Question: I only need help with the second question but the first question is continued in order to solve the second. Use the information to answer

I only need help with the second question but the first question is continued in order to solve the second.

I only need help with the second question but the first question is continued in order to solve the second.

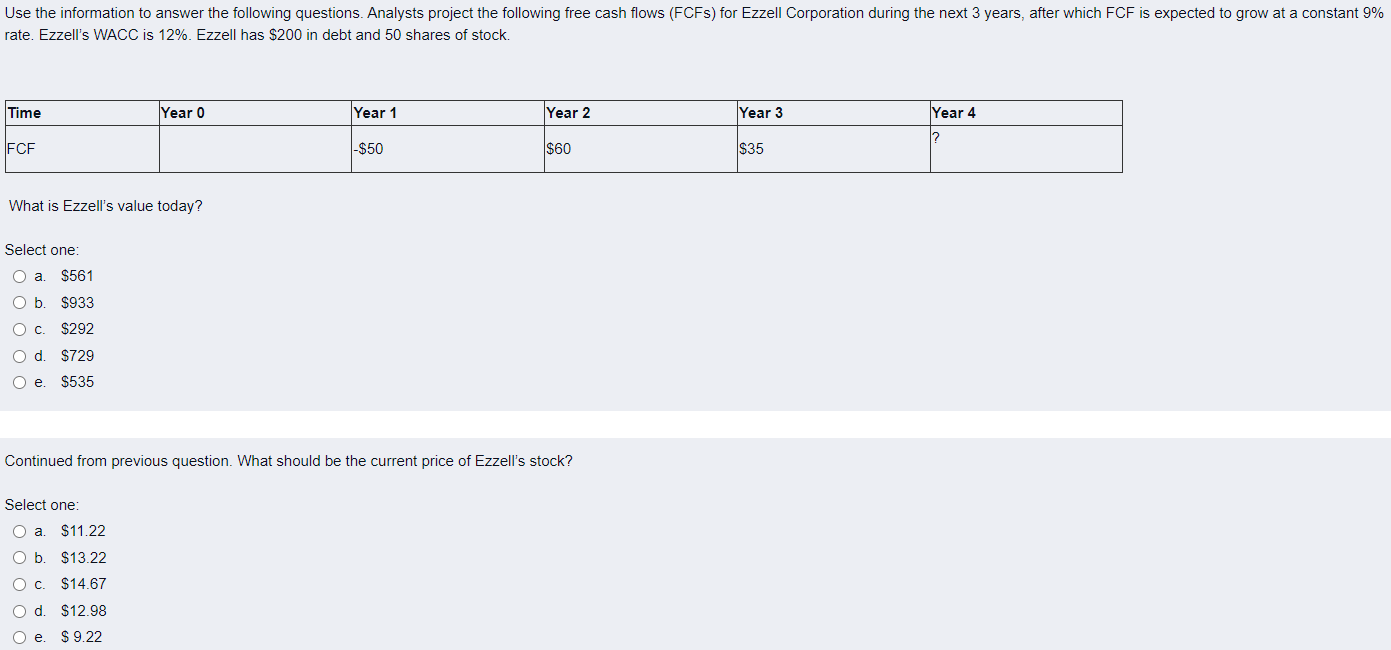

Use the information to answer the following questions. Analysts project the following free cash flows (FCFS) for Ezzell Corporation during the next 3 years, after which FCF is expected to grow at a constant 9% rate. Ezzell's WACC is 12%. Ezzell has $200 in debt and 50 shares of stock. Time Year o Year 1 Year 2 Year 3 Year 4 FCF -$50 $60 $35 What is Ezzell's value today? Select one: O a $561 Ob. $933 . $292 Od $729 Oe $535 Continued from previous question. What should be the current price of Ezzell's stock? Select one: O a. $11.22 Ob $13.22 . $14.67 Od $12.98 Oe $ 9.22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts