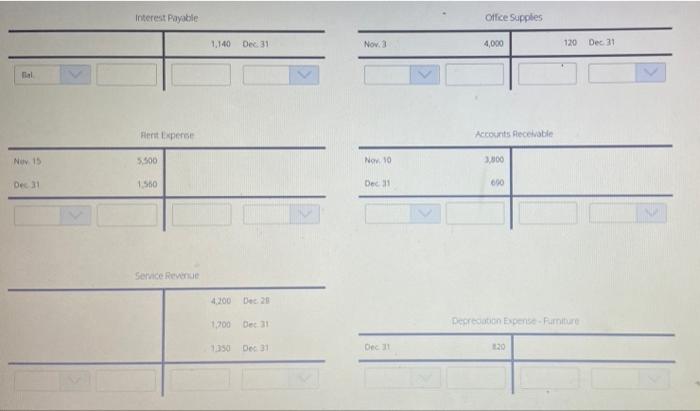

Question: I really need help on this as soon as possible Interest Payable Office Supplies 1.140 Dec 31 Nov. 3 4,000 120 Dec 21 al Rest

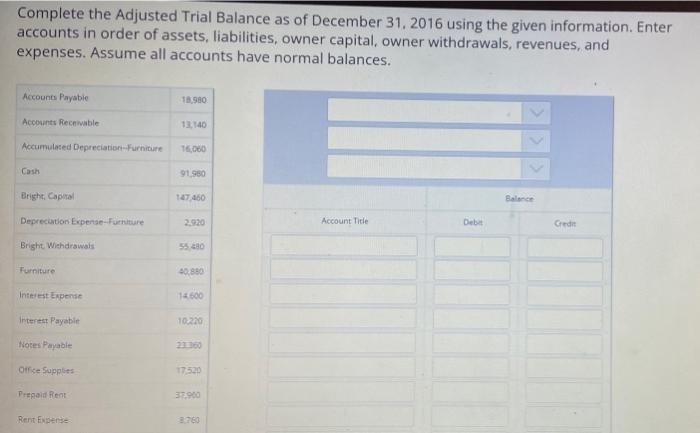

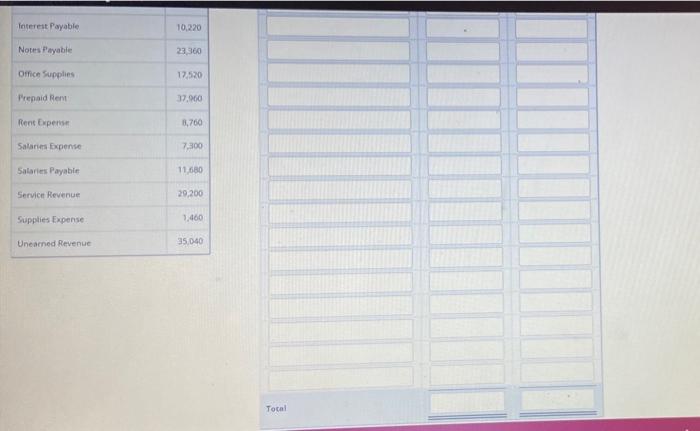

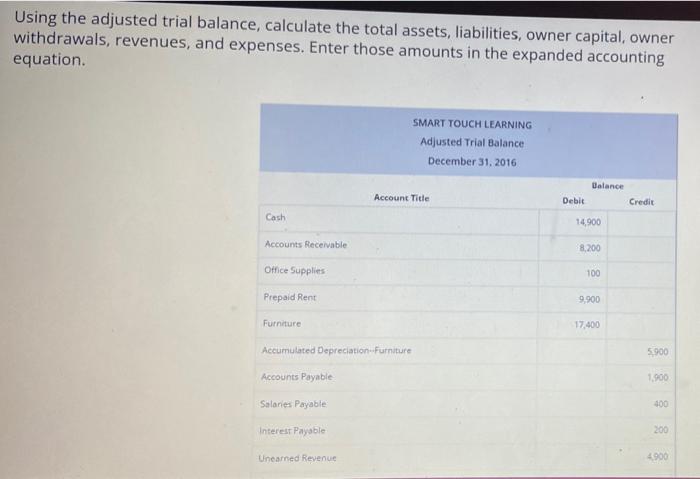

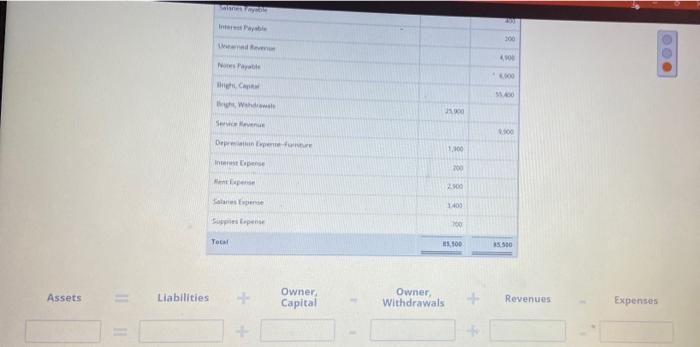

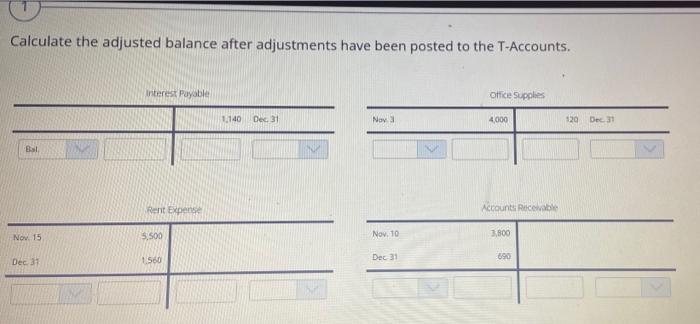

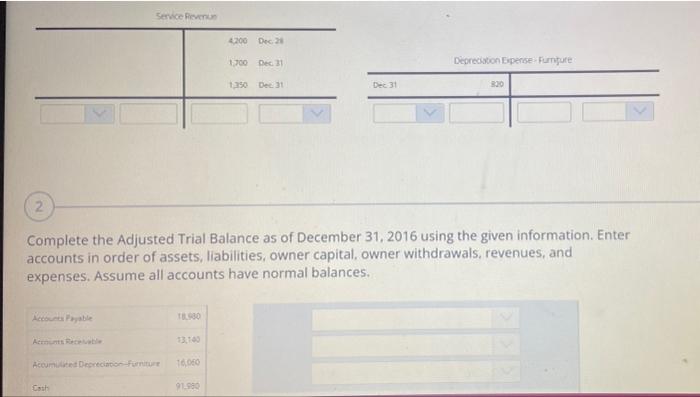

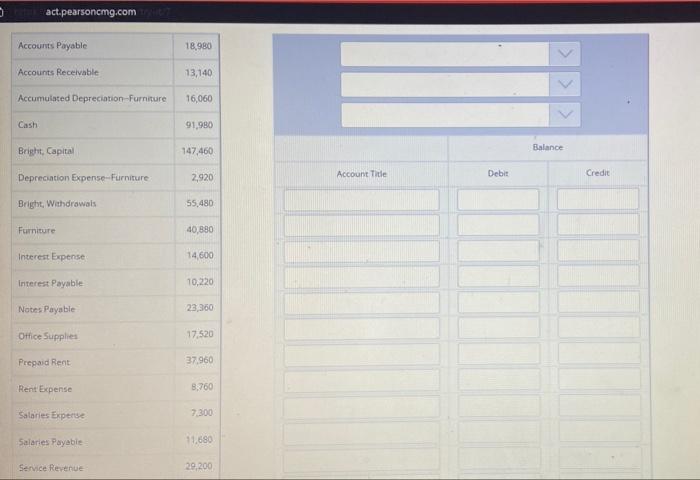

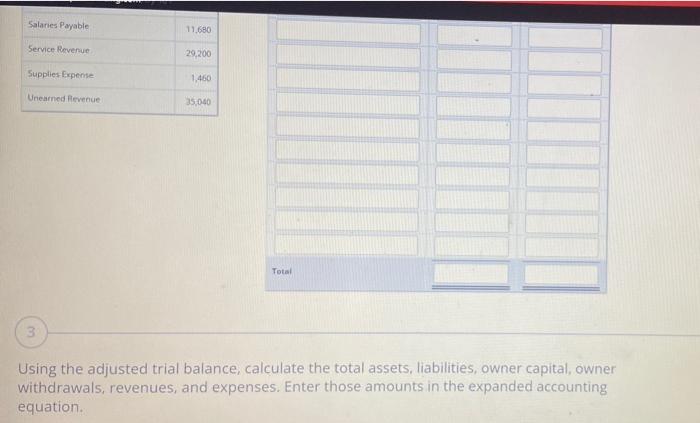

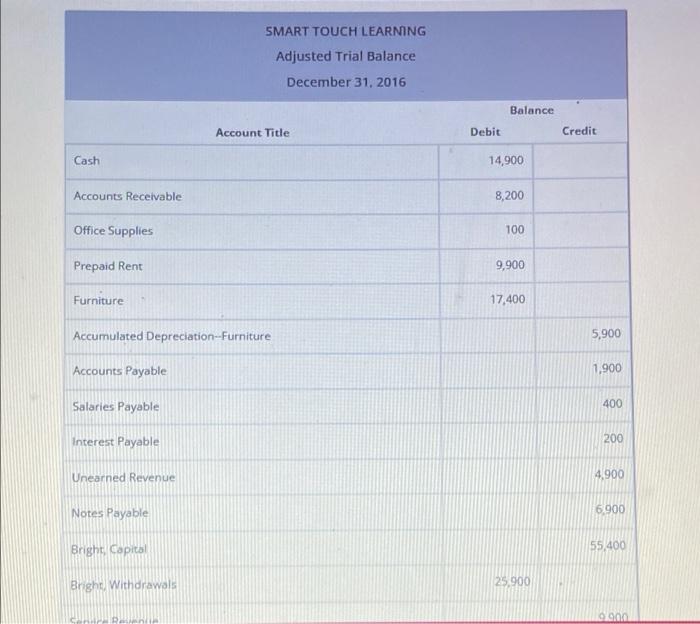

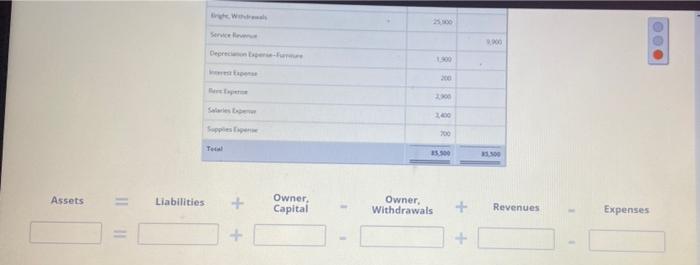

Interest Payable Office Supplies 1.140 Dec 31 Nov. 3 4,000 120 Dec 21 al Rest Expense Accounts Receivable Nov 15 5.500 No 10 3.300 Det 1560 Dec 31 600 Service Rene 4,200 Dec 20 1.200 Det Deoretion Expensumitur 050 31 Dec 120 Complete the Adjusted Trial Balance as of December 31, 2016 using the given information. Enter accounts in order of assets, liabilities, owner capital, owner withdrawals, revenues, and expenses. Assume all accounts have normal balances. Accounts Payable 18.980 Accounts Receivable 12.140 Accumulated Depreciation Furniture 16.000 Cash 91.980 Bright Capital 107460 Balance Depreciation Expense-Furniture 2.920 Account Title Debet Credit Bright Withdrawals 55480 Furniture 40.880 Interest Expense 14.500 Interest Payable 10:22 Notes Payable 21360 Office Supplies Prepaid Rent 37.900 Rent Expense Interest Payable 10.220 Notes Payable 23300 Omice Supplies 17.520 Prepaid Rent 37.900 Rent Expense 3,700 Salaries Expense 7.300 Salaries Payable 11.680 Service Revenue 29,200 Supplies Expense 1,460 Unearned Revenue 35.040 Total Using the adjusted trial balance, calculate the total assets, liabilities, owner capital, owner withdrawals, revenues, and expenses. Enter those amounts in the expanded accounting equation. SMART TOUCH LEARNING Adjusted Trial Balance December 31, 2016 Account Title Balance Credit Debit Cash 14,900 Accounts Receivable 8.200 Office Supplies 100 Prepaid Rent 9,900 Furniture 17.400 Accumulated Depreciation-Furniture 5.900 Accounts Payable 1.900 Salaries Payable 400 Interest Payable 200 Unearned Revenue 4900 200 4100 Na 6.000 nh 51.00 Wh Serwis De 1.000 Inc 200 1400 Suppen 700 Toca 100 15500 Assets Liabilities Owner Capital Owner Withdrawals Revenues Expenses Calculate the adjusted balance after adjustments have been posted to the T-Accounts. interest Payable Office Supplies 140 Dec. 31 Nov 4,000 120 Dec 31 B Rent Expense Accounts Recewable 5.500 Nov. 10 3.800 Nov. 15 Dec 31 890 1.560 Dec 31 Service Rever 4200 Dec 24 1.700 Dec Depreciation Expense Furniture 1350 Dec Dec 31 220 2 Complete the Adjusted Trial Balance as of December 31, 2016 using the given information. Enter accounts in order of assets, liabilities, owner capital, owner withdrawals, revenues, and expenses. Assume all accounts have normal balances. TIL 30 12.100 Acoume Decor Furnitur 1600 Cash 91.99 act.pearsoncmg.com Accounts Payable 18,980 Accounts Receivable 13,140 Accumulated Depreciation - Furniture 16,060 Cash 91,980 Bright, Capital 147,460 Balance Depreciation Expense-Furniture 2,920 Credit Account Title Debit Bright, Withdrawals 55.480 Furniture 40,890 Interest Expense 14,600 Interest Payable 10,220 Notes Payable 23,360 Office Supplies 17.520 Prepaid Rent 37.960 Rent Expense 8,760 Salaries Experts 7.300 Salaries Payable 11,680 Service Revenue 29,200 Salaries Payable 11.680 Service Revenue 29,200 Supplies Expense 1,460 Uneamed Revenue 35,040 Total 3 Using the adjusted trial balance, calculate the total assets, liabilities, owner capital, owner withdrawals, revenues, and expenses. Enter those amounts in the expanded accounting equation SMART TOUCH LEARNING Adjusted Trial Balance December 31, 2016 Balance Account Title Debit Credit Cash 14,900 Accounts Receivable 8,200 Office Supplies 100 Prepaid Rent 9,900 Furniture 17,400 Accumulated Depreciation-- Furniture 5,900 Accounts Payable 1,900 Salaries Payable 400 Interest Payable 200 Unearned Revenue 4.900 Notes Payable 6.900 Bright Capital 55,400 Bright Withdrawals 25.900 91900 3500 Service 0.00 Derech 1300 200 2000 Spe 200 To 13.00 35.00 Assets Liabilities + Owner Capital Owner Withdrawals + Revenues Expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts