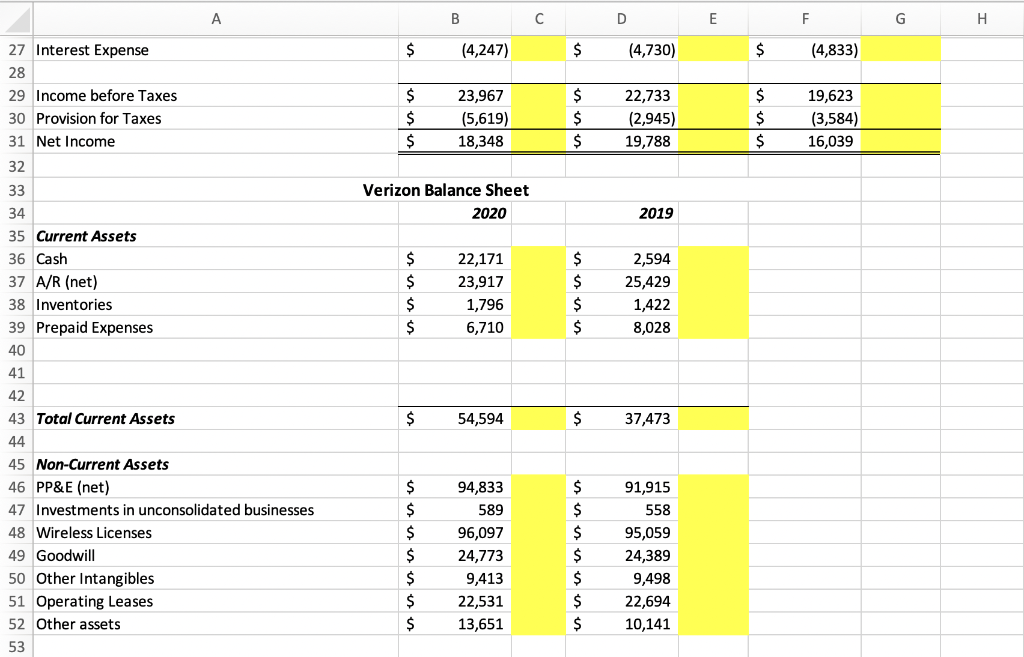

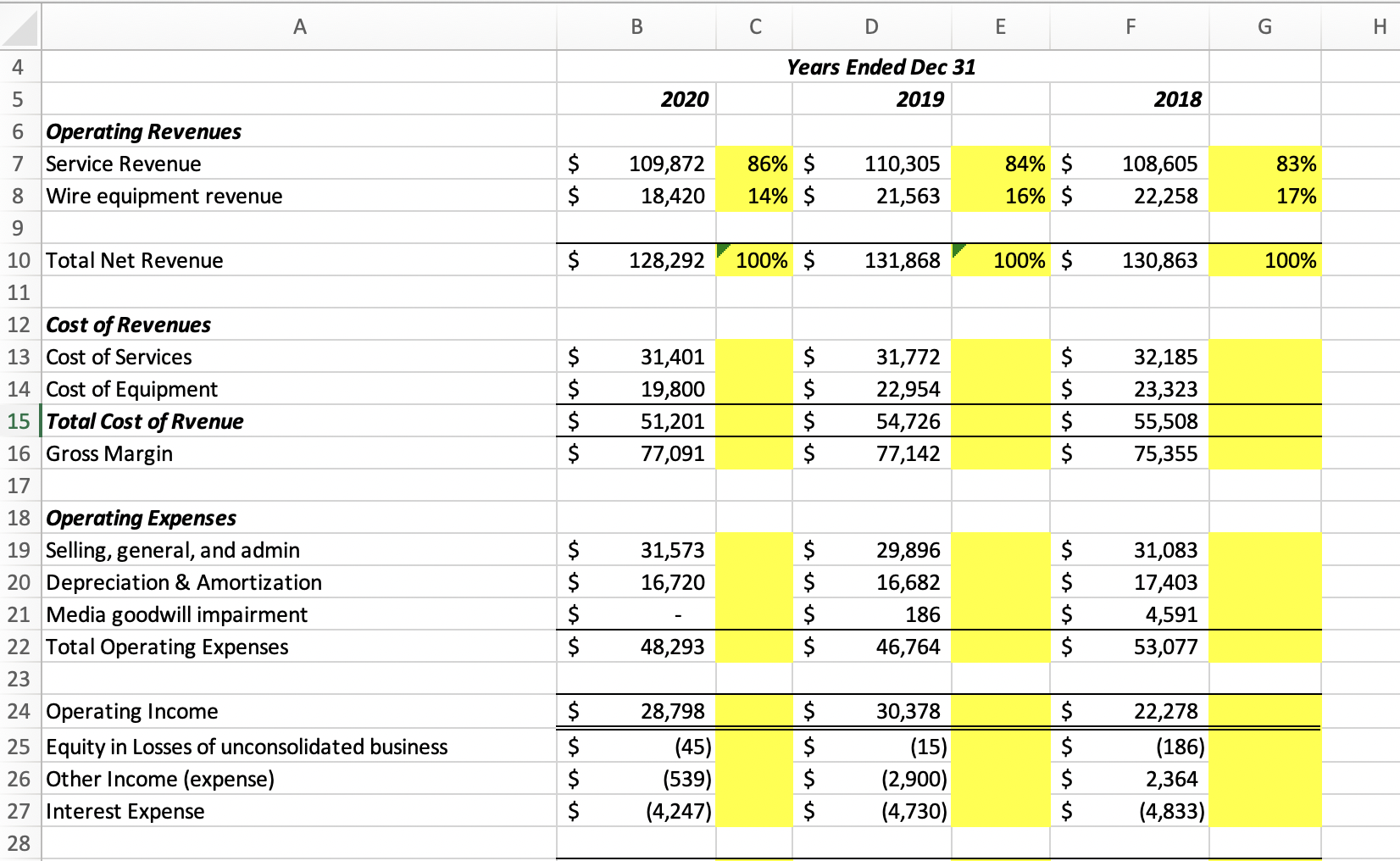

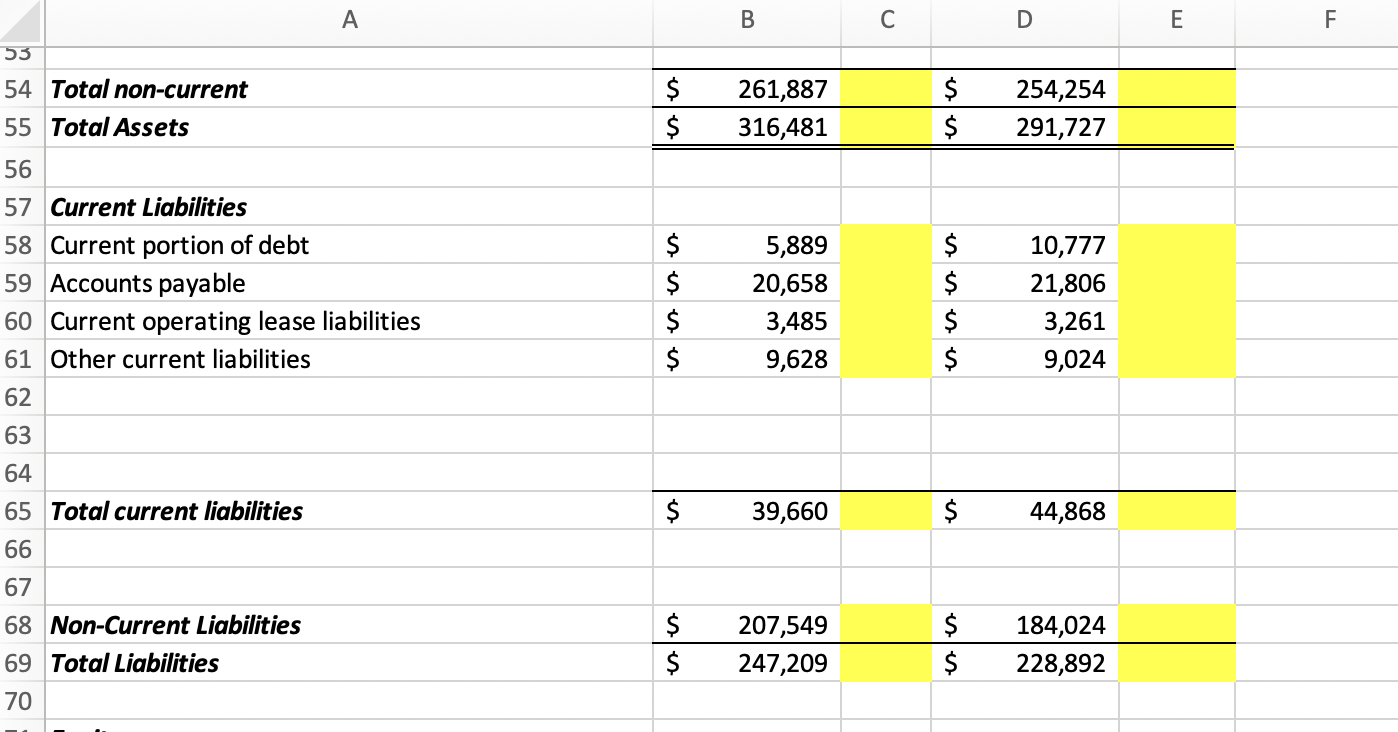

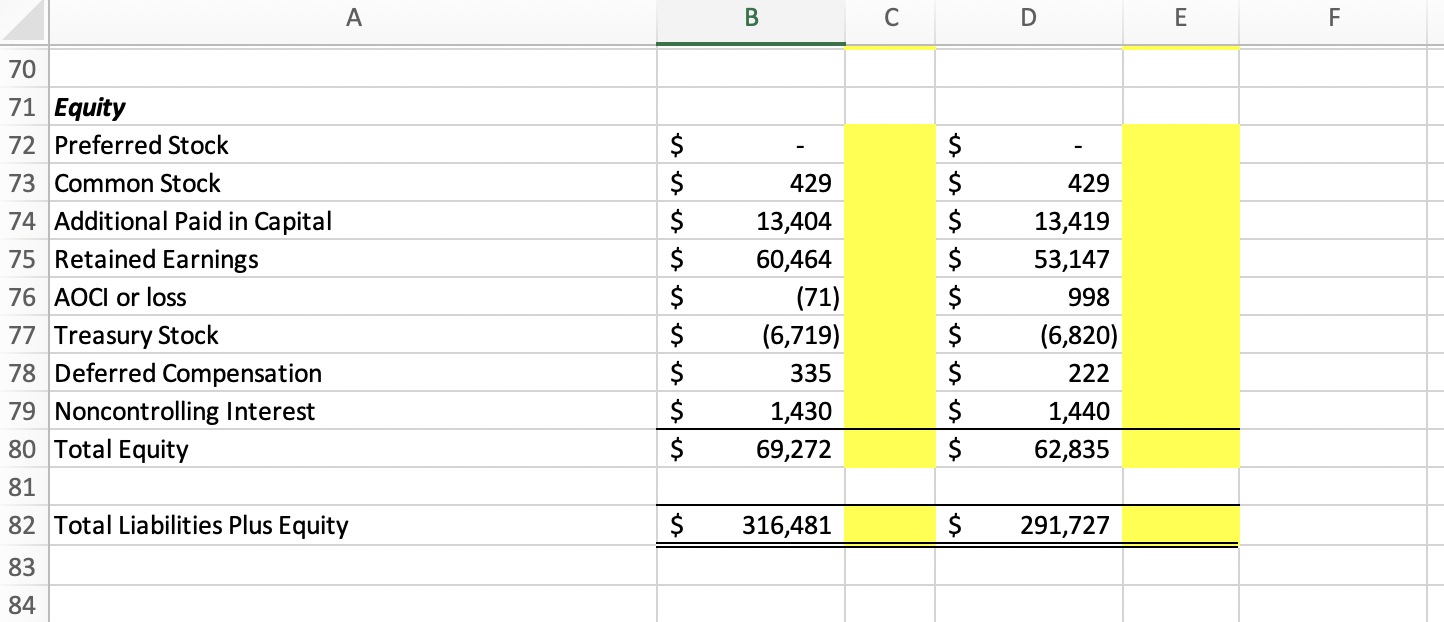

Question: I ONLY NEED HELP WITH EXCEL FORMULAS PLEASE :) I must fill each yellow box with a formula to complete its value, however these are

I ONLY NEED HELP WITH EXCEL FORMULAS PLEASE :)

I must fill each yellow box with a formula to complete its value, however these are stumping me a bit. Any help with these would be greatly appreciated. Thank you!

I

I

A 27 Interest Expense 28 29 Income before Taxes 30 Provision for Taxes 31 Net Income 32 33 34 35 Current Assets 36 Cash 37 A/R (net) 38 Inventories 39 Prepaid Expenses 40 41 42 43 Total Current Assets 44 45 Non-Current Assets 46 PP&E (net) 47 Investments in unconsolidated businesses 48 Wireless Licenses 49 Goodwill 50 Other Intangibles 51 Operating Leases 52 Other assets. 53 B $ (4,247) $ 23,967 $ (5,619) $ 18,348 Verizon Balance Sheet 2020 $ 22,171 $ 23,917 $ 1,796 $ 6,710 $ 54,594 $ 94,833 $ 589 $ 96,097 $ 24,773 $ 9,413 $ 22,531 $ 13,651 D $ (4,730) $ 22,733 (2,945) $ 19,788 2019 $ 2,594 $ 25,429 $ 1,422 $ 8,028 $ 37,473 $ 91,915 $ 558 $ 95,059 $ 24,389 9,498 $ 22,694 $ $ 10,141 E F $ (4,833) $ 19,623 $ (3,584) $ 16,039 G H A 4 5 6 Operating Revenues 7 Service Revenue 8 Wire equipment revenue 9 10 Total Net Revenue 11 12 Cost of Revenues 13 Cost of Services 14 Cost of Equipment 15 Total Cost of Rvenue 16 Gross Margin 17 18 Operating Expenses 19 Selling, general, and admin 20 Depreciation & Amortization 21 Media goodwill impairment 22 Total Operating Expenses 23 24 Operating Income 25 Equity in Losses of unconsolidated business 26 Other Income (expense) 27 Interest Expense 28 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ B C (45) (539) (4,247) D Years Ended Dec 31 2019 110,305 21,563 131,868 31,772 22,954 54,726 77,142 29,896 16,682 186 46,764 30,378 (15) (2,900) (4,730) 2020 109,872 86% $ 18,420 14% $ 128,292 100% $ 31,401 $ 19,800 $ 51,201 $ 77,091 $ 31,573 $ 16,720 $ $ 48,293 $ 28,798 $ $ $ $ E 84% $ 16% $ 100% $ $ $ $ $ $ $ $ $ $ $ $ $ F 2018 108,605 22,258 130,863 32,185 23,323 55,508 75,355 31,083 17,403 4,591 53,077 22,278 (186) 2,364 (4,833) G 83% 17% 100% H A 53 54 Total non-current 55 Total Assets 56 57 Current Liabilities 58 Current portion of debt 59 Accounts payable 60 Current operating lease liabilities 61 Other current liabilities 62 63 64 65 Total current liabilities 66 67 68 Non-Current Liabilities 69 Total Liabilities 70 B $ 261,887 $ 316,481 $ 5,889 $ 20,658 $ 3,485 $ 9,628 $ 39,660 $ 207,549 $ 247,209 C $ $ $ $ $ $ $ $ $ D 254,254 291,727 10,777 21,806 3,261 9,024 44,868 184,024 228,892 E F A 70 71 Equity 72 Preferred Stock 73 Common Stock 74 Additional Paid in Capital 75 Retained Earnings 76 AOCI or loss 77 Treasury Stock 78 Deferred Compensation 79 Noncontrolling Interest 80 Total Equity 81 82 Total Liabilities Plus Equity 83 84 $ $ $ $ $ $ $ $ $ B 429 13,404 60,464 (71) (6,719) 335 1,430 69,272 316,481 C D $ $ 429 $ 13,419 $ 53,147 $ 998 $ (6,820) $ 222 $ 1,440 $ 62,835 $ 291,727 E F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts