Question: I only need help with question B and C, would help a lot if done in excel. I only need help with part B and

I only need help with question B and C, would help a lot if done in excel.

I only need help with part B and C, thanks

I only need help with part B and C, thanks

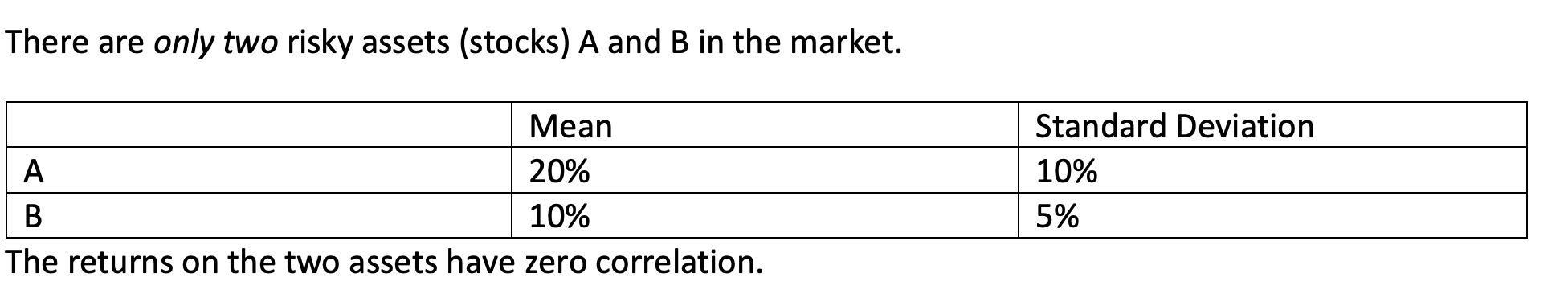

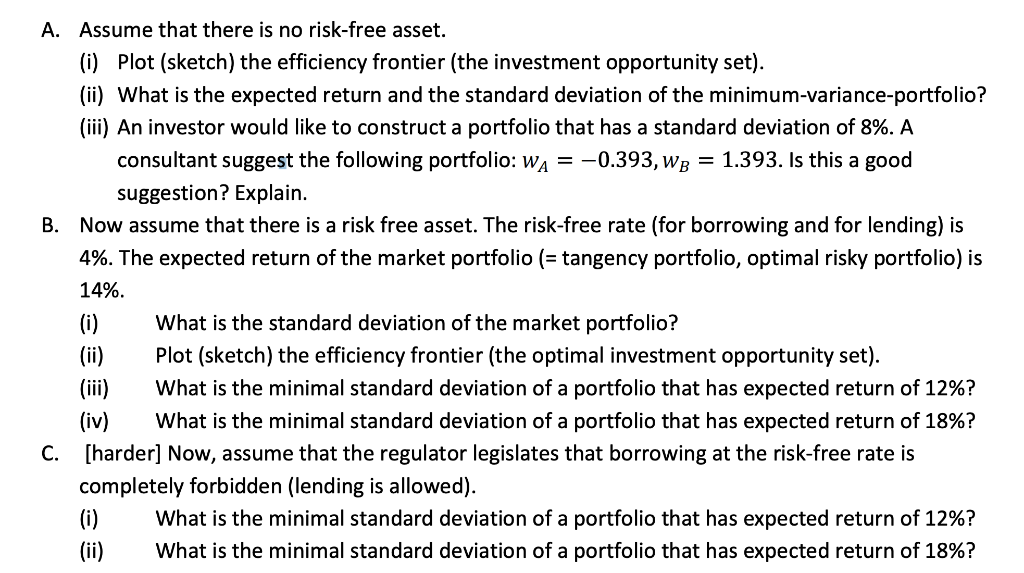

There are only two risky assets (stocks) A and B in the market. Mean A 20% B 10% The returns on the two assets have zero correlation. Standard Deviation 10% 5% a a A. Assume that there is no risk-free asset. (i) Plot (sketch) the efficiency frontier (the investment opportunity set). (ii) What is the expected return and the standard deviation of the minimum-variance-portfolio? (iii) An investor would like to construct a portfolio that has a standard deviation of 8%. A consultant suggest the following portfolio: WA = -0.393, wb = 1.393. Is this a good suggestion? Explain. B. Now assume that there is a risk free asset. The risk-free rate (for borrowing and for lending) is 4%. The expected return of the market portfolio (= tangency portfolio, optimal risky portfolio) is 14%. What is the standard deviation of the market portfolio? (ii) Plot (sketch) the efficiency frontier (the optimal investment opportunity set). What is the minimal standard deviation of a portfolio that has expected return of 12%? (iv) What is the minimal standard deviation of a portfolio that has expected return of 18%? C. [harder] Now, assume that the regulator legislates that borrowing at the risk-free rate is completely forbidden (lending is allowed). (i) What is the minimal standard deviation of a portfolio that has expected return of 12%? (ii) What is the minimal standard deviation of a portfolio that has expected return of 18%? There are only two risky assets (stocks) A and B in the market. Mean A 20% B 10% The returns on the two assets have zero correlation. Standard Deviation 10% 5% a a A. Assume that there is no risk-free asset. (i) Plot (sketch) the efficiency frontier (the investment opportunity set). (ii) What is the expected return and the standard deviation of the minimum-variance-portfolio? (iii) An investor would like to construct a portfolio that has a standard deviation of 8%. A consultant suggest the following portfolio: WA = -0.393, wb = 1.393. Is this a good suggestion? Explain. B. Now assume that there is a risk free asset. The risk-free rate (for borrowing and for lending) is 4%. The expected return of the market portfolio (= tangency portfolio, optimal risky portfolio) is 14%. What is the standard deviation of the market portfolio? (ii) Plot (sketch) the efficiency frontier (the optimal investment opportunity set). What is the minimal standard deviation of a portfolio that has expected return of 12%? (iv) What is the minimal standard deviation of a portfolio that has expected return of 18%? C. [harder] Now, assume that the regulator legislates that borrowing at the risk-free rate is completely forbidden (lending is allowed). (i) What is the minimal standard deviation of a portfolio that has expected return of 12%? (ii) What is the minimal standard deviation of a portfolio that has expected return of 18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts