Question: I pts The table below presents correlation coefficients among US dollar returns, real interest rate, inflation rate, nominal risk-free rate in the US for the

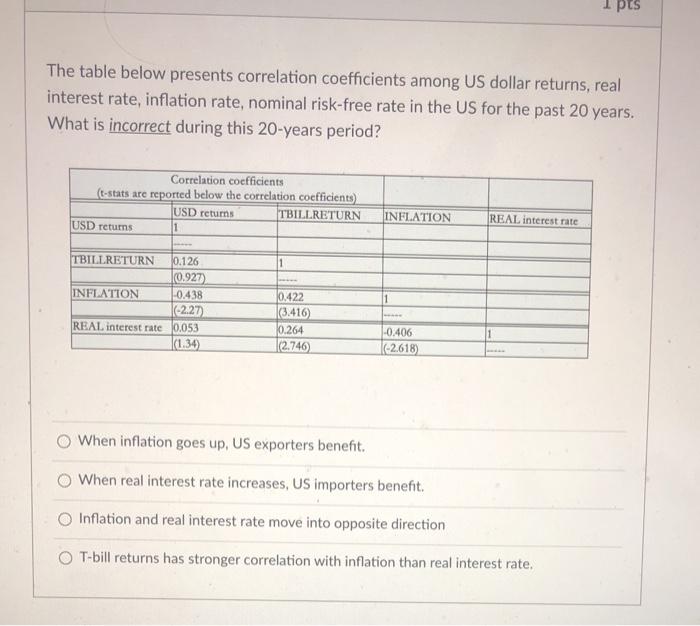

I pts The table below presents correlation coefficients among US dollar returns, real interest rate, inflation rate, nominal risk-free rate in the US for the past 20 years. What is incorrect during this 20-years period? Correlation coefficients (t-stats are reported below the correlation coefficients) USD retums TBILLRETURN USD returns 11 INFLATION REAL interest rate 1 TBILLRETURN 0.126 10.927) INFLATION -0.438 (42.27 REAL interest rate 0.053 (1.34) 0.422 (3.416) 0.264 2.746 -0.406 |-2.618) When inflation goes up, US exporters benefit. When real interest rate increases, US importers benefit Inflation and real interest rate move into opposite direction OT-bill returns has stronger correlation with inflation than real interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts