Question: I really need help on this question. The numbers written in the answered boxes are wrong, so please make sure to do those ones too.

I really need help on this question. The numbers written in the answered boxes are wrong, so please make sure to do those ones too.

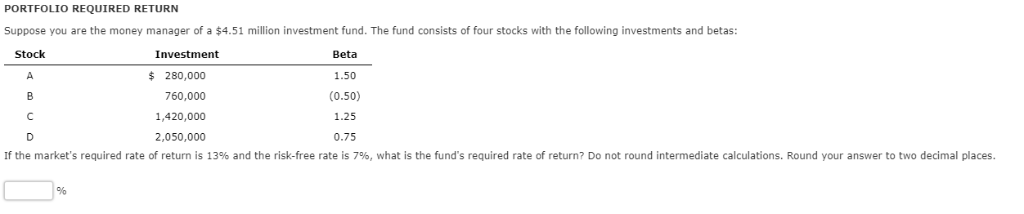

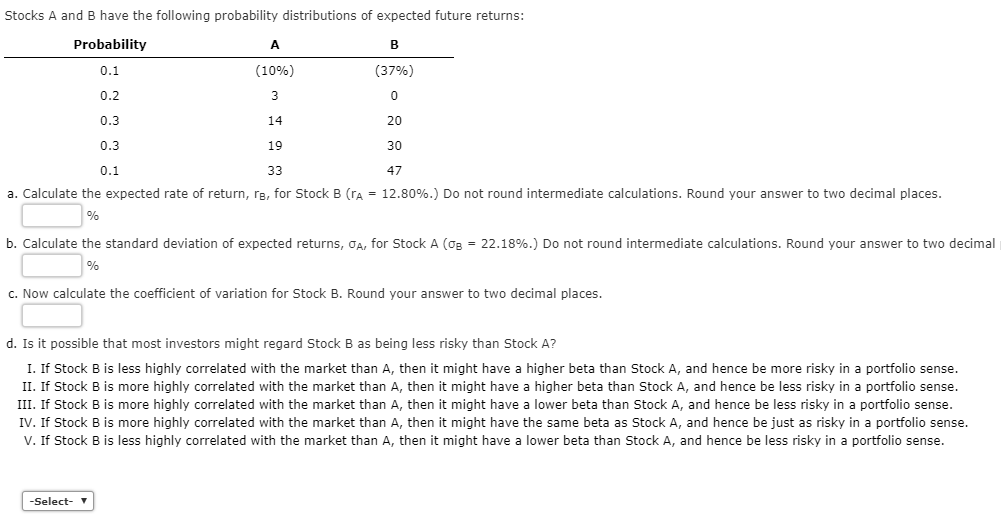

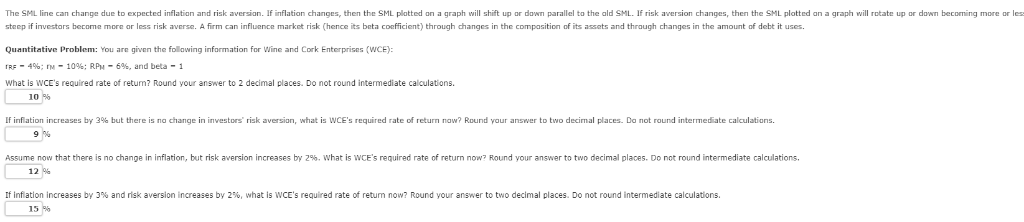

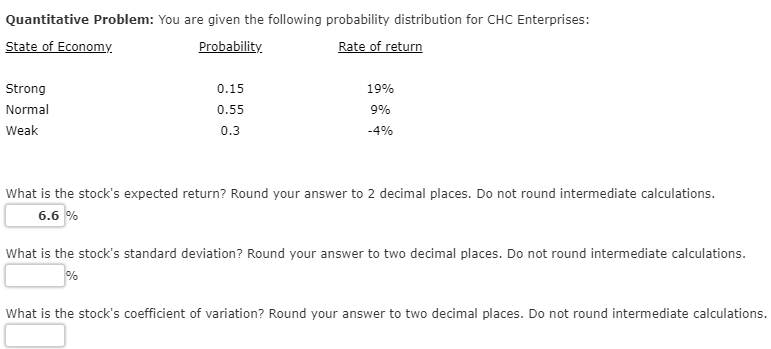

PORTFOLIO REQUIRED RETURN Suppose you are the money manager of a $4.51 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta $ 280,000 1.50 (0.50) P 760,000 1.25 1,420,000 2,050,000 D 0.75 If the market's required rate of return is 13 % and the risk-free rate is 7%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. Stocks A and B have the following probability distributions of expected future returns: Probability A B (10%) (37%) 0.1 0.2 3 0 0.3 14 20 0.3 19 30 0.1 33 47 a. Calculate the expected rate of return, r, for Stock B (ra = 12.80%.) Do not round intermediate calculations. Round your answer to two decimal places. % b. Calculate the standard deviation of expected returns, OA, for Stock A (oB 22.18%.) Do not round intermediate calculations. Round your answer to two decimal % c. Now calculate the coefficient of variation for Stock B. Round your answer to two decimal places. d. Is it possible that most investors might regard Stock B as being less risky than Stock A? I. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense II. If Stock B is more highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be less risky in a portfolio sense. III. If Stock B is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. IV. If Stock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense. V. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. -Select- or down becoming more or les The SML line can change due to expected inflation and risk aversion. If inflation changes, then the SML platted on a graph will shift up or down parallel to the ald SML. If risk aversion changes, then the SML plotted an a graph will rotate f its assets and through changes in the amount of debt it uses. steep if investars become more or less risk averse, firm can influence market risk (hence its bcta coefficient) through changes in the compasition Ouantitative Problem: You are given the following information for Wine and Cork Enterprises (WCE) 4%: M- 100 % ; RPM 6%, and beta 1 RF required rate of return? Round vour answer to 2 decimal places, Do not round intermediate calculations What If inflation increases by 3 % but there is na change a not round intermediate calculations. investors risk aversign, what is WCE's required rate Freturn now? Round yaur answer to two decimal places. 9 % 26. What is wCE's required rate of return now? Round your answer o change in inflation, but risk aversion increases two decimal places. Do not round intermediate calculations. Assume now that there is 12 % creases by 3 % and risk aversion increases 2% , what is wCE's required rate of retun now? Round vour answen o two decimal places, Do not round intermediate calculations. If infla Quantitative Problem: You are given the following probability distribution for CHC Enterprises: State of Economy Rate of return Probability Strong 0.15 19% Normal 0.55 9% Weak 0.3 -4% What is the stock's expected return? Round your answer to 2 decimal places. Do not round intermediate calculations. 6.6 % What is the stock's standard deviation? Round your answer to two decimal places. Do not round intermediate calculations. What is the stock's coefficient of variation? Round your answer to two decimal places. Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts