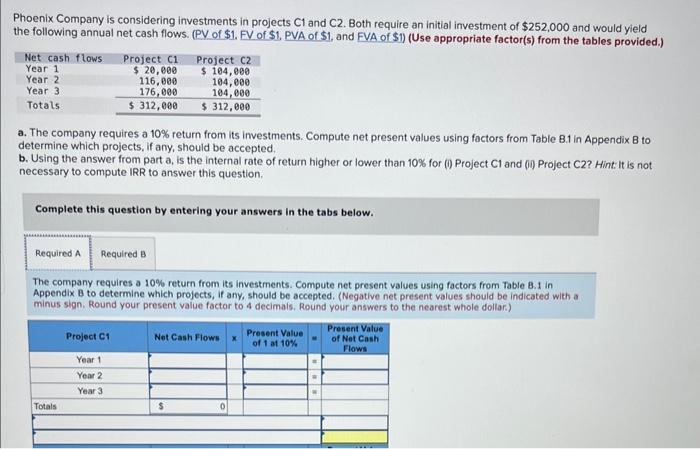

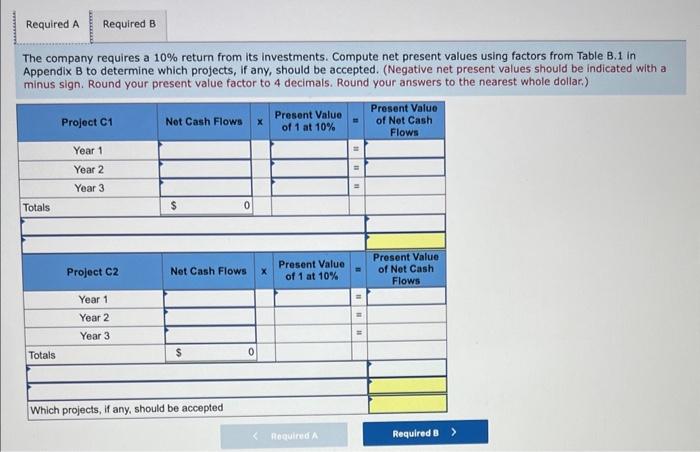

Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $252,000 and would yield the following annual net cash flows. (PV of \$1. FV of \$1, PVA of \$1, and FVA of \$1) (Use appropriate factor(s) from the tables provided.) a. The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 10% for (i) Project Cl and (i) Project C2? Hint: It is not necessary to compute IRR to answer this question. Complete this question by entering your answers in the tabs below. The company requires a 10% return from its investments. Compute net present values using factors from fable 8.1 in Appendix B to determine which projects, if any, should be accepted. (Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.) The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, If any, should be accepted. (Negative net present values should be indicated with a minus sian. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts