Question: Background: A realized return is the return that actually occurs over some period of time (like a year). With that in mind, define the following:

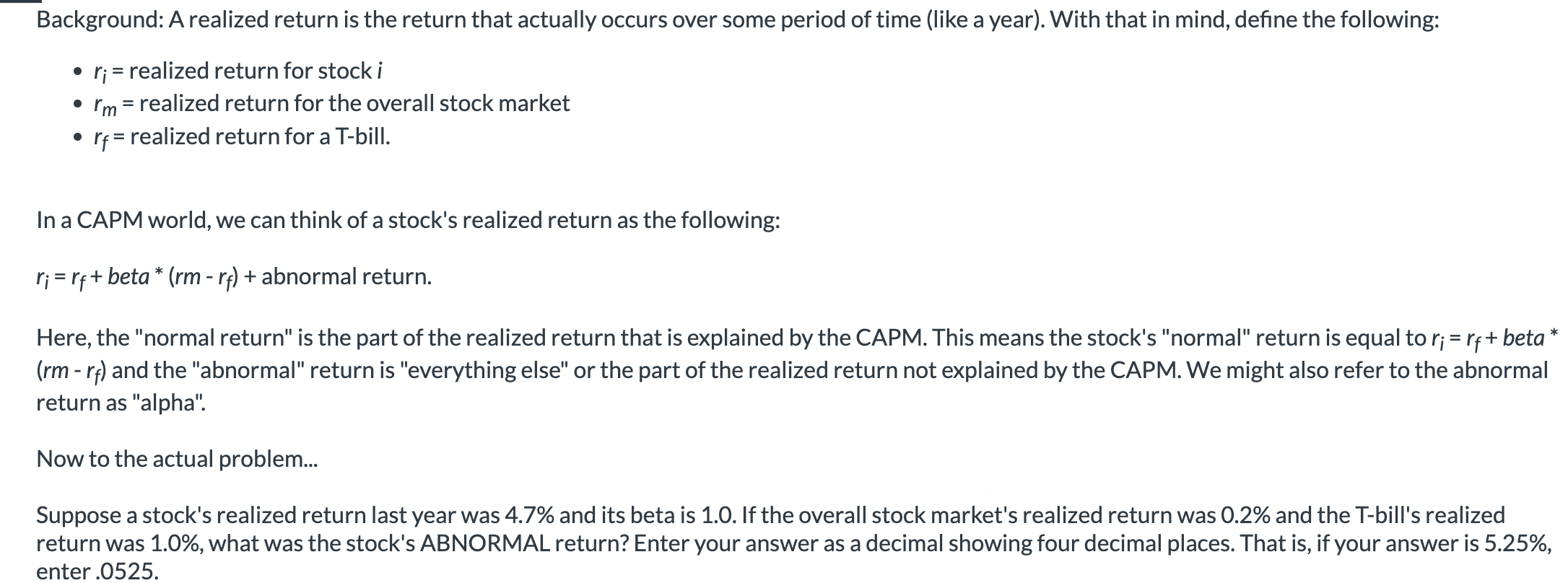

Background: A realized return is the return that actually occurs over some period of time (like a year). With that in mind, define the following: - ri= realized return for stock i - rm= realized return for the overall stock market - rf= realized return for a T-bill. In a CAPM world, we can think of a stock's realized return as the following: ri=rf+beta(rmrf)+ abnormal return. Here, the "normal return" is the part of the realized return that is explained by the CAPM. This means the stock's "normal" return is equal to ri=rf+ beta (rmrf) and the "abnormal" return is "everything else" or the part of the realized return not explained by the CAPM. We might also refer to the abnormal return as "alpha". Now to the actual problem... Suppose a stock's realized return last year was 4.7% and its beta is 1.0. If the overall stock market's realized return was 0.2% and the T-bill's realized return was 1.0%, what was the stock's ABNORMAL return? Enter your answer as a decimal showing four decimal places. That is, if your answer is 5.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts