Question: I only need help with E and F. I am not sure how to explain and elaborate more on E and F COMPREHENSIVE PROBLEM Five

I only need help with E and F. I am not sure how to explain and elaborate more on E and F

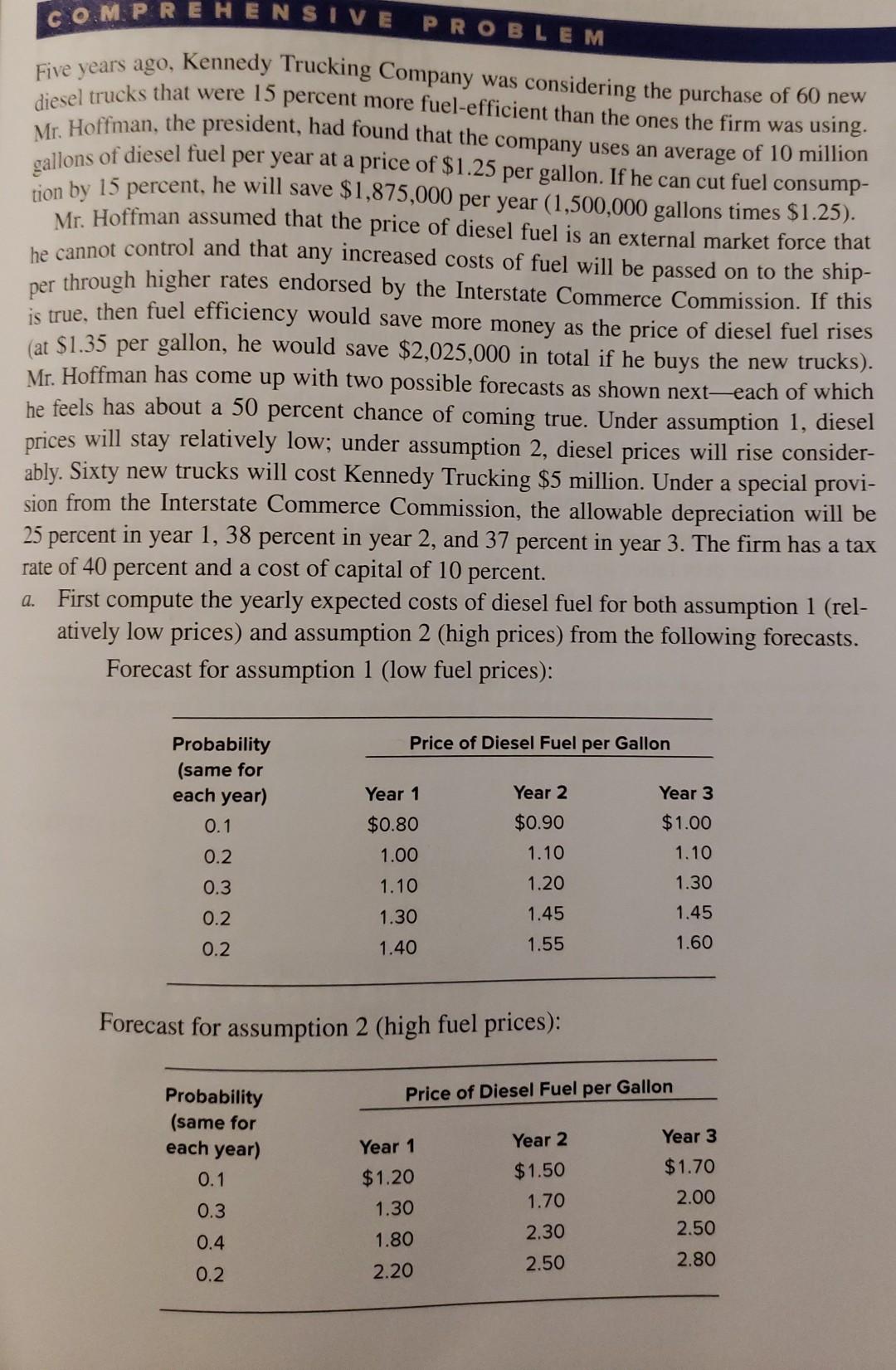

COMPREHENSIVE PROBLEM Five years ago, Kennedy Trucking Company was considering the purchase of 60 new diesel trucks that were 15 percent more fuel-efficient than the ones the firm was using. Mr. Hoffman, the president, had found that the company uses an average of 10 million gallons of diesel fuel per year at a price of $1.25 per gallon. If he can cut fuel consump- tion by 15 percent, he will save $1,875,000 per year (1,500,000 gallons times $1.25). Mr. Hoffman assumed that the price of diesel fuel is an external market force that he cannot control and that any increased costs of fuel will be passed on to the ship- per through higher rates endorsed by the Interstate Commerce Commission. If this is true, then fuel efficiency would save more money as the price of diesel fuel rises (at $1.35 per gallon, he would save $2,025,000 in total if he buys the new trucks). Mr. Hoffman has come up with two possible forecasts as shown next-each of which he feels has about a 50 percent chance of coming true. Under assumption 1, diesel prices will stay relatively low; under assumption 2, diesel prices will rise consider- ably. Sixty new trucks will cost Kennedy Trucking $5 million. Under a special provi- sion from the Interstate Commerce Commission, the allowable depreciation will be 25 percent in year 1, 38 percent in year 2, and 37 percent in year 3. The firm has a tax rate of 40 percent and a cost of capital of 10 percent. First compute the yearly expected costs of diesel fuel for both assumption 1 (rel- atively low prices) and assumption 2 (high prices) from the following forecasts. Forecast for assumption 1 (low fuel prices): a. Price of Diesel Fuel per Gallon Probability (same for each year) 0.1 0.2 Year 1 Year 2 Year 3 $0.80 1.00 $1.00 1.10 0.3 $0.90 1.10 1.20 1.45 1.55 1.30 1.10 1.30 1.40 0.2 1.45 0.2 1.60 Forecast for assumption 2 (high fuel prices): Price of Diesel Fuel per Gallon Probability (same for each year) 0.1 Year 2 Year 3 Year 1 $1.20 $1.50 $1.70 1.70 2.00 0.3 1.30 0.4 1.80 2.30 2.50 2.50 2.80 0.2 2.20 C. b. What will be the dollar savings in diesel expenses each year for assumption 1 and for assumption 2? Find the increased cash flow after taxes for both forecasts. d. Compute the net present value of the truck purchases for each fuel forecast assumption and the combined net present value (that is, weigh the NPVs by 0.5 If you were Mr. Hoffman, would you go ahead with this capital investment? f. How sensitive to fuel prices is this capital investment? e. COMPREHENSIVE PROBLEM Five years ago, Kennedy Trucking Company was considering the purchase of 60 new diesel trucks that were 15 percent more fuel-efficient than the ones the firm was using. Mr. Hoffman, the president, had found that the company uses an average of 10 million gallons of diesel fuel per year at a price of $1.25 per gallon. If he can cut fuel consump- tion by 15 percent, he will save $1,875,000 per year (1,500,000 gallons times $1.25). Mr. Hoffman assumed that the price of diesel fuel is an external market force that he cannot control and that any increased costs of fuel will be passed on to the ship- per through higher rates endorsed by the Interstate Commerce Commission. If this is true, then fuel efficiency would save more money as the price of diesel fuel rises (at $1.35 per gallon, he would save $2,025,000 in total if he buys the new trucks). Mr. Hoffman has come up with two possible forecasts as shown next-each of which he feels has about a 50 percent chance of coming true. Under assumption 1, diesel prices will stay relatively low; under assumption 2, diesel prices will rise consider- ably. Sixty new trucks will cost Kennedy Trucking $5 million. Under a special provi- sion from the Interstate Commerce Commission, the allowable depreciation will be 25 percent in year 1, 38 percent in year 2, and 37 percent in year 3. The firm has a tax rate of 40 percent and a cost of capital of 10 percent. First compute the yearly expected costs of diesel fuel for both assumption 1 (rel- atively low prices) and assumption 2 (high prices) from the following forecasts. Forecast for assumption 1 (low fuel prices): a. Price of Diesel Fuel per Gallon Probability (same for each year) 0.1 0.2 Year 1 Year 2 Year 3 $0.80 1.00 $1.00 1.10 0.3 $0.90 1.10 1.20 1.45 1.55 1.30 1.10 1.30 1.40 0.2 1.45 0.2 1.60 Forecast for assumption 2 (high fuel prices): Price of Diesel Fuel per Gallon Probability (same for each year) 0.1 Year 2 Year 3 Year 1 $1.20 $1.50 $1.70 1.70 2.00 0.3 1.30 0.4 1.80 2.30 2.50 2.50 2.80 0.2 2.20 C. b. What will be the dollar savings in diesel expenses each year for assumption 1 and for assumption 2? Find the increased cash flow after taxes for both forecasts. d. Compute the net present value of the truck purchases for each fuel forecast assumption and the combined net present value (that is, weigh the NPVs by 0.5 If you were Mr. Hoffman, would you go ahead with this capital investment? f. How sensitive to fuel prices is this capital investment? e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts