Question: I really need help with these problems (Related to Checkpoint 9.2) (Yield to maturity) The market price is $1.075 for a 13-year bond ($1,000 par

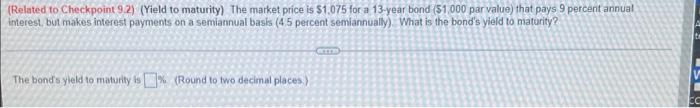

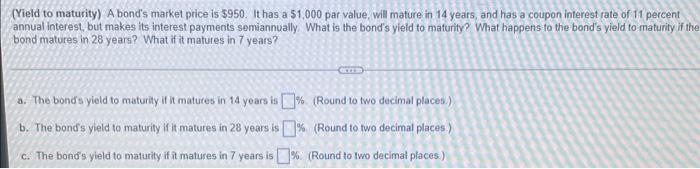

(Related to Checkpoint 9.2) (Yield to maturity) The market price is $1.075 for a 13-year bond (\$1,000 par value) that pays 9 percent annual tnterest, but makes interest payments on a semiannual basks (4.5 percent semiannually) What is the bond's yleld to maturity? The bond's yeld to maturity is \%. (Round to two decimal places.) (Yield to maturity) A bond's market price is $950. It has a 51,000 par value, will mature in 14 years, and has a coupon interest rate of 11 percent annual interest, but makes its interest payments semiannually. What is the bond's yield to mafurity? What happens to the bond's yield to maturity if th bond matures in 28 years? What if it matures in 7 years? a. The bond's yield to maturity if it matures in 14 years is % (Round to two decimal places.) b. The bond 5 yield to maturity if it matures in 28 years is % (Round to fwo decimal places.) c. The bond's yield to maturity if it matures in 7 years is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts