Question: I only need question c pls (c) What is gross profit under each method? FIFO LIFO Gross profit $ $ b (b) Your answer is

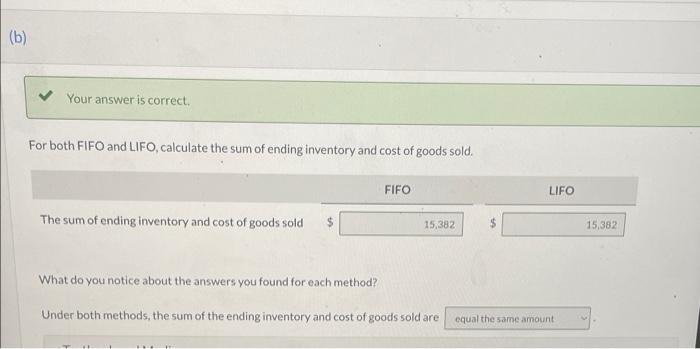

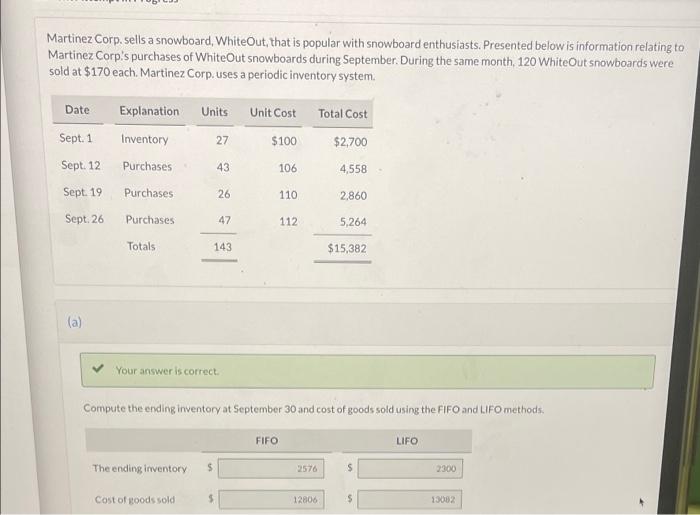

(c) What is gross profit under each method? FIFO LIFO Gross profit $ $ b (b) Your answer is correct. For both FIFO and LIFO, calculate the sum of ending inventory and cost of goods sold. FIFO LIFO The sum of ending inventory and cost of goods sold $ 15,382 $ 15,382 What do you notice about the answers you found for each method? Under both methods, the sum of the ending inventory and cost of goods sold are equal the same amount Martinez Corp.sells a snowboard, WhiteOut, that is popular with snowboard enthusiasts. Presented below is information relating to Martinez Corp's purchases of WhiteOut snowboards during September. During the same month, 120 WhiteOut snowboards were sold at $170 each. Martinez Corp.uses a periodic inventory system Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 27 $100 $2,700 Sept. 12 Purchases 43 106 4,558 Sept. 19 Purchases 26 110 2,860 Sept. 26 Purchases 47 112 5,264 Totals 143 $15,382 (a) Your answer is correct Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods, FIFO LIFO The ending inventory $ 2576 $ 2300 Cost of goods sold $ 12806 13002

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts