Question: I PRACTICE PROBLEM: New lithographic equipment, acquired at a cost of $800,000 on January 1, 2020 the beginning of a fiscal year, has an

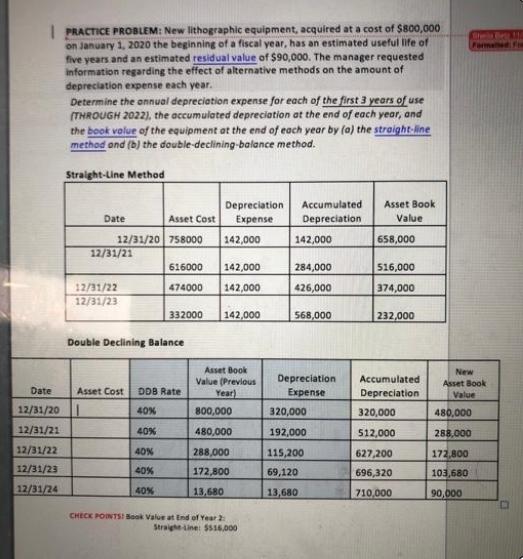

I PRACTICE PROBLEM: New lithographic equipment, acquired at a cost of $800,000 on January 1, 2020 the beginning of a fiscal year, has an estimated useful life of five years and an estimated residual value of $90,000. The manager requested information regarding the effect of alternative methods on the amount of depreciation expense each year. Determine the annual depreciation expense for each of the first 3 years of use (THROUGH 2022), the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by (a) the straight-line method and (b) the double-declining-balance method. Straight-Line Method Depreciation Accumulated Depreciation Asset Book Value Date Asset Cost Expense 12/31/20 758000 142,000 142,000 12/31/21 616000 142,000 284,000 12/31/22 474000 142,000 426,000 12/31/23 332000 142,000 568,000 Double Declining Balance Asset Book Value (Previous Depreciation Asset Cost DDB Rate Year) Expense 40% 800,000 40% 480,000 40% 288,000 40% 172,800 40% 13,680 CHECK POINTS: Book Value at End of Year 2 Straighe-Line: $516,000 Date 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 320,000 192,000 115,200 69,120 13,680 658,000 516,000 374,000 232,000 Accumulated Depreciation 320,000 512,000 627,200 696,320 710,000 Simia Bege 110 Formated Fre New Asset Book Value 480,000 288,000 172,800 103,680 90,000

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Deprecation under straight line method Acquisition Cost Resudial Cost Estimated life 800000 ... View full answer

Get step-by-step solutions from verified subject matter experts