Question: I really need help getting all the number inputs on the side because I have no idea how to get them. This is for a

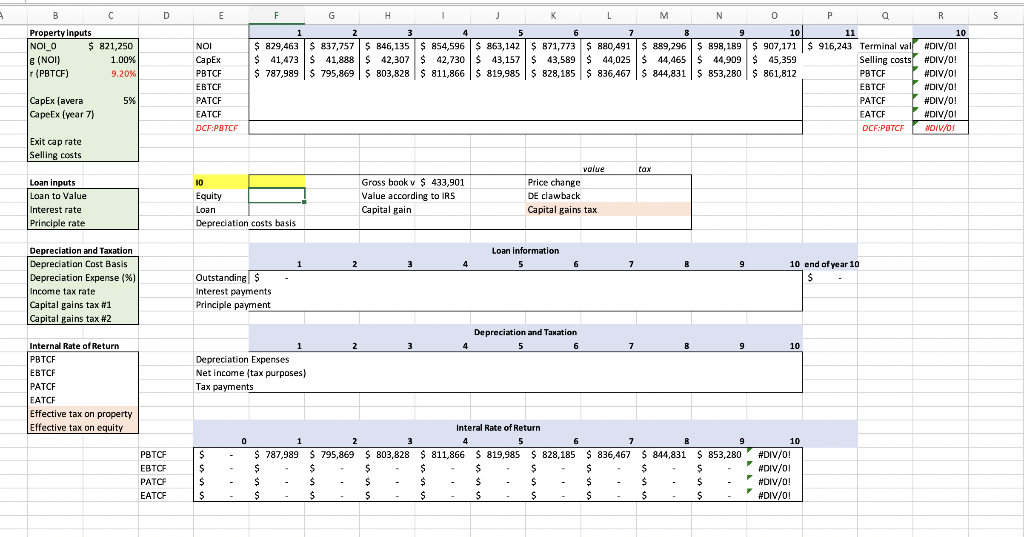

I really need help getting all the number inputs on the side because I have no idea how to get them. This is for a real estate investments project and I picked an apartment property with the starting NOI as in the table.

I really need help getting all the number inputs on the side because I have no idea how to get them. This is for a real estate investments project and I picked an apartment property with the starting NOI as in the table.

Using the pro-forma calculate the (1) Property Before Tax Cash Flow (PBTCF), (2) Property After Tax Cash Flow (PATCF), (3) Equity Before Tax Cash Flow (EBTCF), and (4) the Equity After Tax Cash Flow (EATCF). Also compute the Internal Rate of Return (IRR) for all four sets of cash flows and put this in the report as well. As noted before, you can pick levels of debt you feel is realistic/desirable for your client.

Please use the following inputs to complete the pro-forma.

Use a 20% income tax on the cash flow.

The recapture tax rate on the accrued depreciation is 25%.

The difference between the sales price and gross book value is taxed at 15%.

Use an 80% depreciation cost basis.

Cost of selling the property is 5% of the sales price.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts