Question: I only need the correct answer for noncontrolling interest in Subsidiary, 12/31/21. All other answers are correct already, thank you. ProForm acquired 70 percent of

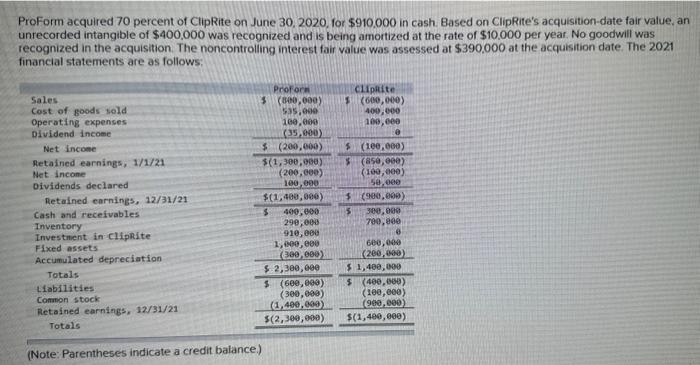

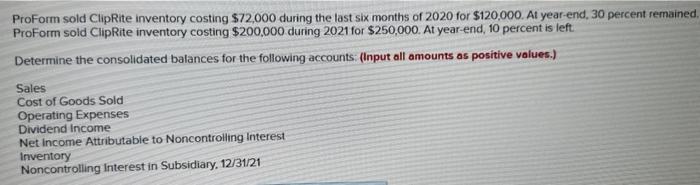

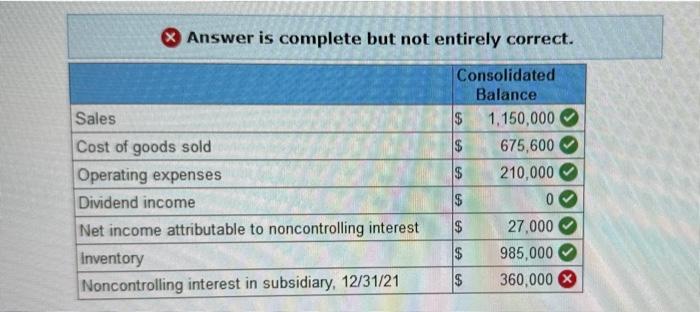

ProForm acquired 70 percent of ClipRite on June 30,2020 , for $910,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $400,000 was recognized and is being amortized at the rate of $10.000 per year. No goodwill was recognized in the acquisition. The noncontroliing interest fair value was assessed at $390,000 at the acquisition date. The 2021 financial statements are as follows: (Note: Parentheses indicate a credit balance.) ProForm sold ClipRite inventory costing $72,000 during the last six months of 2020 for $120,000. At year-end, 30 percent remained. ProForm sold ClipRite inventory costing $200,000 during 2021 for $250,000. At year-end, 10 percent is left. Determine the consolidated balances for the following accounts: (Input all amounts as positive values.) Sales Cost of Goods Sold Operating Expenses Dividend Income Net income Attributable to Noncontrolling Interest Inventory Noncontrolling Interest in Subsidiary. 12/31/21 Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts