Question: I only need help with the last question. Please include how you were able to calculate it (by calculator or by table) thanks! 3 Exercise

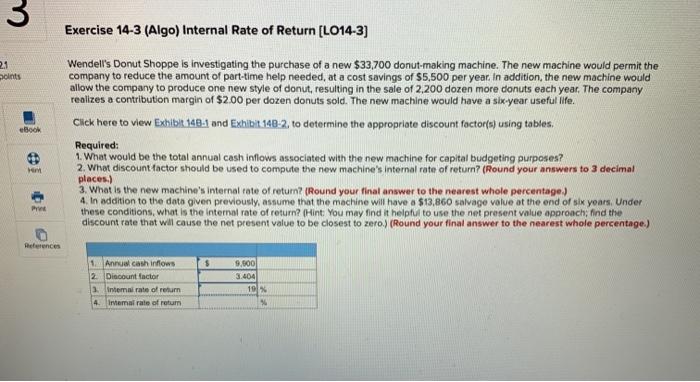

3 Exercise 14-3 (Algo) Internal Rate of Return [LO14-3) 21 Saints eBook Wendell's Donut Shoppe is investigating the purchase of a new $33,700 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of 55,500 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,200 dozen more donuts each year. The company realizes a contribution margin of $2.00 per dozen donuts sold. The new machine would have a six-year useful ilfe. Click here to view Exhibit 140.1 and Exhibit 140-2. to determine the appropriate discount factor(a) using tables. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. Whet discount factor should be used to compute the new machine's Internal rate of return? (Round your answers to 3 decimal places.) 3. What is the new machine's internal rate of return? (Round your final answer to the nearest whole percentage) 4. In addition to the data given previously, assume that the machine will have a $13,860 salvage value at the end of six years. Under these conditions, what is the internal rate of return? (Hint: You may find it helpful to use the net present value approach; find the discount rate that will cause the net present value to be closest to zero) (Round your final answer to the nearest whole percentage.) em References 1 Annual cash inflows 2 Discount factor 3. Intemai rate of return 4. nemal rate of retum 9.500 3.404 10 27 Ferods 5% 8% 3% 9% 90% TEX 13% 14% 16 17 183 9926 21% 73 245 25% 1 0.962 0952 090 0.9050 926 0911 0909 0.01 0.893 0.885 0.77 0.870 0.862 0.855 086 080 081 0.826 0.20 0.813 0806 0.300 1886 1859 1800 1703 1799 1736 170 1690 1668 1626 1605 1505 1506 157 158 1509 1492 1474 145 1460 2775 2723 2673 2624 2577 2531 2.487 240 2.402 2361 2.322 223 2246 220 211 2.00 2.806 2014 2012 2011 6 1630 3543465 3337 3:32 1951 1952 3240 3170 3102 101 2.974 295 2850 2.79 270 2.00 2.09 2589 2540 241 248 2454 2362 5 4452 4229 4212 4100 3.993 3.090 1791 3696 3.605 2517 3433 3352-3276 3190 3127 3058 291 2926 284 2833 2.75 2.600 6 5242 507549 4.77 4527 4486 4355 421 411 3.999 3.69 3704 305 359 3.090 1.090 1.326 3245 1.167 1052 3.000 2.955 7 6002 5786 5.582 5.389 5.200 500 460 470 494 4.423 4288 4150 4029 2912 302 300 2605 2.50 249 3.37 322 11 0233 6.463 0.210 597 5740 5535 535 5105 496 499 469 4314.202 407 395 3.837 3725 361925181421 1.129 9 7435 710 6.812 6515 6 247 5.995 5.750 5.537 512 5132 406 472 4.607 4651 4300 44001 1905 70 1671 1560 1453 10 Em 7300 7024 6710 64 65 S60 S60 5.426 5.28 507) 434 494 434192 4054 1922 373 1671 11 1030678 7.490 700 6.005 605 6.207 con 50075453 524 5029 036 4400 437 41 40 3902 3770 365 12 28.06 11:34 7943 7536 7961 6.42 658 5600 5.421 574 40 401 402 41271 3.851 1729 12 9.906 353 3.38 2904 7487 7100 750 5.634 6.1225.042 550 5.547 37 4910715 4520 4200 4032 0237 14 10561 99295145 244 1700 73 8.502 6.620 602 6002 5.726 54605220 500 400 401 402 426 40 3962224 15 19 103009 1559 2001 76057191 6.0 6.00 650S 5324 54828 409 410 4113001 2050 102 10100344 313 2824 7370 699 6604 205 5950 560 5.405 5.63 43 470 45 435 40 4033 16112410477 92 9122 022750 2120 6.729 0 0 0 2 0 4 04.04200503.90 10 12.01 1990 120 100 92 0.00 201 202 250 047 20 23 481240414243401 04 2005 390 606 950 75 2366 350 190 ST 500 5070 A1408 404 4007 2012 50012462 2004 120 5795374070255029 50 5101 40 402 404040 04 21 14029 76000022 8.0 72 72 66 60 55 504642 12 1691 169 1700 10.2014 2765 23 MUST 114 122 500 1000 5400 400 4000 400 72309 4671 542 1925 70 2008 19 24 15247052907 05278 2200736.01440 450 40 25 10301 1622010540902 9:07 142270 70 44 CORP. 5670 544 MT 26 3006690109 361 12604 500 5200 49 420 424 27 no 160 15 10 5 1027 931 206130 700 15 0164 3.900 20 1936 2012 11.051 100 507 77441 536 62 50 5502222 970422 1992 25 1.5641541 12 000 1.002 46 655 60 6.20 10 40 60 251994 30 202 2034 140 14100 1005 10 15.12 77 093680500233 354 4450410 1009 10 NEW 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts