Question: I only need the correct answer for noncontrolling interest in subsidiary. All other answers are correct already. ProForm acquired 70 percent of ClipRite on June

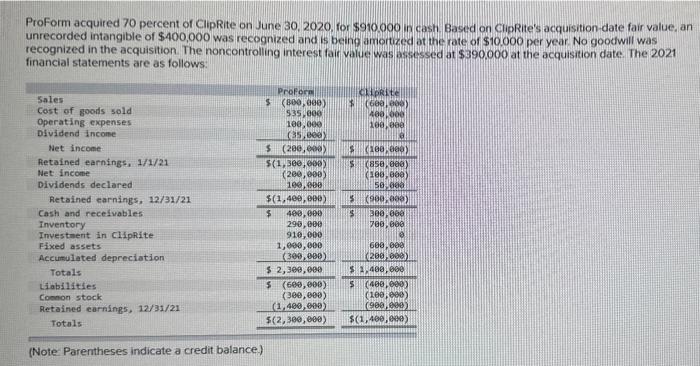

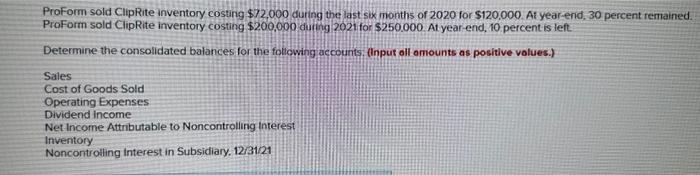

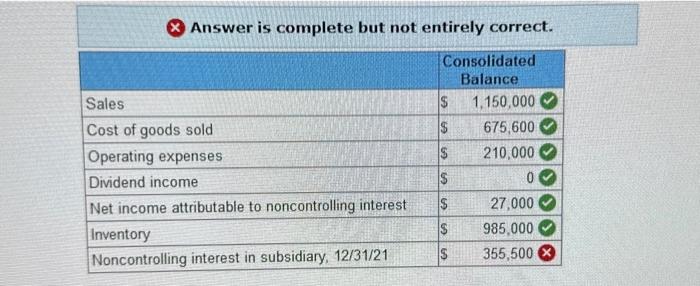

ProForm acquired 70 percent of ClipRite on June 30, 2020, for $910000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $400,000 was recognized and is being amortized at the rate of $10.000 per year. No goodwill was recognized in the acquisition. The noncontrolling interest fair value was assisssed at $390,000 at the acquisition date. The 2021 financial statements are as follows: (Note Parentheses indicate a credit balance) ProForm sold ClipRite inventory costing $72,000 during the last six months of 2020 for $120,000. At year-end, 30 percent remained. ProForm sold ClipRite inventory costing $200,000 during 2021 for $250.000 At year-end, 10 percent is left. Determine the consolidated balances for the following accounts. (Input all amounts as positive volues.) Sales Cost of Goods Sold Operating Expenses Dividend income Net Income Attributable to Noncontrolling interest Inventory Noncontrolling interest in Subsidiary. 1231/21 Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts