Question: I only need the solution to part b. Thanks for the help. The following exercises use the random stock price ST Soelr-o2/2)T +0 VTZ This

I only need the solution to part b. Thanks for the help.

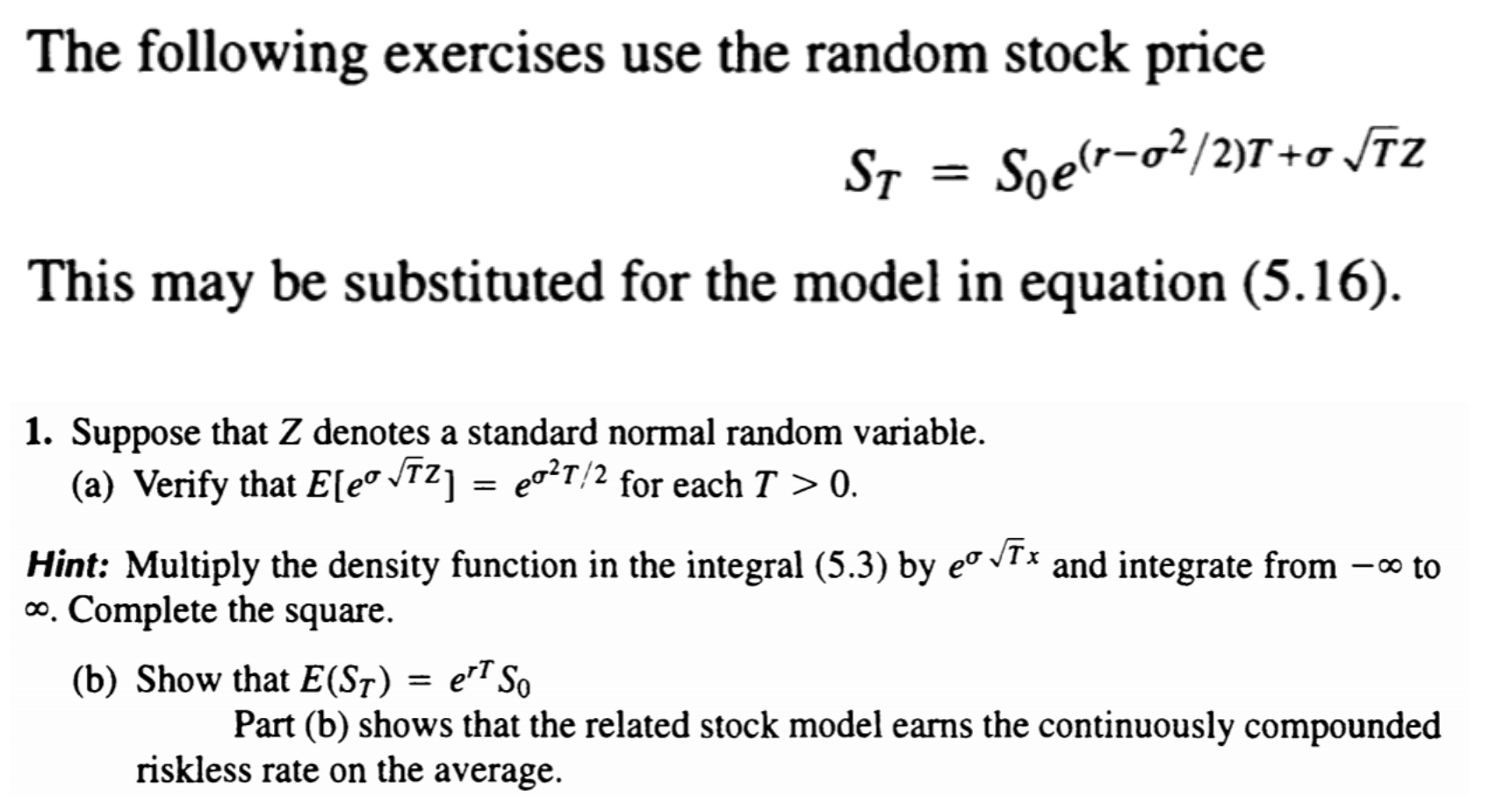

The following exercises use the random stock price ST Soelr-o2/2)T +0 VTZ This may be substituted for the model in equation (5.16). 1. Suppose that Z denotes a standard normal random variable. (a) Verify that Eeo VT2] = 2027/2 for each T > 0. Hint: Multiply the density function in the integral (5.3) by eo Vix and integrate from to co. Complete the square. (b) Show that E(ST) = et So Part (b) shows that the related stock model earns the continuously compounded riskless rate on the average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts