Question: I ONLY NEED THE LAST QUESTION. INDIFFERENT . CONFUSED AS TO HOW YOU GET THAT. Problem 9-9 Calculating NPV and IRR (LO1, 5) A project

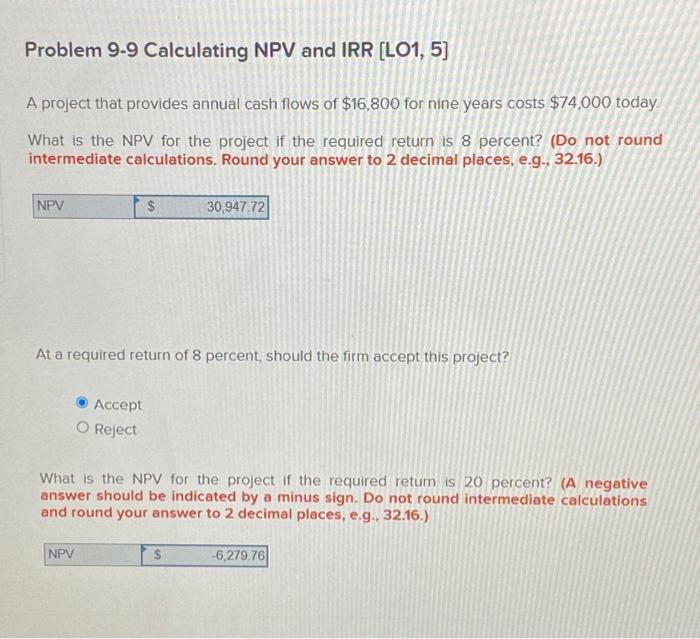

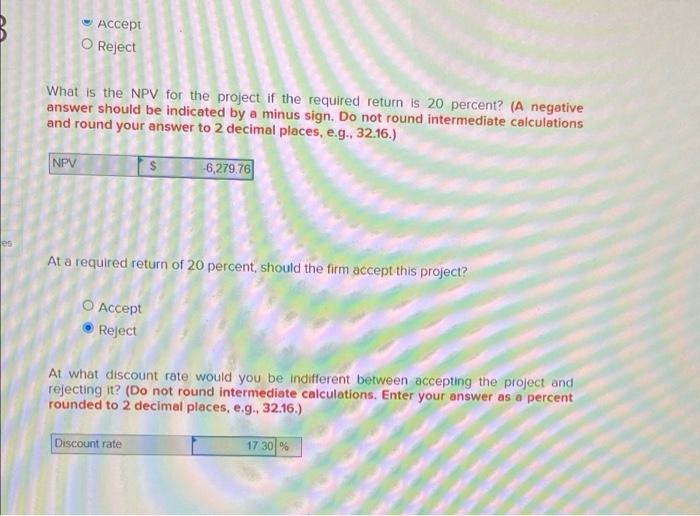

Problem 9-9 Calculating NPV and IRR (LO1, 5) A project that provides annual cash flows of $16,800 for nine years costs $74,000 today What is the NPV for the project if the required return is 8 percent? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) NPV $ 30,947.72 At a required return of 8 percent, should the firm accept this project? Accept O Reject What is the NPV for the project if the required retum is 20 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g. 32.16.) NPV $ -6,279.76 Accept O Reject What is the NPV for the project if the required return is 20 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV $ -6,279,76 es At a required return of 20 percent, should the firm accept this project? O Accept Reject At what discount rate would you be indifferent between accepting the project and rejecting it? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Discount rate 17 30% Problem 9-9 Calculating NPV and IRR (LO1, 5) A project that provides annual cash flows of $16,800 for nine years costs $74,000 today What is the NPV for the project if the required return is 8 percent? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) NPV $ 30,947.72 At a required return of 8 percent, should the firm accept this project? Accept O Reject What is the NPV for the project if the required retum is 20 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g. 32.16.) NPV $ -6,279.76 Accept O Reject What is the NPV for the project if the required return is 20 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV $ -6,279,76 es At a required return of 20 percent, should the firm accept this project? O Accept Reject At what discount rate would you be indifferent between accepting the project and rejecting it? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Discount rate 17 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts