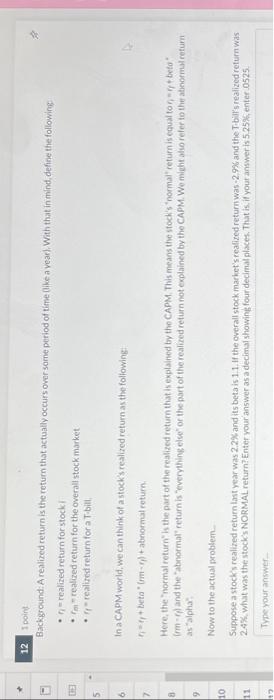

Question: I point Background: A realized return is the return that actually occuirs over sarne period of time (like a vear). With that in mind, define

I point Background: A realized return is the return that actually occuirs over sarne period of time (like a vear). With that in mind, define the followings - n = realized return for stocki - fm1 - realized return for the overall stock market - if" realized return for a T-bili, In a CAPM world, we can think of astock's realized return as the following: n1=t1+ beta " (mr1)+ abiormul return. Here, the "normal roturn"'h the part ot the realized retum that is explained by the CAPM. This means the stock's "normal" return is equal ton " 1y+ beto " as "alpha", Now to the actual problemL Suppose a stock's realized return last year was 2.2% and its beta is 1.1. If the overall stock market's sealized return was 2.9% and the T. bill s realized return was 24\%. what was the stocks NORMAL return? Enter your answer as a decimal showing four decimal places. That is, if your answer is 5.25% enter . O525

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts